This is a review of the "My Investment Answers" radio infomercials sponsored by Greg Fox (AKA GLF Financial Services) as once heard on KABC and most recently heard on KRLA AM 870 "the Answer". This is also a review of index annuities and annuity salesmen in general.

The shady past of Greg Fox

Greg Fox was accused by the California Department of Insurance of illegal acts of churning, altering documents, failing to make basic disclosures known to consumers, etc. Also in the complaint, some clients of Fox claimed that they never signed and/ or dated certain transfer documents, and thus it was alleged that Fox must have forged these signatures and / or dates. As a result of the complaint, Fox was fined $10,000, had his license and licensing rights revoked for 5 years, and was given a restricted license instead. Apparently Fox was also ordered to reimburse the Department of Insurance $20,000 for the cost of the investigation into Fox's behavior.

In light of all of this, one has to ask why was Greg Fox given the right to once again resume selling annuities without restriction? And why would these radio stations shamelessly sell themselves out by allowing Greg Fox to rent their air time?

What is a "Wealth Advisor"?

Greg Fox states that he's been a "Wealth Advisor" for nearly 50 years. There is no such disignation. This is quite ironic because Mr. Fox frequently attacks Doug Andrew's salespeople for calling themselves "Wealth Architects", which is also a fake designation.

Is Greg Fox really an unbiased consumer advocate who is 'retired' and 'just trying to give back' or is he actually just another commission-seeking annuity salesman?

Smart consumers don't trust insurance salesmen for money advice, and for good reason because of the inherent conflict of interest (back-door commissions at the indirect expense of the consumer -- built into the product -- negative impact on returns). Therefore insurance salesmen have a vested interest in disguising the fact that they are actually salesmen trying to sell commission-based annuities.

One of the ways that insurance salesmen in general are known to try to gain people's trust is to style themselves as "consumer advocates" or "critics" who have no conflicts of interest and are looking out for your best interests (rather than their own through back-door commissions). One way to do this is to host a "radio show" that sounds like it's part of the regular programming of hired on-air talent (like Bob Brinker or Clark Howard). Even with disclaimers at the start and end of the radio show, some listeners may miss or not understand the meaning of the disclaimers.

Greg Fox claims on his 'radio show' that he's not trying to sell anything. Really?

During his infomercials, Greg Fox loves to mention that essentially he's not trying to sell you the listener anything. He states that he's retired and he's just "trying to give back". That's what he says. You be the judge if his infomercials are not for the purpose of finding indications of interest in annuities by puffing up index annuities.

Here's why it appears that Greg Fox must be selling annuities or at least have some sort of conflict of interest in puffing up annuities:

1. Greg Fox has a history of being accused of being deceptive. In a complaint filed by the California Department of Insurance, Mr. Fox was accused of deceptive and misleading annuity sales practices. One of the issues raised in a California Department of Insurance complaint filed against Mr. Fox was his failure to use the phrase 'insurance sales presentation' in his business solicitation materials following the word "seminar," "class," "informational meeting," or substantially equivalent terms to characterize the purpose of the public gathering or event. 7 separate customers of Mr. Fox said that he made misrepresentations to them about insurance products (including annuities). The department concluded that Mr. Fox was also churning and twisting policies.

2. Both Greg Fox and his company have active life-only insurance licenses and were recently renewed to continue conducting business until 2019. A life-only license can encompass index annuity sales.

“I can’t tell you a financial plan that we put together that we didn’t include the safety valve of some form of an annuity” - Greg Fox

(NOTE: This is not surprising considering that Greg Fox is an INSURANCE SALESMAN!)

3. Every indication is that Mr. Fox is paying for airtime. A one hour block of radio air time is expensive. People generally don't buy expensive air time for charity! Somehow those expenses must be recouped.

4. Mr. Fox has a toll-free 800 number that he repeatedly gives out on the air, encouraging listeners to call including after hours (when he's off the air). He says that he will speak with you for free to go over your finances with you. He also has a FAX number for listeners to send him their financial information for review. He also says that he will even drive out to meet with you in person! Is he really doing all of this for charity? Financial radio hosts like Bob Brinker, Clark Howard, Dave Ramsey and Suze Orman never give free investing advice after the show, let alone meet with you in person. NEVER!

