What caused stocks to crash from 1929 to 1932?

1) Wild Speculation + Easy Credit = Artificially inflated stock prices. By the late 1920's a whopping 90% of the purchase price of stocks was made with borrowed money (AKA buying on margin). 40% of every dollar loaned was for stocks. Stocks had become so over hyped that even shoe shiners were borrowing money to invest in stocks. This vast influx of money drove prices up. In 1928 alone stocks went up 43.81%.

2) Lack of government regulation + fraud = further inflated stock prices. With no adequate government regulation, the stock market was ripe for insider trading. Even some of the elite investment houses were engaged in stock manipulation.

Why a 1929-type crash is unlikely today

Here's a few reasons why a stock market crash of 90% would seem highly unlikely:

1) New forces of solid demand have come into existence since 1929. Pension plan money and 401K money is now entrenched in the stock market and not going anywhere. The job of money managers is to invest -- not time the market by liquidating and going to cash.

2) The Securities & Exchange Commission did not exist prior to 1929. The SEC serves to amoung other things prevent fraud, which would otherwise lead to stock overvaluation.

3) The FDIC did not exist before 1929.

4) Glass-Steagall Act was enacted to stop overzealous bank investment in the stock market.

5) Since 1929 other new rules have been put in place to prevent overvaluation, circuit breakers to prevent out of control selling, etc.

6) Central Bank bail outs, quantitative easing.

7) The crash of 1929 - 1932 was offset by deflation from 1930 - 1933. Yes portfolio valuations declined, but this was offset by increasing purchasing power. Deflation by year:

1930 average: -2.3%

1931 average: -9.0%

1932 average: -9.9%

1933 average: -5.1%

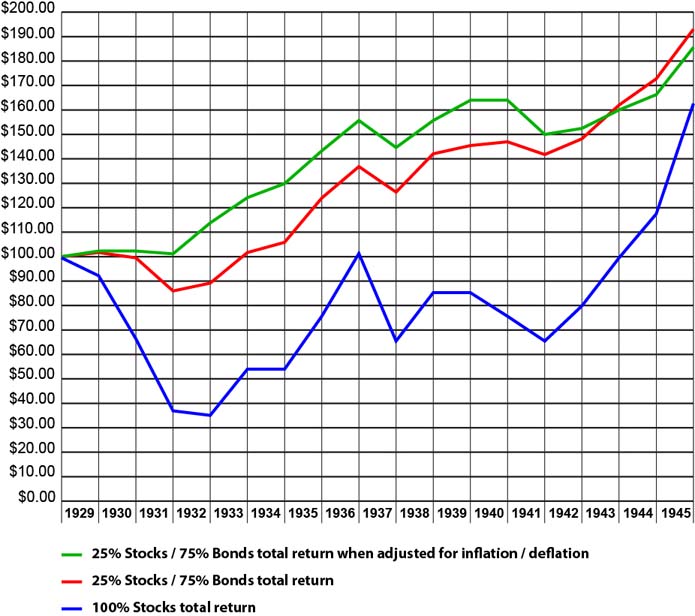

How did a 25 / 75 portfolio hold up during the great depression?

Just for fun let's take a look at how diversification into bonds protected you back then. From 1929 to 1946 your portfolio was never in danger of running down to zero. In this example the money is allowed to compound and dividends are reinvested. The lowest the 25/75 portfolio ever dropped to was $85,524 at the end of 1931, however when adjusting for deflation of the 1930's you were actually even at that low point in time! Not bad considering that you were 3 years into the great depression!

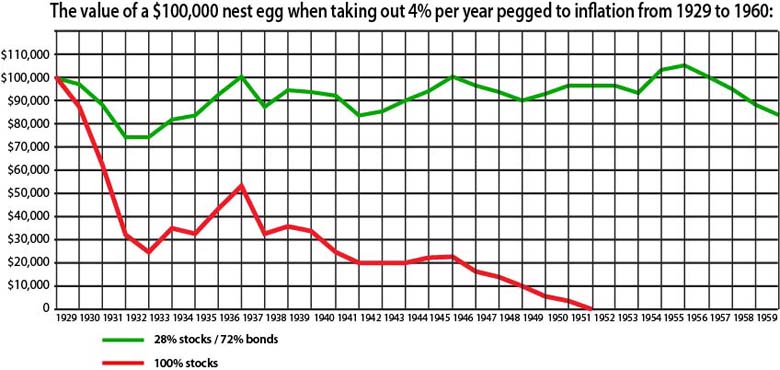

How did a 28 / 72 portfolio hold up during the great depression when taking out 4% per year pegged to inflation?

Keep in mind that valuations above are not adjusted for inflation / deflation. There was double digit deflation in the early 1930's. In reality in the early 1930's your 28/72 potfolio had only dropped to about $90,000 when adjusted for deflation.

Disclaimer and Waiver - Nothing on this consumer advocate website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy, hold or sell, or as an endorsement, of any company, security, fund, product or other offering. This website, its owners, affiliates, agents and / or contributors are not financial or investment advisors or broker / dealers and assume no liability whatsoever by your reliance on the information contained herein. The information should not be relied upon for purposes of transacting securities, assets, financial products or other investments. Your use of the information contained herein is at your own risk. The content is provided 'as is' and without warranties, either expressed or implied. This site does not promise or guarantee any income or particular result from your use of the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained. Always hire and consult with a professional regarding the evaluation of any specific information, opinion, or other content.