BONDS

"The primary role of bonds in your portfolio is to serve as a diversifier against sharp swings in the stock market" -- Vanguard

What does the know-nothing investor need to know about bonds?

Bonds are a time-tested, bread and butter part of a diversified portfolio. Visit any portfolio creation website such as Vanguard's tool (or their nest egg calculator) and the portflio that it spits out will always be a combination of stocks, bonds and maybe a little bit of cash reserves.

Owning bonds is like having brakes on a car. You wouldn't want to drive without them. Bonds are nowhere near as volatile as stocks. They provide balance to a portfolio. Over very long periods of time, stocks have been the best performing asset class, but bonds help protect against stock market volatility. When the stock market crashes, money tends to run to the safety of bonds. Being diversified is what saved conservative senior citizen investors during the so called "lost decade" from 2000 - 2008. No conservative retiree who was properly diversified into an age-appropriate portfolio of perhaps 72% bonds and 28% stocks had to go back to work.

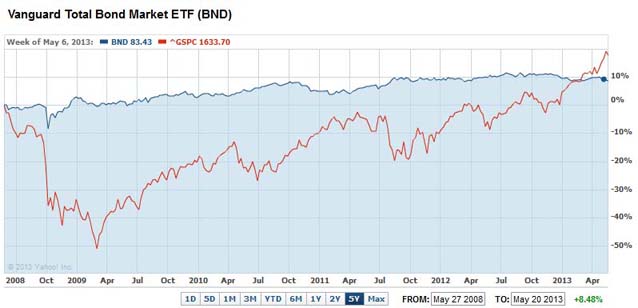

RIGHT: In this chart we compare the total bond market ETF BND versus the S&P 500 index. Before the 2008 - 2009 stock market crash, if you were properly diversified (into not just stocks, but bonds) then this helped protect your portfolio nicely. As the market declined you would have also had the opportunity to keep rebalancing your portfolio by shifting money out of bonds and into stocks in order to maintain your stock / bond ratio. Conversely, as your stock asset class outperforms your bond asset class, you can rebalance your portfolio by moving money out of stocks and into bonds in order to maintain a stock/bond balance that fits your investment goals.

What is a good bond / stock ratio for you? To get an idea check out Vanguard's portfolio creation tool. Many fiduciary advisers are sounding the alarm to get out of long-term bonds and into short and medium-term bond ETF's, which are less sensitive to interest rate rises. However a study of the charts reveals that total bond market ETF's like AGG are actually not much more volatile than the iShares 3 - 7 Year Treasury Bond ETF IEI.

Technical Talk

What is a bond? Technically a bond is a debt investment in which an investor loans money (to corporate or governmental entities) for a set period of time and at a fixed interest rate. These entities use bonds to fund various projects and activities. The 3 main bond categories are corporate bonds, municipal bonds, and U.S. Treasury bonds, notes and bills, which are collectively referred to as simply "Treasuries." So you loan them (the "issuer") a set amount of money ("principal") and they make periodic interest payments ("coupon") to you (usually every 6 months) until the set period of time ends ("maturity" date") at which time they pay you back your principal. Bond investing is not complicated. You can invest in the bond asset class by simply buying a total bond market ETF such as BND or AGG through any deep discount brokerage firm (such as Charles Schwab).

Bonds are not created equally

Every investment has risk, including bonds. Some have more risk than others. Sometimes an entity goes into default and cannot make interest payments and / or pay back the principal investment amount. Ratings companies such as Standard & Poor's, Moody's and Fitch provide bond ratings that help investors gauge the issuer's financial strength -- or their ability to make interest payments and pay back the principal as agreed upon. Credit quality ranges from AAA rated down to C (also known as "non-investment grade" or "junk bonds").

Bond maturities range from 90-day Treasury bills to a 30-year government bonds. Corporate and municipal bonds typically range from 3 to 10 years.

How much interest rate a bond pays is determined by it's credit quality and the duration of the bond. The lower the credit rating the more interest it pays, but there is of course more risk of default. The longer the maturity the more interest it pays, but you run the risk of missing out on other investment opportunities that may become more promising or the risk of just plain needing your money before the bond's maturity date. However with ETF's you can invest in long-term bonds without having to stay the course. These ETF's may be more volatile if a large number of investors cash out of the fund.

Also when interest rates go down, bond prices go up. When interest rates go up, bond prices go down. Bonds of longer maturities are much more effected by interest rate changes than bonds of shorter maturities.

