Review of Tony Robbins

and fixed index annuities

"I wouldn't expect more than 2-3% returns from index annuities" -- Chris Wang

"low single digit returns of 1-3% which all indexed annuities will return" -- Chris Wang

Motivational speaker Tony Robbins has stooped to a new low. The guy who supposedly helps people is now puffing up these financial products called fixed index annuities, which consumer advocate Clark Howard calls "a danger to your financial health". Immediately you have to ask what on earth is a motivational speaker doing giving investment advice for anyway?

Conflict of Interest

It has been said that the only people who have good things to say about index annuities are the very people who sell them. Sure enough on Tony Robbin's website he discloses that he is partners with none other than an insurance brokerage company. Surprise surprise! Anyone could have predicted this after reading what he has to say because it’s all of the same boiler plate insurance salesmen strawman arguments, false choices, misdirects, anecdotes (instead of data), cherry picked information, and of course the fatally flawed study that couldn’t be peer reviewed. It’s almost as if Tony went to an insurance salesman’s free steak dinner seminar and never did any follow up research to find out if he was being fed a bunch of BS or not. And when a guy is reported to be worth $480 million, why does he need to further fatten his bank account if that is indeed what he's doing? How about actually helping people by educating them about low cost index funds and diversification? Gee! Could it be because there's no money to be made by promoting index funds?

Preaching to investors who don't know squat

about diversification into bonds

On Tony’s website he says...

Rule #1: Don’t lose money. That sounds wonderful but for a generation that has experienced two 40% drops in the past 10 years, is there really a practical way to do this in the modern financial world?

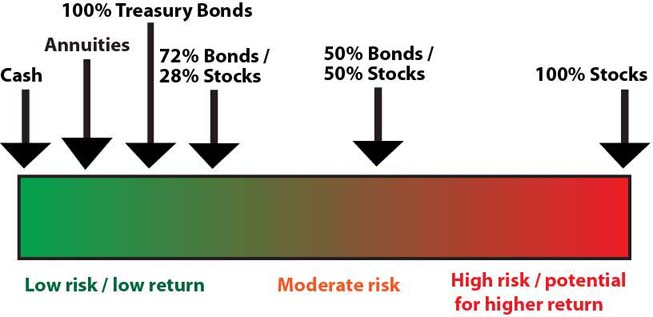

Yes there is a practical way. It's called diversification into bonds. But ignoring bonds is the number one deception used by insurance salesmen when pitching annuities to unsophisticated investors. It's the classic false choice / strawman presentation. They compare lowly, mediocre-returning annuities to a high-risk, volatile portfolio of 100% stocks. If all we need to do is earn slow, boring and consistent returns then we invest heavily on the bond side. Investing 101.

