The Pros and Cons of Annuities

1 - 2 - 3 - 4 - 5 - 6 - 7 - 8 - 9 - FAQ - Top Annuity Lies

Index Annuities - Immediate Annuities

Variable annuity "guarantees" against loss of principal:

Since annuities are long-term investments this guarantee has little value. You have plenty of time to recover from market drops even if you made the huge mistake of investing 100% in stocks.

A big broker "selling point" for annuities is that the insurance company guarantees that you will never lose your original investment (also known as your "principal"). This guarantee is a big "so what" because 1) Bonds protect against stock market volatility and 2) annuities are long-term investments and 3) over long-term periods the market has generally always been positive or at least even. If you are a short-term investor then you should not invest in annuities because annuities are not short-term financial products.

A big broker "selling point" for annuities is that the insurance company guarantees that you will never lose your original investment (also known as your "principal"). This guarantee is a big "so what" because 1) Bonds protect against stock market volatility and 2) annuities are long-term investments and 3) over long-term periods the market has generally always been positive or at least even. If you are a short-term investor then you should not invest in annuities because annuities are not short-term financial products.

As previously mentioned even T Rowe price has admitted that annuities are meant to be held for 10 - 20 years. History has shown us that you're not likely to lose any of your original principal over a period of 10 to 12 years when diversified among asset classes such as stocks and bonds. Therefore it is not realistic to be worried about loss of principal over long periods of time. Yet this is the fallacy that unscrupulous brokers assume when they rave about this guarantee against loss of principal. Over even longer periods of 15 or more years it becomes completely unrealistic to be concerned about losing principal, especially if you plan on investing some of that annuity in lower risk sub-funds such as bond funds. So when a broker tries to sell a variable annuity to someone in their 20's, 30's or even their mid 40's based on this guarantee I say they are selling snake oil. Furthermore how do you think the insurance company is so comfortable making this guarantee? It's because they know that it's a very easy guarantee to make.

Historically on average the stock market has dropped at least 10% about once a year. It has dropped at least 20% every 3 1/2 years. It has dropped at least 30% every 10 years. It has dropped at least 40% every 25 years. And it has dropped at least 50% every 50 years. This is what annuity salesmen want you to fear. But what happens after the stock market collapses? It simply bounces back a few months or years later. History has shown us that over periods of 10 - 20 years you have plenty of time to recover from drops along the way. Over long time periods the stock market goes up -- not down! Beware of any annuity salesman who cherry picks short-term historical stock market performance data (such as 2008 - 2009) in order to make you fear the market! Annuity salesmen LOVE to do this and it's completely deceptive!

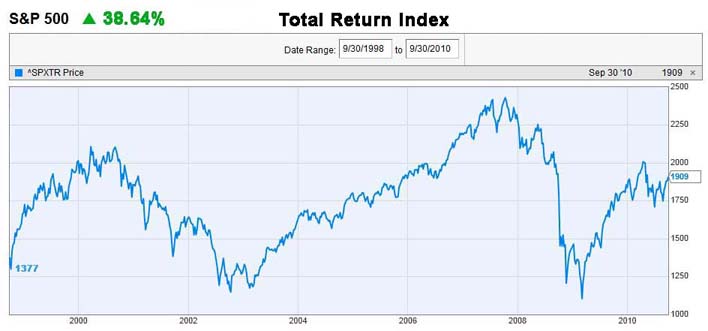

EXAMPLE: A lot of investors have been disappointed by the stock market's performance over the last decade and as a result some have been duped into investing in variable annuities for fear of "loss of principal". But even if you were the biggest loser of losers and you to entered into the stock market at the absolute worst possible time on Sept. 1, 2000, after 10 years and 4 months you were right back to even! NO loss of principal by investing in the stock market like everyone else! Again, annuities are long term investments, so an insurance company "guarantee" against loss of principal during this so-called "lost decade" was pointless and has only wound up costing you lots of money in high management fees, loss of stepped up cost basis, higher taxes, loss of liquidity, etc, etc. Even during this time period annuities were poor investments!

ANOTHER EXAMPLE: Now let's look at another bear market that spanned from the mid 60's to early 1980. Unlike the above "total return" chart, this "price return" chart below does not factor in dividend gains. Accordingly after 10 years one would expect the total return probably to be perhaps about 30% higher. This makes annuities look even less attractive. There probably wouldn't have been any "loss of principal" after 10 years had you invested when the S & P 500 was at $92.43 or $103.86 or $118.05....

Below: S&P "PRICE RETURN" CHART ONLY -- NOT A "TOTAL RETURN" CHART

So annuity guarantees are unnecessary for even the biggest loser of losers who made the fatal mistake of putting 100% of their money in stocks, and got in at historical peaks and right before long bear markets. With a time horizon of just 10 years (the minimum annuity holding period cited by T Rowe Price), eventually the market bounces back.

Again these charts are based on someone buying 100% into a volatile asset class (the S & P 500) at some of the absolute worst possible times in recent and relevant history -- at historical market peaks. Odds are that your timing won't be this bad and odds are that you would diversity! With diversification (into bonds) there would undoubtedly be much less risk of loss of principal and less time required to recover from market dips, thus making annuity guarantees even more unnecessary.

NOTE: I have not gone back as far as the 1929 crash because many changes have been made since then to prevent such crashes. Before 1929 the Securities and Exchange Commission and the Federal Deposit Insurance Corporation didn't even exist which left the door wide open for corruption and stock overvaluation. After the 1929 crash the Glass-Steagall Act was also passed to prevent future improper banking activity, which has been identified as a leading cause of the market crash. Accordingly, beware of any annuity salesman who tries to use the 1929 stock market crash to create fear in order to sell you an annuity.

Furthermore with each subsequent market crash, additional measures have been put in place to 1) prevent over valuation and 2) to prevent exaggerated panic selling.

In summary all of this fear of losing your principal is completely exaggerated by brokers who want to sell you annuities! Remember that it's diversification that should be used to protect your money from market volatility -- not annuities!

Avoid annuities especially after market collapses

BELOW: Remember there is NO good time to get into an annuity. Completely avoid annuities. But the absolute WORST time to lock your money up in an annuity prison is after the market has collapsed, such as the areas circled in red below. When the market is at historical lows, this is the LAST time you would ever need such an unnecessary "guarantee" against principal loss! At this time your strategy should be the complete opposite -- to invest in and feel much more comfortable about investing in more volatile investments like ordinary stock-based index funds (ETF's). Yet paradoxically this is when amateur investors get scared and flock to perceived conservative investments like annuities, and when brokers happily jump at the opportunity to sell annuities, earning huge commissions.

Investors usually break the 5% rule with annuities

Investors usually break the 5% rule with annuities