In the chart below we compare three very different bond index funds:

BLV (invests in bonds with maturities of greater than 10 years and pays a yield of 4.47%)

FIVZ (invests in 3 - 7 year bonds and pays a yield of 1.33%)

SHY (invests in 1 - 3 year bonds and pays a yield of 0.27%).

Bonds with longer maturities are most effected by changing interest rates. Accordingly when interest rates began rising in 2013, BLV lost 20% of its value! This is why you can't always just go with the highest yielding bond ETF. With that higher yield you are taking on greater risk, which might backfire.

The "Bond Bubble"

US Treasuries (T-bills and T-bonds) as well as municipal bonds were once considered a risk-free safe haven. Now the credit rating company S & P has lowered their rating of US Treasuries to "low risk". 10-year Treasury bond yields are now below 2% for the first time in 50 years. For starters this pathetic yield won't even keep your money at pace with inflation which historically has run about 3% per year on average.

The bigger concern is that interest rates are at all time historical lows -- rates really can't get any lower. If and when interest rates do go back up it is a fact that bond prices will go down! Of course interest rates could just go sideways for years to come. Or as some people such as Jim Cramer believe, when interest rates go up they will go up slowly and therefore bonds prices won't suffer greatly and therefore the "bond bubble" is over-hyped.

Most at risk of rising interest rates are long-term bonds (such as 20 and 30 year bonds). One can mitigate this risk by instead focusing on short and medium term bonds (such as 3, 5, 7, 10 years). Broadly diversified bond funds such as AGG (the total bond market) is only slightly more volatile than 3 - 7 year treasury ETF's like IEI. AGG's has an average duration of only 5.6 years.

Bill Gross, the biggest fixed income manager in the world, has warned that the three-decade bond party is likely over.

The Vanguard Group sent out a warning signal to bond investors. CLICK HERE for article.

Dan Fuss has said that the fixed-income market hasn't been this overbought in the 55 years of his career.

UBS is set to reclassify bond investors as "aggressive" rather than "moderate".

Warren Buffet says that long-term bonds should come with a "warning label". CLICK HERE for article or CLICK HERE for full article.

The other risks associated with Treasury bonds are negative yields (or just plain low yields that can't keep pace with inflation), higher inflation, to even panic selling that would send bond prices in a tail spin, or even an outright collapse and then default. A bursting of the bond market would have a ripple effect far beyond just bonds. Stocks, real estate, and just about everything else would be effected adversely. If you are content to just sit on cash then inflation will just eat away at your savings. At current inflation rates your money loses about 1/3 of its value in about 10 years.

Should you abandon bonds when interest rates are low?

Fee-only fiduciary registered investments advisers will say no. For starters, abandoning bonds would leave you exposed to 100% stocks. Bonds and stocks tend to move in opposite directions because they are fighting for the same money. Your total bond market index fund has an average duration of only around 6 years, which is a modest amount of bond risk. Stick to your predetermined allocation ratio that meets your retirement goals.

Secondly, abandoning bonds or moving bond money to shorter-term, lower-yielding bonds would be an attempt to time the market, which is a bad strategy. Bond prices already reflect things like fears of rising interest rates. Nobody is psychic. Only Texas Sharpshooters can predict future market movements.

If interest rates do go up, bond prices will go down, however bond yields go UP for years to come. Those who don't panic and sell will enjoy the higher income.

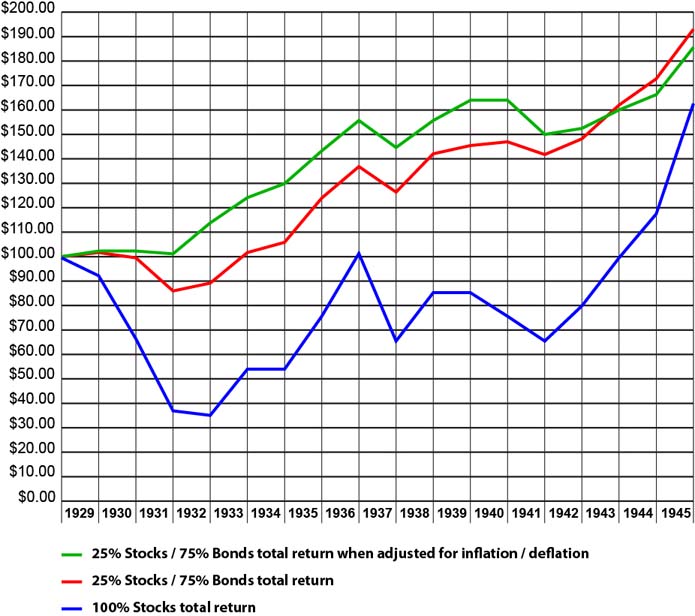

LEARNING FROM THE PAST: Investors who were diversified into bonds were protected from the 1929 stock market crash. When the stock market crashed, people had less money and spent less, and this in turn caused deflation. So your 75/25 portfolio had a lower dollar value by the start of 1932, but the purchasing power of your money was equal to where it was at the start of 1930.

