1 - 2 - 3 - 4 - 5 - 6 - 7 - 8 - 9 - FAQ - Top Annuity Lies

Index Annuities - Immediate Annuities

Life Insurance

THE UGLY TRUTH ABOUT

Index Annuities

AKA Fixed Indexed Annuities

Fixed Annuities

Fixed Deferred Index Annuities

(formerly known as "Equity Indexed Annuities")

Hybrid Index Annuities

Guaranteed Income Rider

Expect an internal rate of return on par with CD's

SUMMARY: An index annuity is an inferior financial product that can be expected to provide a very low annualized return on investment of between 1 and 3 percent. Generally the growth of your money stops once you start taking income on an index annuity. Once you reach your actuarial life expectancy there is typically nothing left for heirs.

"Index annuities are a danger to your financial health." -- Clark Howard

"[The insurance company] is not playing Santa Claus. Even with interest rates near record lows, CDs may still do better than indexed annuities". -- William Reichenstein Article

"The opacity of [index annuity] fees and complexity of the return calculations makes it impossible for investors to figure out if they’re getting a good deal". -- Glenn Daily, a fee-only insurance consultant based in New York. Article

"[Indexed annuities] carry exorbitant and indeterminable costs, lack of federal regulation and an inability to decipher what the investments will earn... They are complicated investments sold to unsophisticated investors." -- Craig McCann, Ph.D. and CFA, and Dengpan Luo, Ph.D. and CFA

"Some 99% of the time, indexed annuities under perform a simple portfolio that’s 60% in zero-coupon Treasuries and 40% in a low-cost S&P 500 index fund, according to a 2008 study by economic consultant Craig J. McCann" -- Forbes Magazine

"[Indexed annuity] contracts have really high hidden fees. That’s why they’re terrible ideas for older people even though they’re peddled to them." -- Kent Smetters, a former U.S. Treasury Department economic policy official and professor of insurance at the University of Pennsylvania’s Wharton School

"...if the sales hype is replaced with analysis, most astute individual investors will avoid [index annuities]. Giving up dividends plus imposing a cap on market capital gains is far too severe a penalty to pay for protection against periodic market losses. Astute investors seeking long-term tax-deferred accumulation are likely to have their investment returns substantially muted by investing in indexed annuities, if history is any guide." -- Peter Katt, CFP, a fee-only life insurance adviser

INDEX ANNUITIES EXPOSED: Two University professors (Yale and UCLA) discovered that investors would be better off in a simple portfolio of U.S. Treasury bonds and large cap stocks – a whopping 97% of the time! Other studies have suggested that when someone buys an annuity this typically results in a wealth transfer of as much as 15% to 20% from the investor to the insurance companies and the sales agents. SOURCE

A Telling Tale: Guests at the Tiburon CEO Summit include the top investment advisers, top executives of the largest brokerages, insurance companies, mutual funds companies, private equity firms and technology companies serving the financial sector. According to Ric Edelman, when surveyed, it was found that nobody at the 2014 summit owns fixed annuities! If the biggest and best money minds themselves don't own fixed annuities then why should you?

"Index annuities are the 'poster children' for products that are too good to be true" -- Larry Swedroe

"I've shown no interest in these fixed index annuities for a variety of reasons" -- Bob Brinker, consumer advocate radio host

REALLY LOW RETURNS: "Index annuities are CD [like] return products" -- Stan Haithcock, an annuity salesman

REALLY LOW RETURNS: "...returns of 1-3% which all indexed annuities will return."

"Expect returns on par with CD's"

-- Chris Wang, Runnymead Capital

"Annuity Agent Commissions Are Built Into the Policy"

"The next time an annuity agent says that they charge [you] no fee, stop them mid-sentence and tell them to stop playing word games" -- Stan Haithcock, annuity salesman

Ric Edelman's list of 15 investments to avoid includes index annuities.