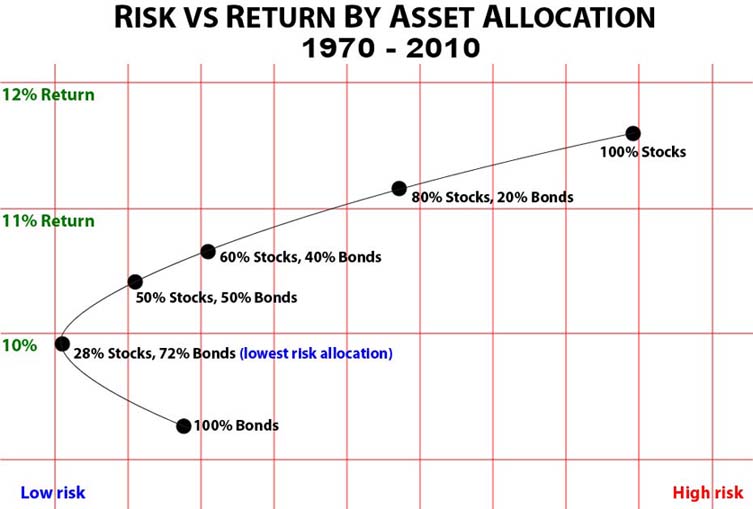

The Ibbotson 28/72 Rule

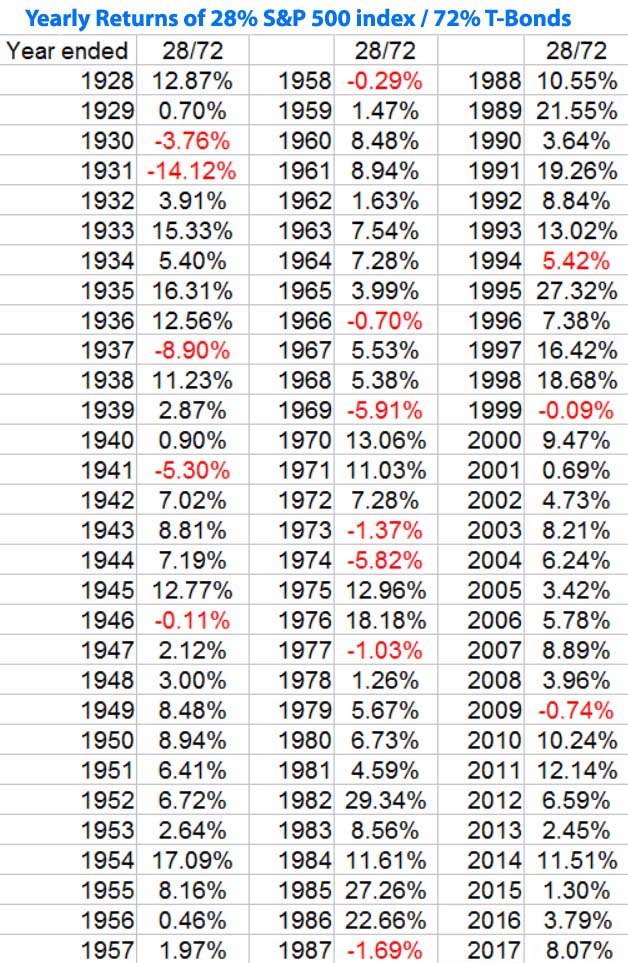

In a study by Ibbotson, they determined that from 1970 to 2010 the lowest risk bond/stock allocation ratio was 28% stocks / 72% bonds. Not only does a 28/72 allocation provide very low risk and better returns than annuities, but it doesn’t lock your money in prison for years and years as with an annuity, doesn’t rob your beneficiaries, and doesn’t screw you over with higher ordinary income taxes. It's a win-win-win-win-win situation! So why do insurance salesmen always ignore diversification and go straight for the annuity? Because annuities pay huge sales commissions while index funds like SPY and BND pay nothing. Is Tony Robbins making money off of this?

It is a mathematical FACT that anyone whose portfolio dropped 40% in the past 10 years, was over allocated into stocks. If they’re complaining about the last 10 years it wasn’t the stock market’s fault -- It was their fault for failing to diversify into bonds. The solution is not to dump money into an annuity prison. The solution, if you desire low risk is simple. Don't load up on stocks! You invest heavy on the bond side.

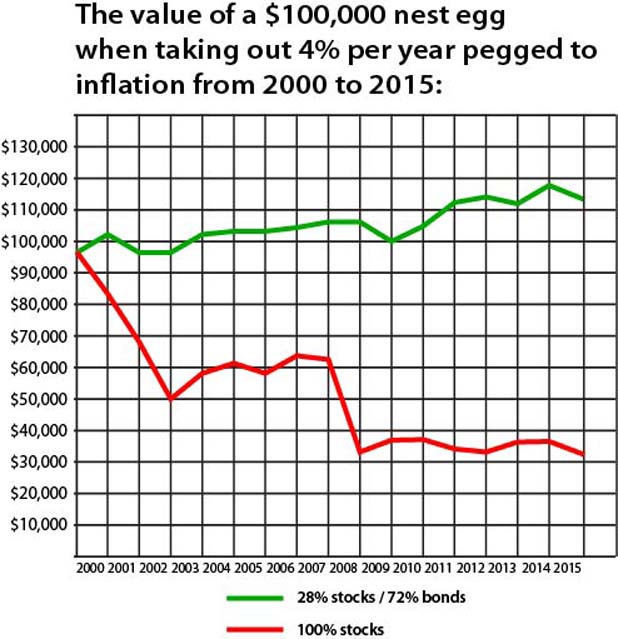

Note: The above chart factors in calendar rebalancing on Jan 1 of every year

Above rate of withdrawal for each year: Jan 2000: $4,000, 2001: $4,136, 2002: $4,251.81, 2003: $4,319.84, 2004: $4,419.19, 2005: $4,538.51, 2006: $4,692.82, 2007: $4,842.99, 2008: $4,978.59, 2009: $5,167.78, 2010: $5,147.11, 2011: $5,229.46, 2012: $5,396.81, 2013: $5,510.14, 2014: $5,592.79, 2015: $5,682.28, 2016: $5,687.96

Then Robbins talks about what he calls his “three core challenges” for investors.