5. On Mr Fox's radio show he uses all of the classic sales techniques and deceptive talking points that insurance salesmen use to sell annuities, including strawman arguments, shell games and he presents lots of suggestive anecdotes which are not a substitute for actual annuity contract data. In other words talk is cheap. Show me actual contracts.

6. A very telling on-air conversation: It is possible that Mr. Fox is playing a shell game when he says that he's not selling anything. The operative word is "he". He may not be selling index annuities. But this would make no difference if he's actually passing these people off to agents working for his company, thus recouping the costs of air time indirectly. In fact recently a caller (or someone posing as a caller) to his show pressed him with some questions, although they did not ask the right questions (namely what are his conflicts of interest). Mr. Fox also cut this caller off quickly before they could ask further questions.

"CALLER": Are you a fiduciary?

GREG FOX: Yes. Yes. In fact when it comes to pension related assets, by code you have to be a fiduciary. So everybody is pretty much in that boat now. But I’ve been one for a thousand years. So what else is new? Now what does that mean to you? I’d like to use that question to interpret for you.... Who’s policing that move?

"CALLER": But you don’t have products to sell do you?

GREG FOX: “Well we do but I don’t sell them. In other words if I went to someone like yourself just trying to get some direction. First I’ll talk to ya. OK. That’s what the number is for after hours. And I uncover some things and give you some direction and then maybe put you in a direction where you could get some help. OK. That’s the most important... Now we’re running out of time, but thank you for calling.”

Analysis of first statement: If Greg Fox is "retired" then how on earth is he a fiduciary, let alone why does he have an active life-only insurance license? This is contradictory because 'fiduciary' is a professional designation!

Also when he said "everybody is pretty much in that boat now" he was speaking only to the question of fiduciary duty related to pension related assets. When dealing with retirement plan money all advisors are now governed by the new DOL fiduciary rule. A more relevant question would be whether he acts as a fiduciary when dealing with money that does not fall under the DOL fiduciary rule. Furthermore "fiduciary duty" does not fully protect investors! The most relevant questions that should have been asked are "What are your conflicts of interest?" and "Do you and/or the people at your company act in the capacity of fee-only fiduciaries and do you memorialize that in writing?" and "If you do stand to gain financially by recommending index annuities then why did you select an index annuity strategy for me instead of a bond index fund strategy to mitigate stock market volatility, especially when bond index funds pay zero commissions to advisors?"

Analysis of second statement: He just admitted that his company GLF Financial services indeed sells products! What are the odds that these "products" are index annuities?! He also used a qualifier word "maybe". So maybe he'll send you elsewhere OR maybe, more than likely, he won't. Maybe he'll refer you to someone else at his GLF Financial Services company or maybe some other company (that gives him a kickback) to sell you that index annuity?! And so the questions that should have been asked are "What products do you sell?" and "How are you recouping the cost of these infomercials, your toll-free 800 number and your time driving out to visit with callers in person?" and "Do you or your company have any conflicts of interest in puffing up index annuities on the radio, and/or when speaking with or meeting with people to discuss their finances and will you memorialize that in writing?"

REVIEW:

KABC 790-AM and KRLA "The Answer" 870-AM are radio stations in Los Angeles which incessantly air a charade of infomercials on the weekends. Typically these infomercials are thinly disguised as bonafide radio shows. If you miss the disclaimers at the start and end of these shows you might be confused. Greg Fox's infomercials have been preceded by announcements stating that the show is furnished by "Greg Fox" or "Gregory L. Fox Insurance" or "GLF Financial Services, INC". Therefore, Greg Fox's My Investment Answers "radio show" is almost certainly a paid commercial announcement -- not part of the regular line-up of hired on-air talent.

And like all of the other advertisements that you hear for annuities, Mr. Fox uses the same old strawman arguments, shell games, anecdotes and other one-sided sales presentations to puff up annuities.

What do insurance companies do with your money in order to make the promises that they make?