Fixed indexed annuities are sold to unsophisticated investors using several clever deceptions:

"The stock market [alone] is risky!" -- Annuity salesman strawman argument

"The stock market [alone] is risky!" -- Annuity salesman strawman argument

"Look at the high rate of annuity return!" -- Annuity salesman switcharoo

"Look at the high rate of annuity return!" -- Annuity salesman switcharoo

Failure to mention that the growth of your money stops once you take income.

Failure to mention that the growth of your money stops once you take income.

Failure to mention that death denefit (inheritance) value erodes quickly.

Failure to mention that death denefit (inheritance) value erodes quickly.

Failure to mention that terms (caps, etc) of the annuity contract can change.

Failure to mention that terms (caps, etc) of the annuity contract can change.

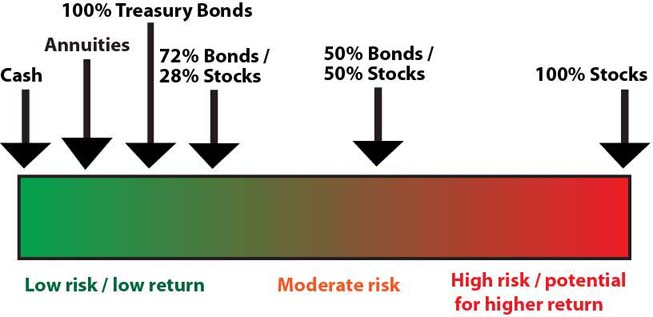

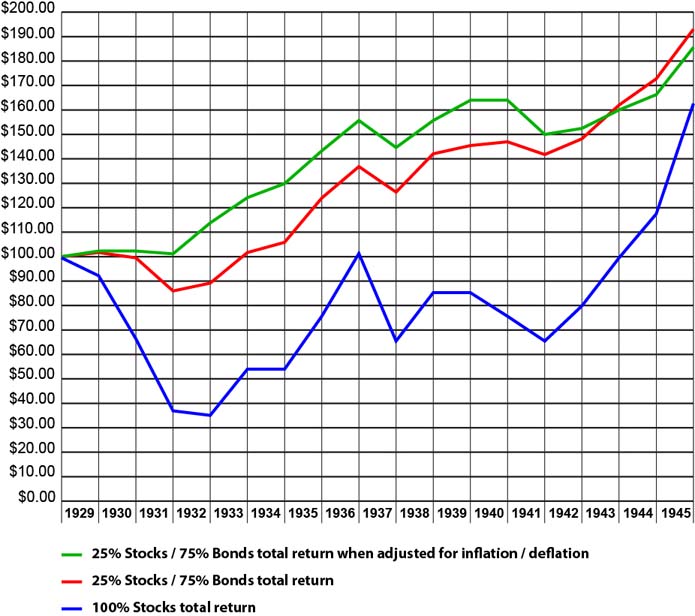

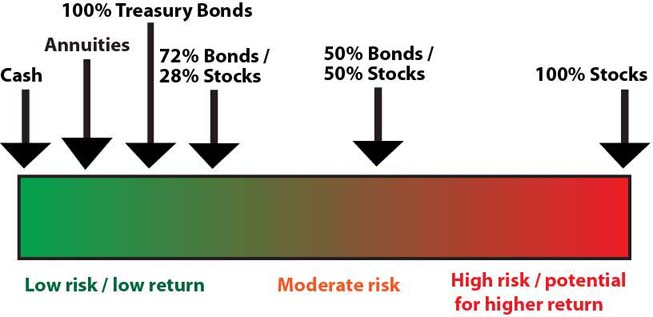

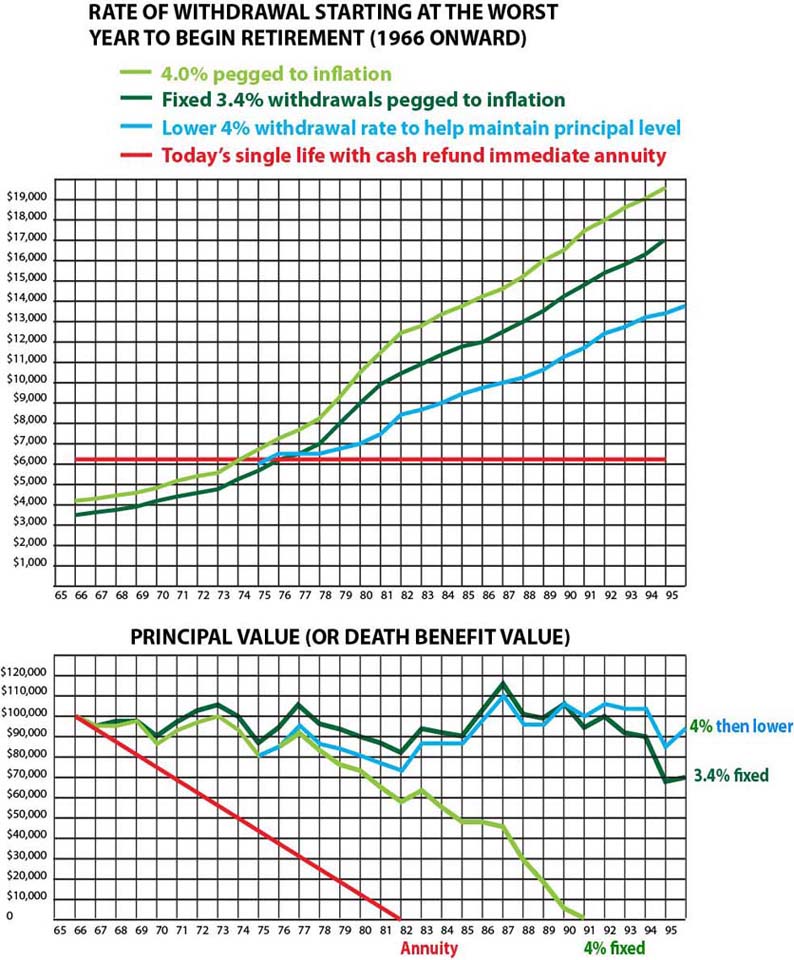

1) Commission-based advisors love to present strawman arguments. The most common insurance industry deception is to appeal to low-risk investors by looking at the performance history of a high-risk portfolio of 100% stocks during bear market periods.