1) With two 40% market drops in the past 12 years, none of us can afford another.

Again, with regard to his first point, you diversify into bonds and your portfolio will not drop 40%. In fact in the last 20 years it hasn’t even dropped 1% in any year. 2009 was the "worst" year, in which you lost less than one percent...

2) Finding tax efficiency is CRUCIAL. You can only spend your after-tax income.

His second point is yet another classic insurance industry misdirect. Annuity gains are tax free, but once you take money out you get slammed by the higher ordinary income tax rate. Tony never mentioned that there is a study by Wealth Manager called Photo Finish in which they determined that the so-called "advantage" of annuity tax deferral is more than offset by the higher ordinary income taxes that you have to pay later. Tony also didn’t talk about the 10% federal tax and additional state tax penalties that you are subject to if you take out money before age 59 1/2. All he says is "there are generally penalties for early withdrawals". That's called glossing over, which insurance salesmen are famous for!

3) Excessive Fees. In addition to the Expense Ratio, one must add the Transaction Costs (brokerage commissions, market impact, spread costs), Tax Costs, Cash Drag, Soft Dollar Costs, and Advisory Fees. Forbes Magazine estimates the average cost of owning a mutual fund to be 4.1% annually.

And Mr. Robbins presents yet another insurance industry deception. Actively managed mutual funds are really expensive and they under perform index funds. That’s why everyone should invest in super low cost and 100% liquid index funds. But Tony loves a strawman argument / false choice! He pretends as if your only option is expensive mutual funds or the annuity that he's hucking.

Then Robbins talks about how...

“Participating in market gains, but not market losses is the investing equivalent of having your cake and eating it too.”

Insurance salesmen love to present anecdotes instead of rigorous scientific data. They want to suggest that you’re gonna make out like a bandit. But insurance companies are not playing Santa Claus. Insurance companies hire experts in finance and risk, called actuaries, who make sure that the promises that the insurance company makes do not exceed the returns of a portfolio comprised of about 94% in bonds and 3% in stocks, while keeping 2% -- and that's after the insurance company shells out typically 7% to 10% or even more in commission money to the insurance agent who sells the index annuity.

Tony also writes...

It is important to note that unlike mutual fund commissions that are deducted from a client’s annual account balance, a commission paid on the sale of an FIA does not negatively affect a client’s account balance.

Absolute hogwash! What Tony Robbins deceptively isn’t telling you is that there’s more than one way to essentially “bill” you. Fees are baked into the annuities themselves! All they have to do is lower the performance cap or participation rate. For example instead of getting a 7% performance cap they might set it at 5%. Then you’re getting less! Insurance companies are not selling annuities for charity. For Tony to even begin to suggest that annuities are somehow "free" is total nonsense.

Also once you enter the distribution phase with an index annuity, the insurance company essentially “bills” you again by simply stopping you from enjoying growth of you money (the income base). Usually with index annuities, whatever the final value of your money is when you turn on the income spigot, the growth of your money stops right there and starts to dwindle down to zero. Meanwhile the insurance company is still investing your money and reaping the gains. In fact, from your heir’s perspective, regardless of when you die, whether sooner or later or right at your actuarial life expectancy, their return on investment will be ZERO! And from your perspective, even if you live a long life, your return on investment is still going to be really low because once you die there is nothing left for your heirs.

Next Robbins uses a rigged and fatally flawed study to make his argument for index annuities....

FIAs can be a great alternative to other “safer money” financial instruments. A recently conducted study by Wharton Business School titled “Real World Index Annuity Returns” states “Index annuities have been producing returns since the first one was purchased on February 15, 1995.” The study goes on to say “From 1997 through 2007 the five-year annualized returns for FIAs averaged 5.79%.”

First of all, with a 100% liquid and low risk mix of 28% in an S&P 500 index fund and 72% in a total bond market index fund, your $100,000 grew to $218,245 when implementing a simple annual rebalancing strategy. That means that it returned an 8.1% compounding annualized return on investment. A percentage rebalancing strategy certainly would have produced even better results. If this Wharton School study looked at simple annualized return on investment then we should do the same with the 28/72 portfolio, in which case it actually returned 8.3% by comparison.