Before we delve into Greg Fox's sales pitch, let's first start by reverse engineering what insurance companies do with your money when you give it to them (putting it into an index annuity or immediate annuity). They don't do anything that you can't easily replicate on your own by investing in a couple of index funds. By investing on your own you eliminate the many overhead costs.

According to William Reichenstein, a professor of investments at Baylor University who has studied index annuity contracts, an insurance company will typically pay your adviser his lavish commission, then invest 94.33% in bonds, 3.67% in derivatives linked to the S&P 500 index and keep the remaining 2%. Don't expect insurance salesmen to ever clue you in on how insurance companies make the promises that they make.

We know that insurance companies have to earn a profit, have to pay for their overhead costs and have to pay the "advisor" who sells you that annuity his lavish commission of typically 7 to 10% with index annuities. Immediate annuities "only" pay agents typically 3 - 4%. Now we have a good guess as to why annuity salesmen spend money for costly radio air time!

So what does it all mean? This should tell you that the insurance company cannot pay out greater than what mainly bonds earn MINUS overhead costs, minus insurance company profit, and minus whatever commission is paid to the sales agent who manages to convince you to lock your money into the annuity. And 10-year treasuries have only returned 5.16% from 2006 to 2015. 3-month T-bills have only returned 1.16%. Those are not stock market-like returns. According to Greg Fox himself, right now in 2017 insurance companies are struggling to earn 2%.

Insurance companies are not stupid and they aren't playing Santa Claus when they offer annuity contracts. They hire armies of experts in math, risk and the financial markets called "actuaries" who make sure that the insurance company will come out the winner.

Strawman Argument: Stock market volatility

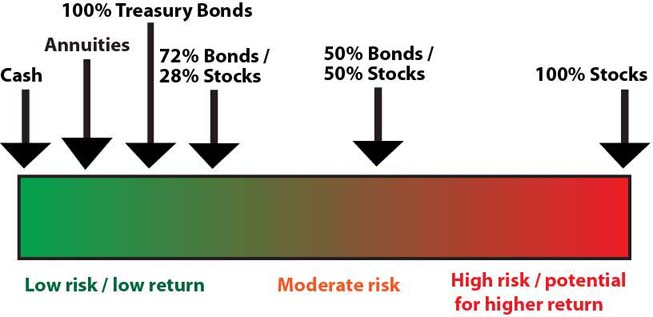

The number one strawman argument used by annuity salesmen is to appeal to conservative retiree investors who are ignorant of bonds and how bonds protect against stock market volatility. Ever heard the phrase "When stocks fall, money runs to the safety of bonds"? In order to sell their product, these annuity salesmen always talk about how someone who over-invests in the stock asset class is vulnerable to huge market loses. Strawman argument!

Insurance salesmen love to ignore diversification into bonds! Greg Fox actually has to gall to completely bastardize bonds. Here's some of his statements:

“You’re on the table and rolling the dice with bonds. You’re in Vegas folks” -- Greg Fox

"This bond stuff is a bunch of nonsense because it has significant risk in a downturn." -- Greg Fox

(NOTE: Bonds and stocks are the two basic building blocks of modern portfolios.)

"Here’s a news alert: Bonds are down about 8% this year." -- Greg Fox

(NOTE: The total bond market return index was NOT down 8%. It was actually up 2.8% in 2017)

"Do not buy bond funds." -- Greg Fox

(NOTE: This is ludicrous. You buy a total bond market index fund for the bond portion of your portfolio.)

What annuity salesmen never talk about:

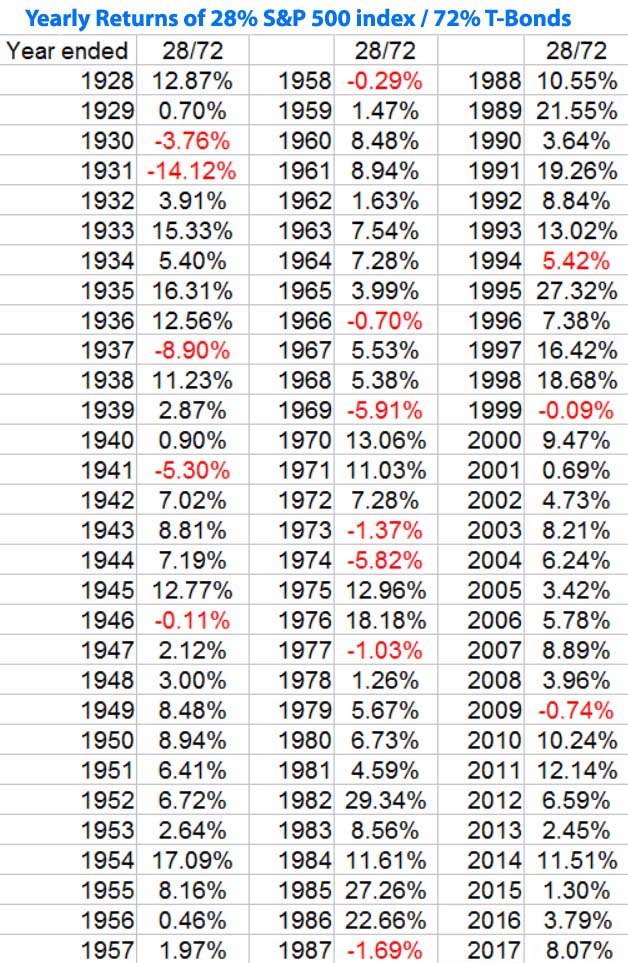

The Ibbotson 28/72 Rule

From 1970 to 2010 the lowest risk bond/stock allocation ratio was 28% stocks / 72% bonds. This is not cherry picking of time periods either. Bonds have always been low-risk, slow, boring and consistent, especially when held TOGETHER with some stocks. Money has to go somewhere! It is a mathematical fact that no conservative retiree investor who was properly diversified into bonds with a low-risk 28/72 portfolio ever lost 50% of their money during the so-called 'lost decade' of the 2000's. In fact since 2000, every single year has been positive except for 2009 when investors lost less than 1%. Don't expect insurance salesmen on the radio to ever discuss the Ibbotson 28/72 rule because once investors realize that if they diversify heavily into bonds, such as through a simple total bond market index fund like BND, there is no crazy volatility and thus no need to lock your money in an annuity prison for guaranteed mediocre returns.

NOTE: If you're thinking that 1930 and 1931 looks scary then you need to understand that the stock market of today is not what it was back then. We also had double digit deflation in the early 30's. Click here for details.

The 4% rule works great!

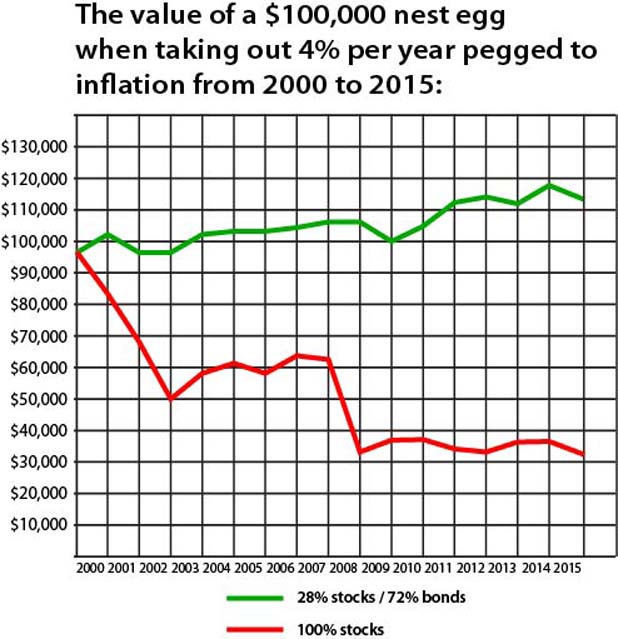

"The theory came around in the mid-90's [when] some financial guy said if you take out 4% of your money in retirement and then adjust it for inflation every year there's a good chance you won't run out of money. We tried that. You run out of money folks. The pot goes dry while you're still breathing." -- Greg Fox

This statement by Mr. Fox is just plain false. Either he is ignorant or he is deceptively talking about someone who is unnecessarily paying an asset manager year after year and/or he is talking about a high risk portfolio that is over-weighted in stocks.

