REVIEW OF

Doug Andrew Missed Fortune

Infomercial

AS HEARD ON 790 AM - KABC LOS ANGELES

WHAT OTHERS ARE SAYING ABOUT DOUG ANDREW:

"...think long and hard about the adage if it sounds too good to be true it probably isn’t true. That is the perfect way to sum up Doug Andrew’s Missed Fortune 101" -- Certified Financial Group

WHAT OTHERS ARE SAYING ABOUT THE MISSED FORTUNE CONCEPT:

"Beware of anyone peddling the Missed Fortune concept. Life insurance is not a retirement plan. At The Center for Life Insurance Disputes we are getting calls from unsuspecting investors being sold the Missed Fortune concept from insurance agents and financial planners across the country. Stay away from these scam artists" -- Certified Financial Group

WHAT OTHERS ARE SAYING ABOUT INDEXED UNIVERSAL LIFE:

"...the chances of earning 8% - 9% -- it's not going to happen. We can't take a bond yielding 3.5% and turn it into something that produces 9%. That's financial alchemy. The ability of [the insurance company] to credit interest to the [IUL] product depends on how well its own investment portfolio of bonds is doing." -- Larry J. Rybka, chief executive of Valmark Securities Inc.

"Avoid [indexed] universal life insurance at all costs!" - Clark Howard

"The hidden fees of insurance policies are more pervasive than in virtually any other product in the market place." - Ric Edelman

"You do not purchase insurance for investment purposes." - Ric Edelman

"I can easily recommend term life insurance as the only thing [people need] because [WL, UL and VL] is garbage. It's a rip-off. You're much better off buying term insurance at about 5 cents on the dollar for the same amount of insurance and investing the rest of your money. You'll wind up with much more." -- Dave Ramsey

"[WL, UL and VL are on the] top 10 list of investments that I hate. They literally do absolutely nothing for you and they do everything for the financial salesperson." -- Suze Orman

1) Doug Andrew pays for airtime in which he hosts radio infomercials that have the appearance of being part of the regular on-air programming. Listeners might be fooled by how Doug Andrew says "our incredible national audience coast to coast". Make no mistake, these infomercials are not part of the regular programming. They are 30 minute advertisements.

2) Doug Andrew is pushing a so-called "cash value" (or "investment grade") insurance product called index universal life insurance (IUL). For a complete review of investment grade insurance products please visit this page.

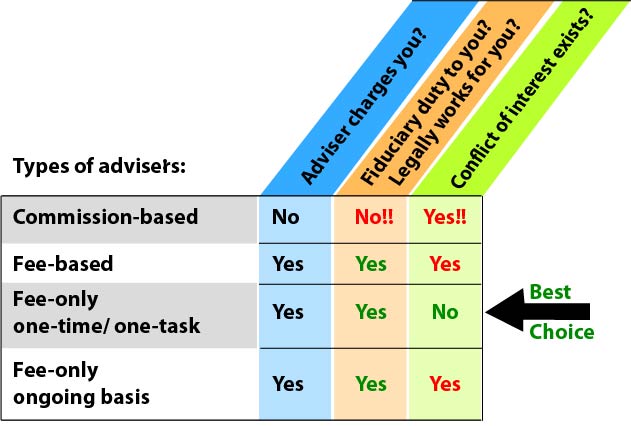

4) Commissions = conflict of interest: Commission-based insurance agents earn lavish commissions if and when they manage to sell investment grade insurance products like IUL. Investment-grade (cash value) insurance policies like whole life, variable life, universal life, and indexed universal life insurance generally pay agents 100% of the first year’s premiums then 6% of the premiums for every year thereafter. Ask yourself, do you think this is why Doug Andrew loves cash value life insurance so much and is paying for expensive radio air time every weekend?!

Financial professionals earn substantially less commissions if and when they manage to sell securities such as bonds and stock funds. When hired on a one-time or hourly basis, fee-only fiduciary financial professionals earn no commissions if and when they recommend tax efficient, 100% liquid, low-cost index funds.

3) Doug Andrew claims on his "radio show" that he let his securities licenses expire in order to "become your advocate -- a consumer advocate." But the inquisitive consumer has to ask, is he really looking out for your best interests over his own best interests when IUL pays such lavish agent commissions? What he doesn't mention during this segment is that he is a licensed insurance product salesman. Is the real reason he got out of the securities business because there is much more commission money to be earned by selling insurance products (versus selling securities as a commission-based securities salesman)?

Here's what you can do if you choose to work with Doug Andrew. Ask him to agree in writing to work for you as a fee-ONLY fiduciary. This would legally prohibit him from earning back door commissions by selling your financial products. Let us know how quickly he says no.

