![]() The do it yourself option: Buy, hold and rebalance index funds

The do it yourself option: Buy, hold and rebalance index funds

Lots of people manage their own investment money. It's easy. Generally speaking you decide how much risk you should take (based on such factors as your age, appetite for volatility) then buy, hold and rebalance stock and bond index funds. Again, the securities and strategies cited on this site do not constitute personalized investing advice.

Lots of people manage their own investment money. It's easy. Generally speaking you decide how much risk you should take (based on such factors as your age, appetite for volatility) then buy, hold and rebalance stock and bond index funds. Again, the securities and strategies cited on this site do not constitute personalized investing advice.

Past statistics have shown that by investing in as little as just one single index fund (such as a total stock market index fund or an S & P 500 index fund) the average investor is likely to outperform most professionally managed stock funds over a number of years. Warren Buffet swears by this incredibly simple strategy for the average know-nothing couch potato investor (for stock-based asset class investing). This study concluded that the best course of action for the average investor is to buy and hold an index fund for the long term, thus eliminating all of the expenses of managers and trading costs. By default, broad market index funds like VITPX track performance of the overall stock market. VITPX has management costs of next to nothing (only 0.02% per year) and a super low turnover rate of only 8% per year. Total stock market index funds like VITX are fully diversified into about 3,300 stocks. You can literally own one single index fund and be "stock diversified". And if one of the companies held by the fund goes bankrupt then it literally can't effect the overall fund value very much because the largest holding (Apple) is only 2.38%. The 10th largest holding is Phizer at 1.19%. The rest of the 3,300 or so stocks held by VITPX continue to decline in holding size.

Most people over the age of 30 aren't going to risk putting 100% of their money in the stock asset class alone. They would instead diversify into bonds which are a conservative, much less volatile asset class. Bonds will never be as volatile as stocks on even their worst day. One can invest in bonds through a passively managed index fund such as BND or AGG, which essentially track the total US bond market.

If 60% stocks and 40% bonds happens to suit your situation and you don't want to take the time rebalancing, then there is one single index fund that will truly allow you to be full time a couch potato. VBNIX consists of 60% total US stock market index and 40% US Barclay's bond index and it rebalances automatically. You can literally invest everything in this one single balanced index fund and then forget about it!

How much should someone invest in the stock-based asset class (versus bonds and/ or cash)? It depends on the investor. Advisors will typically recommend that you invest anywhere from 25% to 100% of your savings in stock based investments, depending on your tolerance for risk, time frame, whom you are investing for (yourself or perhaps your heirs?), etc. Hire a fee-only fiduciary for a one-time consultation to build a portfolio if you need help.

Many follow John Bogle's principals of investing, which is based on Nobel prize-winning financial economics research. Some of the main principles include never bearing too much or too little risk, and never trying to "time the market". The 2nd Grader's Portfolio involves investing in just 3 funds: A total stock market index fund, a total international index fund and a total bond market index fund. Here's a list of many ETF portfolios.

Not sure how much risk to take or where to invest?

Generally speaking this means deciding on a bond / stock allocation ratio that fits your age and appetite for risk. A super aggressive investor in their 20's might put 100% in stocks, whereas an older, super conservative investor might put 70% in bonds and only 30% in stocks. You want to take enough risk to meet your goals, but no more.

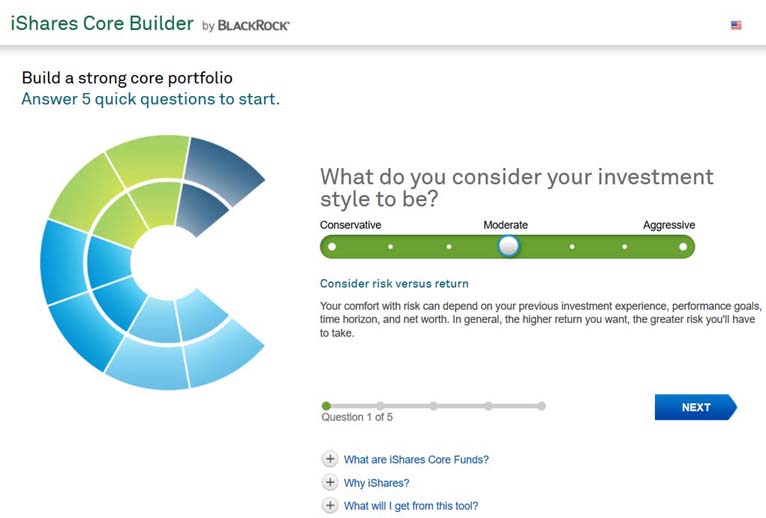

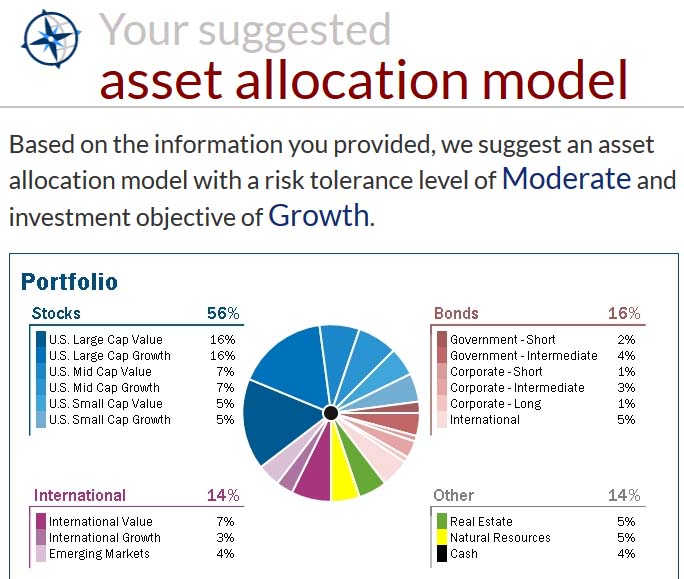

Check out Blackrock's core portfolio bulder. It asks you a few questions then spits out a simple, sensible portfolio that can be replicated with low cost index funds.