The experts say that in order for your nest egg last through retirement, you should aim to take out no more than 4% per year. This assumes a 30 year time horizon (until death). It is important to understand that once you get to a 20 year time horizon, studies have concluded that you can take out between 5.1 and 5.5% per year. Many annuity salesmen falsely use the 2000's as their big compelling argument for dumping money into annuities. They deceptively look at a risky portfolio that is over exposed to the stocks. In reality the 4% rule held up perfectly during the 2000's even when increasing those 4% withdrawals with inflation. By 2015 you were taking out not $4,000.00 -- but $5,687.96. And notice how your nest egg (the green line) still grew to $114,871.12 -- All during the worst of times!

Note: The above chart factors in calendar rebalancing on Jan 1 of every year

Above rate of withdrawal for each year: Jan 2000: $4,000, 2001: $4,136, 2002: $4,251.81, 2003: $4,319.84, 2004: $4,419.19, 2005: $4,538.51, 2006: $4,692.82, 2007: $4,842.99, 2008: $4,978.59, 2009: $5,167.78, 2010: $5,147.11, 2011: $5,229.46, 2012: $5,396.81, 2013: $5,510.14, 2014: $5,592.79, 2015: $5,682.28, 2016: $5,687.96

Even if the 4% rule "fails", this doesn't make an annuity better

It is also important to note that the 4% withdrawal rate can be adjusted lower if needed. And it is critical to note that just because the 4% rule might "fail" certainly doesn't mean that an annuity is a better place to put your money. For example from 1966 to 1996 you really needed to be taking out about only 3.4% per year (pegged to inflation). However even when reduced to 3.4% (pegged to inflation) you were much better off than if you had dumped money into an immediate annuity. To better understand why, please read about immediate annuities.

The risk that annuity salesmen generally don't care about or are quick to look past: The danger that you might need to get your money back!

A truly unbiased advisor who is disinterested in earning back-door commissions will understand the importance of liquidity. An investor might need to get their money back for any number of reasons: wife, child, or grandchild has an expensive medical emergency that is not fully covered by Blue Cross, expensive legal issues, etc, etc. There are literally hundreds of unexpected reasons why someone might need to get their money back, and there is NO WAY TO PREDICT whether you might need to get your money back. But once you annuitize (enter the distribution phase of) an index annuity, your money is generally gone for good. Lack of liquidity is one of many reasons to avoid annuities. Index funds on the other hand are 100% liquid. Sell at any time, for any reason and without penalty. Perhaps annuity salesmen should say "I specialize in creating illiquid money".

Back door commissions = Conflict of interest

If you need help, the qualification that matters is whether an adviser is a fee-only fiduciary who works on a one-time or one-task basis. There are also "light-advice" companies such as Vanguard which only charge 0.03% per year as an asset management fees. An even better choice is to find a so-called robo-advisor, many of which are free.

How most index annuities work:

ZERO growth once you start the income spigot!

Imagine if once you retired, the stock and bond markets got frozen in time. You would be pretty upset if your money stopped growing! Well guess what... Once you elect to annuitize the contract (AKA enter the "distribution phase") the way most annuities work is that the growth of your money stops! Yet the insurance company continues to invest the money that you gave them, as they earn slow, consistent returns by investing heavily in bonds.

So how much annualized return on investment do index annuities in general really provide?