5) Doug Andrew encourages listeners to come out to local hotels to listen to one of his 4-hour sales pitches that he calls "educational events" or "seminars". Andrew conveniently equates coming out to his sales pitches as something that someone with a successful mind-set would do. You are "teachable", you're an "independent thinker", you're "decisive", "you want to apply new truth immediately" and you're about to be "liberated"! If you don't you're "wishy-washy", you "follow the herd", and not only are you not "financially disciplined" but you've been manipulated by the financial services industry! Wow! Do people really fall for this nonsense? The most amusing traits that he mentioned were "independent thinker" and "decisive" coupled with the word "immediately". Nothing like making a rash financial decision all by yourself after going to a hotel sales pitch without doing your research and seeking outside and unbiased opinions!

6) Flashing certifications and/or qualifications is step on in gaining people's trust. Andrew states that he has been in the financial services industry for four and a half decades. That's fine and dandy. However it doesn't tell us what we most need to know. The only qualification that should matter in determining if someone legally works for you and your best interests and without CONFLICTS OF INTEREST is whether or not an advisor is a FEE-ONLY FIDUCIARY! Everyone else by default should be regarded as a salesman. Even fee-based fiduciaries by default should not be trusted for money advice. Many fee-based fiduciaries cannot resist the urge to sell annuities.

7) Andrew then apparently pitches to attendees the idea of pulling equity out of their homes and even the idea of essentially liquidating their IRA's and 401K's to instead invest in indexed universal life insurance -- Never mind that liquidating a retirement account before age 59 1/2 will cost you a 10% Federal tax penalty plus possible state tax penalty.

8) Doug Andrew states that one "can" earn as much as an 8% "return".

9) According to consumer advocate website WhiteCoatInvestor.com an IUL policy is likely to only provide a return in the 2% to 5% range when held for life.

10) According to the insurance brokerage company the Bishop Company, IUL policies are "unlikely to produce returns in excess of bonds".

11) 10 year treasury bonds have provided a 5% (geometric average) return on investment since 1928. From Jan 2000 to Jan 2015 that return was 4.185%. 3-month T-bills have provided a 3.49% return on investment since 1928.

12) Insurance companies in fact invest 70% to 90% in bonds. Insurance companies have overhead costs, they pay lavish commissions to the "advisers" who sell insurance products like IUL, and they are for-profit corporations. This further confirms that insurance companies cannot pay out stock-like returns. They can only pay out returns that do not exceed the return of mainly bonds minus expenses and minus their profit.

13) From Jan 1928 to Jan 2015 the S&P 500 index provided an annualized return on investment of 9.739%. From Jan 2000 to Jan 2015 that return was 4.303%.

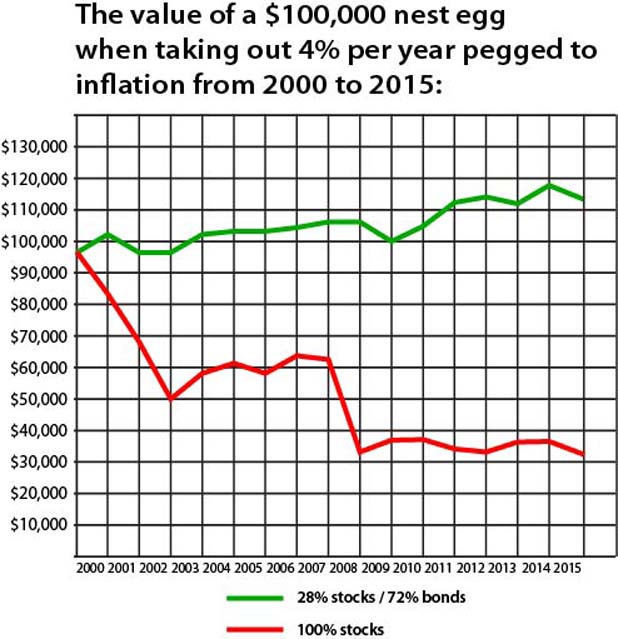

14) Strawman presentation: The number one deception used by product pushing salesmen who sell indexed universal life, annuities, non traded REITS, and other high-commission products is to talk about the volatility of 100% stocks. They never tell you that the way to protect against stock market volatility is through simple diversification into bonds. From 1970 to 2010 the lowest risk bond / stock allocation was 28% stocks and 72% bonds. If your investment goal is to simply earn in the lowly 2 - 5% range then history says that by investing in a very low-risk 28/72 portfolio you should easily beat an indexed universal life policy's return on investment.

Note: The above chart factors in calendar rebalancing on Jan 1 of every year

Above rate of withdrawal for each year: Jan 2000: $4,000, 2001: $4,136, 2002: $4,251.81, 2003: $4,319.84, 2004: $4,419.19, 2005: $4,538.51, 2006: $4,692.82, 2007: $4,842.99, 2008: $4,978.59, 2009: $5,167.78, 2010: $5,147.11, 2011: $5,229.46, 2012: $5,396.81, 2013: $5,510.14, 2014: $5,592.79, 2015: $5,682.28, 2016: $5,687.96

From 1995 to 2015 a 33/67 portfolio returned 8.2% when rebalanced annually.