Also check out Vanguard's FREE portfolio creation tool. It asks you a few questions then spits out a simple portfolio of index funds. Note that they only recommend their own funds. You do not have to buy into their funds. For example you could replace VBMFX with iShares total bond market index fund AGG, replace VTSMX with an S&P 500 index fund like SPY or VOO instead of investing in a total US stock market fund.

You could also check out Ric Edelman's FREE portfolio creation tool (discontinued) to determine a good bond/stock allocation ratio. Ric's portfolio cretion tool produces a wider variety of funds. You do not have to invest in this many funds. We believe that advisers recommend lots of funds in order to make it seem like investing is complicated and therefor investors will continue to pay the yearly asset management fee. If you compare chart performance of index funds on Yahoo Finance you very well might conclude that there is no need to own more than 2 - 5 index funds.

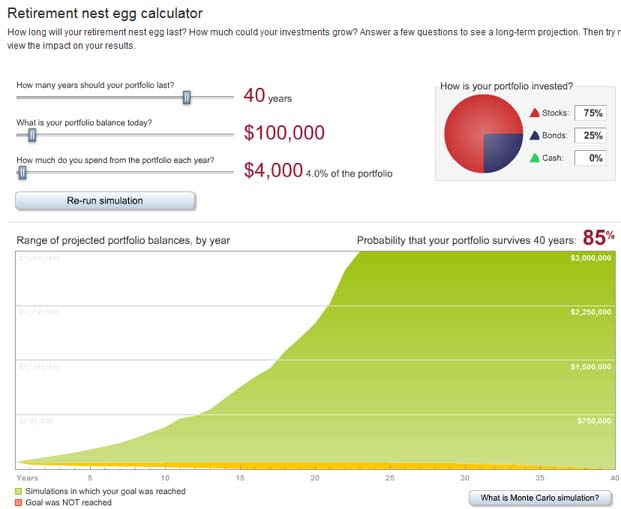

Then definitely check out Vanguard's FREE nest egg calculator. This very helpful tool allows you to test out the survival probability of various stock / bond allocation ratios. Be sure to test out various bond / stock allocations.

Also check out Portfolio Charts, an assortment of lazy portfolios.

You might also check out EasyAllocator.org which is a more rudimentary one-size fits all portfolio selection tool. It actually gives you a projected portfolio growth.

You will notice that some of these automated portfolio creation tools ask you what you would likely do if stocks were to crash and/or how much volatility you can tolerate. This is a very important question. If stocks were to crash 10%... 20%... 30%... 40%... or 50% would you panic and get out of the market? If so then you need to have enough percentage of your money invested in bonds to prevent this type of volatility. Just keep in mind that you also won't be participating in as much of the upside of the market. Basically you have to find a middle ground and stick to it, only rebalancing as needed to maintain your predetermined allocation ratio (example: 50/50). To determine what that desired middle ground is, you need to study the performance history of the markets. Click here to see how the lowest risk allocation of 28% stocks and 72% bonds has performed since 1928.

Also keep in mind is time horizon. History says that with a longer time horizon you can afford to take more risk and are likely to generate higher returns.

Another thing to consider is whether you have already reached your investment goals. For example, if you have already amassed more than enough money to last you a lifetime then it might not make senses to take as much risk as someone else your age who has not yet reached that financial critical mass.

What do some of the investment gurus recommend?

As of late 2014, this was Jim Cramer's general bond / stock allocation ratio recommendation:

Younger than 30 - No reason to own bonds

In your 30's - 10% - 20% bonds

In your 40's - 20% - 30% bonds

In your 50's - 30% - 40% bonds

60 to retirement - 40% - 50% bonds

Similarly, former radio host Bob Brinker recommends a 50/50 bond / stock allocation for a retired 70 year old.

Are you a very aggressive investor? Mark Hulbert makes the argument that it's more sensible to put only 60% in stocks and 40% in bonds than to assume more risk.

Finance professor Benjiman Graham has said to stay within the range of 25/75 to 75/25: "We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequent inverse range of between 75% and 25% in bonds."

How to do the actual investing part?

When managing your own money be sure to do your own trading through a self-directed account with a deep discount brokerage such as Charles Schwab or TDAmeritrade. Charles Schwab offers security tokens for two-factor authentication to protect your account, which is nice!

Again, always avoid full service brokerages and other non-fiduciaries (salesmen who don't legally work for you and your best interests).

FACT: The S&P 500 index is diversified both domestically and internationally because 46.1% of all S&P 500 index company revenue came from outside of the United States (as of 2011). This is why owning a single S&P 500 index fund to represent all of your stock asset class can be perfectly reasonable.

Please note that estate planning is very complex. If your personal situation involves estate planning then absolutely hire a professional. And finally, at the risk of sounding redundant, none of the specific securities or strategies mentioned on this site are personalized investment recommendations. Do your own due diligence.

For other options beside doing it yourself, please visit this page.