According to Chris Wang, moving forward in today's low interest rate environment with all index annuities you can expect returns on investment of only about 1 - 3% and this appears to be the "accumulation phase" that he's talking about. Those are paltry returns that will erode you savings! Click here to test out for yourself how much as little as 2% in lost returns will erode your savings after 10, 25 or even 50 years. This is the danger of bearing too little risk, which annuity salesmen don't like to talk about. Earning CD-like returns is going to send you to the poor house! And remember that according to William Reichenstein, "Even with interest rates near record lows, CDs may still do better than indexed annuities". Article

Calculating your annualized return on investment (ROI) during the "distribution phase" will depend on how long you live. If you live to your life expectancy then yours and your heir's ROI during the the distribution phase is zero. If the annuity works like an immediate annuity "single life with cash refund policy" then yours and your heir's ROI is also zero during the the distribution phase. If you live longer than your life expectancy your heirs typically get nothing. From your perspective, your distribution phase ROI will gradually rise the longer you live, but even if you live to be 100 your ROI is going to be very low. Please visit the immediate annuity page to understand how the math works. Scroll down to where it says "Immediate Annuity return on investment if he lives to be...." and see how in this hypothetical example a 100 year old only realized a 3.4% ROI and heirs get no inheritance.

Also during the "distribution phase" it is typical with most index annuities that you get fixed income payments that do not adjust for inflation (and the cost of living). Eventually inflation can make what was initially a 6 1/2% payment rate seem like 1 1/2% if you live long enough, hence the analogy that annuitizing a contract is "like deciding that taking a vacation at age 65 is more important than having food and shelter at age 85".

While some index annuities may adjust for inflation, the insurance company will typically compensate for this by lowering the payment rate and / or putting caps on amount of upward adjustment for inflation.

Two University professors (Yale and UCLA) discovered that investors would b better off in a simple portfolio of U.S. Treasury bonds and large cap stocks a whopping 97% of the time! Other studies have suggested that when someone buys an annuity this typically results in a wealth transfer of as much as 15% to 20% from the investor to the insurance companies and sales agents. SOURCE

And according to economic consultant Craig J. McCann, "Some 99% of the time, indexed annuities under perform a simple portfolio that’s 60% in zero-coupon Treasuries and 40% in a low-cost S&P 500 index fund."

According to fee-only financial adviser Michael Zhuang, who sold 6 index annuity contracts from 2006 to 2010, all of them lagged the S&P 500 index by a huge margin. One contract actually lost money, despite the fact that index annuities are advertised as "can't lose" products. Two index annuity contracts were purchased right before the market crash and still lagged the S&P 500 index by a large margin!

The article is dated July 4, 2014 and Mr. Zhuang says that a new client of his "recently" provided him with these contracts for analysis. So for the sake of estimating an annualized return using a compounding ROI calculator we will assume that April 1, 2014 was the closing contract value date. As you can see, none of the contracts returned more than 2.2% per year.

| Purchase date | Annuity Annualized ROI |

Annuity Total Return |

S&P Total Return | Duration |

|---|---|---|---|---|

| 7/25/2005 | 1.4% | 16.2% | 90.2% | 8.6 years |

| 3/28/2006 | 2.1% | 18.8% | 78.1% | 8 years |

| 5/15/2007 | 1.6% | 11.8% | 49.9% | 6.8 years |

| 9/26/2007 | 2.2% | 15.9% | 48.8% | 6.5 years |

| 5/12/2009 | 1.7% | 8.9% | 138.9% | 4.8 years |

| 6/04/2010 | -2.4% | -9.2% | 92.7% | 3.8 years |

Notice that one annuity contract actually dropped 9.2% in value. Index annuities are advertised as being products that can "never never drop below zero".

Slight of hand: "Income you can never outlive"

The operative word that insurance salesmen always leave out is "adequate". They never say "adequate income you can never outlive". Once you understand how immediate annuities work, you start to understand why they leave out this word. Once you enter the "distribution phase" with an index annuity, that's when the insurance company really comes out the winner.

Conclusion:

If you need one-on-one money help, do not pick an adviser simply because they sound nice and friendly. They all are! Pick someone because they agree in writing to working for you as a fee-ONLY fiduciary and they will do so on a one-time or one-task basis. This legally eliminates the potential for conflict of interest that is back-door commissions than an advisor may earn. Bob Brinker has said that with the fee-based variety of advisers (in general), by default you can never really know for sure if they are making investment recommendations because it's good for you or good for them.

Once they help you come up with a personalized "game plan", all you do essentially is percentage rebalance your portfolio of index funds as needed. A third grader can do that. Once you realize this, you understand that there is no need for a costly "asset manager" to constantly manage your money. If you insist on having constant attention then consider Vanguard which only charges 0.3% per year.