Part of Mr. Andrew's strawman presentation is to talk about how if the market drops 33%, then it needs to go up 50% just to get back to even. Again he is completely ignoring diversificatioin into bonds! Never in the history of the markets, if you were properly diversified into bonds has the market ever experienced 33% loses. So it's pointless to even have such a discussion about the market dropping 33%.

15) By investing in a bond-heavy portfolio, history says that the risk of losing your money is completely exaggerated by commission-based salesmen who look at 100% stocks. If you have a long time horizon before you will begin taking withdrawals from your nest egg, then history says that you can take more risk than that of a 28/72 portfolio.

16) WHAT TAX BENEFITS? Andrew talks a lot about the "tax benefits" of IUL. First of all if you're liquidating your IRA's and 401 K's then you are paying taxes immediately, and then you have less to invest in his IUL insurance! The tax benefits of IUL over IRA's and 401K's is irrelevant because IRA's and 401K's grow tax free too! And finally, if we're talking about after-tax money outside of a retirement account, then the tax benefits of IUL (if any) are not significant because 2 - 5% returns are too small to begin with.

Regardless of where the money comes from, if you allow the policy to lapse, such as because of the ongoing yearly fees, then any and all money that you have been taking out immediately becomes taxable.

17) Doug Andrew also assumes that investors are in the 33% tax bracket! By investing in a taxable account of index funds you pay taxes but you pay at the lower "capital gains" tax rate. As of 2015 a single person doesn't even begin to pay any taxes on investment capital gains until they have $48,600 of income for the year.

18) Life insurance death benefits are tax free. However if you were to instead invest in simple index funds, principal and gains also pass on to heirs tax free in what is known as "stepped up cost basis".

19) You can take out a loan from IUL tax-free, however you must pay interest on that loan.

20) Most IUL policies come with an option to withdraw cash values rather than take out a loan, however these withdrawals are subject to nasty contingent deferred sales charges and may have additional fees. This is why IUL policies lack liquidity. They are meant to be held for life, and that's just to earn what is likely to be in the 2% - 5% range (according to consumer advocate group WhiteCoatInvestor)!

21) Doug Andrew actually has the gall to bash the fiduciary standard, encouraging investors to trust themselves and listen to him as he tries to sell you a high-commission financial product! How convenient! The fee-only fiduciary standard is the highest standard. Fiduciaries legally work for their clients, versus salesmen who do not have to put the interests of the client first. A fee-only advisor may not earn back-door commissions. Going to a commission-influenced adviser for advice on selecting investments can be one of the worst mistakes an investor can make, potentially having devastating and lasting impact on their financial future.

To make his case against the fiduciary standard he presents a strawman argument, that a fiduciary asset manager charges expensive ongoing fees every year. NOBODY should pay an adviser on an ongoing basis year after year. This is a false choice. As outlined on the main page, you cannot trust an adviser solely because they are a fiduciary. If you need money advice then you must 1) go to a fee-ONLY fiduciary adviser, and 2) work with them on a ONE-time or ONE-task basis. An even better choice is to do it yourself.

Doug Andrew's next strawman argument is to talk about "if the market goes down" when working with a fiduciary adviser. This takes us back to point #14. He is again preaching to investors who are ignorant of stock / bond diversification. If you can't stomach stock market volatility then you diversify more into bonds. Any fee-only fiduciary will work with you to determine a good level of risk that fits your retirement goals. Comparing an investor with a desire / need for greater risk with an investor who has a goal of earning lowly 2 - 5% returns is an apples to oranges strawman presentation. If you are resigned to low risk / low returns then you would diversify heavily into bonds. Investing 101.

As a final note it is very important that investors understand the difference between annual income "return" and actual "return on investment". Return on investment is a basic measurement used to determine the efficiency of an investment and to compare it to other alternatives. Return on investment factors in not just income payments but the cash out value of your underlying principal. When you are constantly paying into an investment, calculating return on investment is impossible for anyone but a mathematician or someone with a special software program to determine. Most IUL investors would be shocked at how low their actual return on investment is and how well they would have done had they instead simply invested in a low-risk mix of a couple of low-cost stock and bond index funds.

Not long ago there was no Internet. It was hard to get answers. Today there is a wealth of information about investing. Amazingly people still manage to get snared by products like indexed universal life even though there is a wealth of information about how inferior these insurance products are.

Another review of Doug Andrew Missed Fortune

Another article: Beware the Doug Andrew Missed Fortune Sales Concept

Review of Ken Moraif Money Matters

Debunking Tony Robbins and index annuities

Disclaimer and Waiver - Nothing on this consumer advocate website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy, hold or sell, or as an endorsement, of any company, security, fund, product or other offering. This website, its owners, affiliates, agents and / or contributors are not financial or investment advisors or broker / dealers and assume no liability whatsoever by your reliance on the information contained herein. The information should not be relied upon for purposes of transacting securities, assets, financial products or other investments. Your use of the information contained herein is at your own risk. The content is provided 'as is' and without warranties, either expressed or implied. This site does not promise or guarantee any income or particular result from your use of the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained. Always hire and consult with a professional regarding the evaluation of any specific information, opinion, or other content.