Investors who were diversified into bonds were protected from the "lost decade" from 2000 - 2009. This chart also debunks the myth that annuities are a good place to be during bear markets. The 75/25 portfolio easily beat the index annuity by 1.4% per year over this 14 year period.

With interest rates as low as they are, should you continue to own just one ETF like BND or AGG (the total US bond market) or VFICX (Intermediate-term investment grade bonds) to represent your entire US bond holdings? As of 4/29/2014 BND's holdings by maturity were as follows:

Over 30 years = 2.6%

20 - 30 years = 26.78%

10 - 20 years =9.01%

5 - 10 years = 20.85%

3 - 5 years = 17.5%

1 - 3 years = 23.27%

As you can see, about 38% of BND is long-term bonds of 10 or more years, however more than 40% is in 1 to 5 year bonds. At the end of the day, the total bond market actually has an average duration of only about 5.6%, which in today's low interest rate environment might be just the right for most investors.

Here's an article that includes a portfolio of bond ETF's to consider.

Here's another article that offers alternatives to total bond market ETF's like BND and AGG.

Bond Index Funds VS Actively Managed Bond Funds

According to the SPIVA scorecard, in 2019, 98% of bond fund managers failed to beat the Barclays US Aggregate Bond Market Index. Going back 3 years, 98% failed to beat the market index. Going back 5 years, 100% failed to beat the market index. Going back 10 years, 99% failed to beat the market index. Going back 15 years, 98% failed to beat the market index.

Vanguard studied how 275 global bond funds performed for a 10 years period ending in 2012. In that 10-year period, 57% of the funds actually topped the Barclays Global Aggregate Bond Index. But according to Vanguard, the active managers did this simply by taking on more risk.

In a 5-year study from 2007 to 2012, a whopping 93.62% of active long bond managers failed to beat the Barclays Long Government index. [Source]

Jim Cramer on Bonds and Bond Allocation Ratio

According to Jim Cramer (MSNBC's Mad Money), either you cling to safety and then when it's time to retire you don't have enough cash or you take some risk in stocks, typically when you're younger, and go for the higher returns that will enable you to retire wealthier. This is Jim Cramer's general bond allocation ratio recommendation:

Younger than 30 - No reason to own bonds

In your 30's - 10% - 20% bonds

In your 40's - 20% - 30% bonds

In your 50's - 30% - 40% bonds

60 to retirement - 40% - 50% bonds

CLICK HERE for an interesting debate about investing in BOND (actively managed) versus BND (passively managed). These are two of the most popular bond funds.

Historical total returns of bonds

Here's what some experts are saying about how to hedge against a bursting of the Treasury bond bubble if you are fearful. Again this is certainly not personalized advice. Market timing is dangerous. The best approach is to diversify and favor short to medium term bonds (with minimal exposure to 20 and 30 year bonds).

![]() In the past, investing in bonds was as simple as buying the total bond market ETF BND. Both with interest rates as low as they are now you want to get out of bonds with long maturities of 10 to 30 years because the longer the maturity the more sensitive to interest rate changes. Instead consider ETF's like Vanguard's intermediate-term investment grade bond fund ( VFICX ) or Vanguard's short-term 1 - 5 year bond ETF BSV and/ or Shares Barclays 3-7 Year Treasury Bond ETF ( IEI ), the the Barclays U.S. 7-10 Year Treasury Bond Index IEF, BIV for Intermediate-term (5 - 10 year) bonds, Intermediate term corporate bonds VCIT, and also consider diversifying into International bonds IGOV.

In the past, investing in bonds was as simple as buying the total bond market ETF BND. Both with interest rates as low as they are now you want to get out of bonds with long maturities of 10 to 30 years because the longer the maturity the more sensitive to interest rate changes. Instead consider ETF's like Vanguard's intermediate-term investment grade bond fund ( VFICX ) or Vanguard's short-term 1 - 5 year bond ETF BSV and/ or Shares Barclays 3-7 Year Treasury Bond ETF ( IEI ), the the Barclays U.S. 7-10 Year Treasury Bond Index IEF, BIV for Intermediate-term (5 - 10 year) bonds, Intermediate term corporate bonds VCIT, and also consider diversifying into International bonds IGOV.