There are also low cost "robo-advisors", many of which are free. Blackrock has a portfolio builder. Vanguard also has a portfolio creation tool. Never lose sight of the fact that investing can be as simple as owning 2 index funds -- a total bond market index fund and a total stock market index fund.

If for some strange reason you absolutely insist on dumping money into an annuity then look at Vanguard's variable annuity. It is "low cost" only compared to other variable annuities and to other types of annuities including index annuities. Costs are low because Vanguard does not pay commissions to any advisor. This keeps costs much much lower. Vanguard also has no surrender penalties. That's huge! Within this Vanguard annuity you can invest in stock and bond index funds. Make no mistake, variable annuities are crap financial products. It's just that Vanguard's variable annuity is the least offensive of the bunch (especially those obscenely expensive "retail" variable annuities, and certainly those grossly inferior index annuities). The easiest way to identify a "retail" annuity is by whether it has a surrender period. Remember Bob Brinker's advice to never buy an annuity with a surrender penalty.

What others are saying about index annuities in general:

"Index annuities are a danger to your financial health." -- Clark Howard Article

"[The insurance company] is not playing Santa Claus. Even with interest rates near record lows, CDs may still do better than indexed annuities". -- William Reichenstein Article

"The opacity of [index annuity] fees and complexity of the return calculations makes it impossible for investors to figure out if they’re getting a good deal". -- Glenn Daily, a fee-only insurance consultant based in New York. Article

"[Indexed annuities] carry exorbitant and indeterminable costs, lack of federal regulation and an inability to decipher what the investments will earn... They are complicated investments sold to unsophisticated investors." -- Craig McCann, Ph.D. and CFA, and Dengpan Luo, Ph.D. and CFA

"[Indexed annuity] contracts have really high hidden fees. That’s why they’re terrible ideas for older people even though they’re peddled to them." -- Kent Smetters, a former U.S. Treasury Department economic policy official and professor of insurance at the University of Pennsylvania’s Wharton School

"...if the sales hype is replaced with analysis, most astute individual investor will avoid [index annuities]. Giving up dividends plus imposing a cap on market capital gains is far too severe a penalty to pay for protection against periodic market losses. Astute investors seeking long-term tax-deferred accumulation are likely to have their investment returns substantially muted by investing in indexed annuities, if history is any guide." -- Peter Katt, CFP, a fee-only life insurance adviser

According to Chris Wang, with the Allianz 222 index annuity you can expect "low single digit returns of 1 - 3%, which all indexed annuities will return."

"You never want to buy an annuity that has a surrender charge" -- Bob Brinker, consumer advocate and legitimate paid radio host of 30 years

"Index annuities are the 'poster children' for products that are too good to be true" -- Larry Swedroe

Ric Edelman's list of 15 investments to avoid includes index annuities.

DISCLAIMER: Always speak to a fee-only fiduciary advisor on a one-time or one-task basis before making any financial decisions. Bob Brinker recommends www.NAPFA.org for finding an advisor.

Our reviews of other infomercials that run on KABC:

Review of Ken Moraif Money Matters market timing infomercials

Review of Doug Andrew Missed Fortune IUL insurance infomercials

Review of Power Trading Radio Online Trading Academy infomercials

Review of Rich Uncles non-traded REIT infomercials

Our other reviews:

Debunking Tony Robbins and index annuities

Go Back to Index Annuities

Disclaimer and Waiver - Nothing on this consumer advocate website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy, hold or sell, or as an endorsement, of any company, security, fund, product or other offering. This website, its owners, affiliates, agents and / or contributors are not financial or investment advisors or broker / dealers and assume no liability whatsoever by your reliance on the information contained herein. The information should not be relied upon for purposes of transacting securities, assets, financial products or other investments. Your use of the information contained herein is at your own risk. The content is provided 'as is' and without warranties, either expressed or implied. This site does not promise or guarantee any income or particular result from your use of the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained. Always hire and consult with a professional regarding the evaluation of any specific information, opinion, or other content.