Second of all, can we even trust this 5.79% figure? This so-called "study" actually wasn’t conducted by the whole school. In fact it was conducted by just 3 guys, only one of which is a Wharton School professor, who also happens to have been a consultant to the insurance industry. Conflict of interest! The 2nd guy heading this study runs a web site and information service for the insurance industry, mostly to help promote the sales of EIAs! Bingo! The last guy at the time was a broker / adviser. You have to assume that he or his firm sells annuities. In other words, these three clowns do not appear to be the disinterested analysts that you would ever trust heading up a real study! And you certainly would not want to cite this study as part of an unbiased presentation about index annuities, but Tony Robbins did.

And if Tony Robbins has so much respect for the Wharton School why didn't he quote Kent Smetters, who is also a professor at Wharton business school. Smetters is quoted as saying that index annuities have "really high hidden fees. That’s why they’re terrible ideas for older people even though they’re peddled to them."

And why did Tony cherry pick Wharton school instead of Yale and UCLA, where two professors discovered that investors would be better off in a simple portfolio of U.S. Treasury bonds and large cap stocks a whopping 97% of the time!

There's also other studies that debunk index annuities including one by William Reichenstein.

Michael Zhuang is a real life adviser who sold 6 equity annuity contracts to real life clients from 2006 to 2010. All of them lagged the S&P 500 index fund by a huge margin. One contract actually lost money. So much for the headline that fixed annuities cannot lose money. Two index annuity contracts were purchased right before the market crash and still lagged the S&P 500 index by a large margin. That says it all.

According to fee-only fiduciary adviser Chris Wang of Runnymede Capital Management, you can expect index annuity returns of only about 1% to 3% per year and that's only when held for at least 10 years. He says that if anyone promises you returns of 6% or more then run for the door!

So the 3 clowns who conducted this Wharton School "study" didn't look at random samples of actual annuity contracts from random investors themselves -- Instead they went to 27 insurance companies and asked THEM to provide index annuity contracts! And of course the insurance companies are gonna put their best foot forward and cherry pick the contract that did the best. So this study is 100% useless!

When Adviser Perspectives attempted to peer review this study they were basically stone walled. The "researchers" claimed that the contracts that were provided to them were confidential. This is a glaring red flag because any personal information could have been blacked out if it wasn't already blacked out by the insurance companies. So next they tried contacting the insurance companies directly. Once again they were basically stone walled by 26 out of the 27 insurance companies. And one of the insurance companies denied even participating in any study! It doesn’t get any more ridiculous.

Even if this study were to have been based on actual contracts provided by annuitants, you have to scratch your head over the other glaring mistakes. The 3 clowns only looked at rolling 5-year returns. According to Adviser Perspectives you need at least a 10 year horizon to assess the performance of these things because insurance companies can change the rules of the game in the middle of the game.

Also in this study they compared the index annuities to 50% stocks and 50% in lowly treasury notes instead of treasury bonds. Totally deceptive. They rigged it so that the bond side would have really low returns!

And by having 50% in stocks instead of 28% you get more volatility and that makes the portfolio have lower returns during bear markets. Again they rigged this study.

Also, on Tony's website he never mentions that insurance companies can default, and then what happens to those annuity promises? And you are banking on the solvency that one single insurance company for the rest of your life! There is no way to predict the future of insurance company solvency going out 10, 20 or 30 years. Each state has a guarantee fund but they only cover up to a certain dollar limit and some states like California only pay 80% up to that dollar limit. And what happens to that guarantee fund in the event of a systemic failure of insurance companies? So basically insurance company guarantees might not be guaranteed.

So you have to ask, did Tony Robbins do any fact checking before he rushed to publish this nonsensical praise of these inferior financial products? Is he hasty? Or is he just looking to make more money in some way shape or form? And why should we care what Tony Robbins has to say about index annuities anyway? We're still trying to figure out why anyone would pay $10,000 to hear him give a pep talk at some hotel. Just tune him out.

Go Back to Index Annuities

Disclaimer and Waiver - Nothing on this consumer advocate website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy, hold or sell, or as an endorsement, of any company, security, fund, product or other offering. This website, its owners, affiliates, agents and / or contributors are not financial or investment advisors or broker / dealers and assume no liability whatsoever by your reliance on the information contained herein. The information should not be relied upon for purposes of transacting securities, assets, financial products or other investments. Your use of the information contained herein is at your own risk. The content is provided 'as is' and without warranties, either expressed or implied. This site does not promise or guarantee any income or particular result from your use of the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained. Always hire and consult with a professional regarding the evaluation of any specific information, opinion, or other content.