![]() Buy gold to protect against inflation / currency devaluation. Some experts recommend up to 20% in gold, however even some "alarmists" only recommend 5%.

Buy gold to protect against inflation / currency devaluation. Some experts recommend up to 20% in gold, however even some "alarmists" only recommend 5%.

![]() Invest more in growth stocks rather than bonds.

Invest more in growth stocks rather than bonds.

![]() Buy Inverse ETF's

Buy Inverse ETF's

SKF - Ultra short Financials -

TWM - Ultra short Russell 2000 -

EEV - Ultra short Emerging Markets -

(Symbol RYJCX ) Rydex Inverse Government Long Bond Strategy - If Treasury bond yields go up then this this fund will go up. So the price of this fund is inversely linked to T-bond prices.

(Symbol TBT) ProShares UltraShort 20+ Year Treasury - This ETF goes up twice the amount that 20-year Treasury bond futures fall.

WARNING: But before you go ahead and buy any of these inverse ETF's you should know that inverse ETF's are not buy and hold investments. Timing is everything with inverse ETF's! Under normal market conditions securities go up in value and when they do these inverse ETF's lose money as they have done over the last several years. Over the last 5 years (ending in January of 2013) TBT has lost 76% of its value!

![]() To protect against currency loss, buy a foreign currency such as Australian, Swiss or Canadian currency.

To protect against currency loss, buy a foreign currency such as Australian, Swiss or Canadian currency.

WARNING: Timing is everything when buying currency. Under normal circumstances currencies fluctuate up and down, but generally just go sideways. Over long periods of time they generally don't go up in value like stocks.

CLICK HERE (look at the bottom chart) to view the history of US 30 year Treasury bond prices. There you will see that from 1978 to 1981 Treasury bonds lost 43%. By 1983 US 30 year Treasury bonds were still off 40%. From 1983 to 1984 US Treasuries lost 25%. They lost 20% in 2009.

Municipal bonds should come with a warning label

NOTE: If you are a bond index investor (example AGG) then you can skip the rest of this article which covers investing in individual bonds.

Many are saying that municipal bonds are terrible investments right now for several reasons. 1) they pay really low interest rates, 2) everyone believes that interest rates will eventually go up and when they do bonds will fall in value, 3) most states and cities are buried in massive debt, 4) in these tough times municipalities are beginning to prioritize paying city employee's salaries and pensions ahead of investors, which is unacceptable, and 5) While municipal bonds are currently tax-free, Obama is trying to change this as part of his 2013 budget proposal, 6 ) with Muni bonds you pay high transaction costs of 2 - 3% (as part of "the spread").

As further confirmation that municipal bonds are too much risk for too little reward, Warren Buffet has terminated credit default swaps regarding 8.25 billion dollars in municipal debt.

More takers than makers: According to Forbes magazine you should avoid investing in "death spiral states". The worst of the worst are Connecticut, Ohio, Hawaii, Illinois, Kentucky, South Carolina, New York, Maine, Alabama, California, Mississippi and New Mexico. The best states to invest in are North Dakota, Nebraska and Virginia.

To top it off, if you are working with a commission-based "adviser" (a salesman) understand that they will earn 17 times more commission money when selling you a municipal bond than a stock. Never work with a commission-based adviser.

Beware of the bond price "spread"

"Spread" is the difference between what underwriters pay for a security versus what they sell it for. With Muni bonds in particular, that difference is quite significant! Individual bonds are happily pushed by non-fiduciaries (brokers) because they stand to earn high commissions that get subtracted from the bond transaction price. Also brokers earn more commission money when they sell individual bonds over bond funds. Typically 2 - 4% is shaved off the transaction price. Don't expect Mr. Broker to have a conversation with you about it either because legally he doesn't have to tell you! As repeatedly discussed on this site, the solution is to never work with a broker / adviser (salesman). Buy bond funds rather than individual bonds. With individual bonds, chances are you will overpay and be sold riskier bonds by Mr. Broker. Read this USA Today article about the spread.

NEXT ARTICLE: Advisers

Disclaimer and Waiver - Nothing on this consumer advocate website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy, hold or sell, or as an endorsement, of any company, security, fund, product or other offering. This website, its owners, affiliates, agents and / or contributors are not financial or investment advisors or broker / dealers and assume no liability whatsoever by your reliance on the information contained herein. The information should not be relied upon for purposes of transacting securities, assets, financial products or other investments. Your use of the information contained herein is at your own risk. The content is provided 'as is' and without warranties, either expressed or implied. This site does not promise or guarantee any income or particular result from your use of the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained. Always hire and consult with a professional regarding the evaluation of any specific information, opinion, or other content.