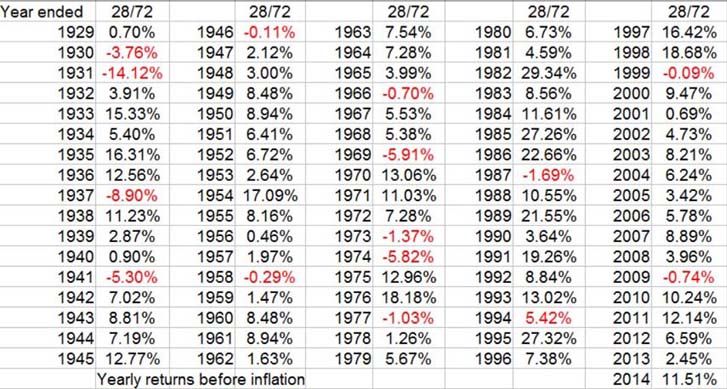

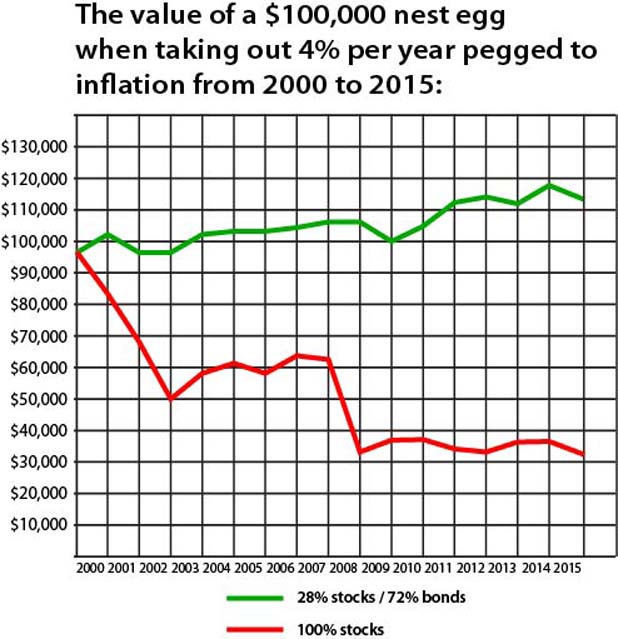

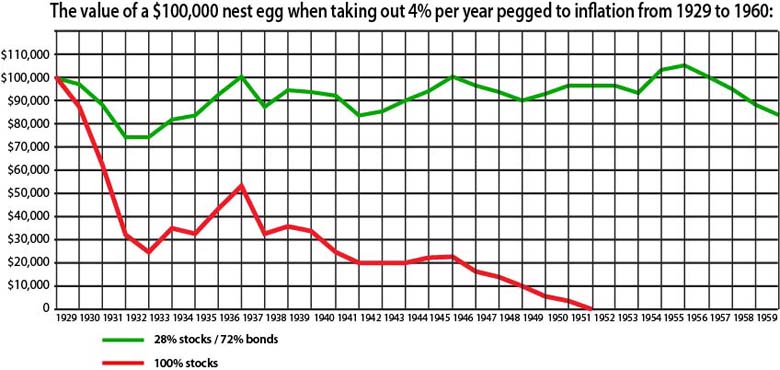

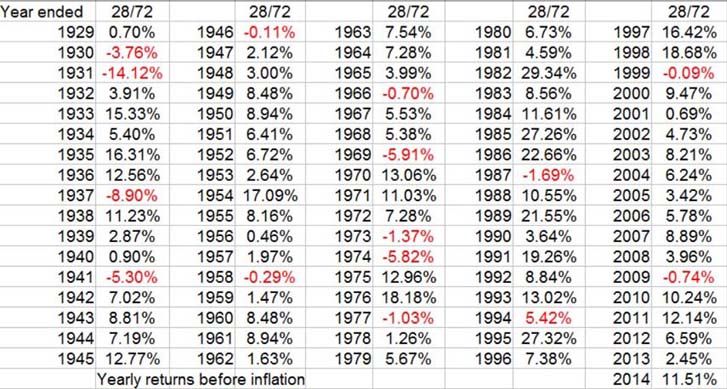

Many naive investors are completely unaware that when you diversify heavily into bonds, the markets are very consistent. From 1970 to 2010 the lowest risk stock/bond allocation was 72% bonds and 28% stocks.

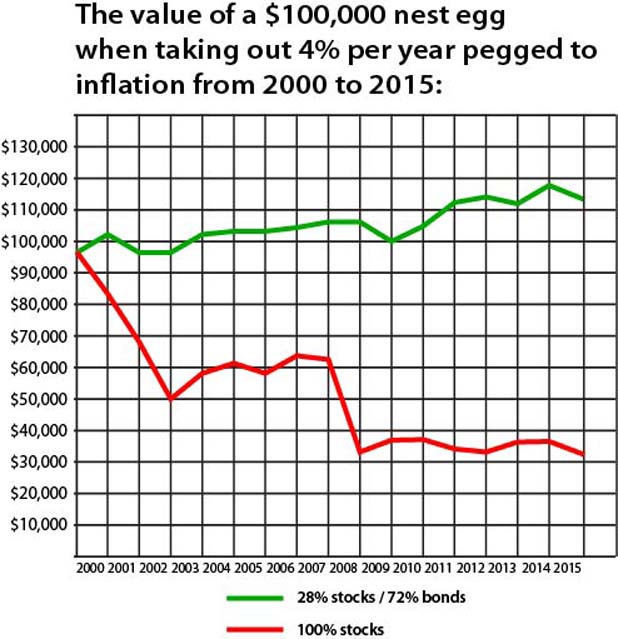

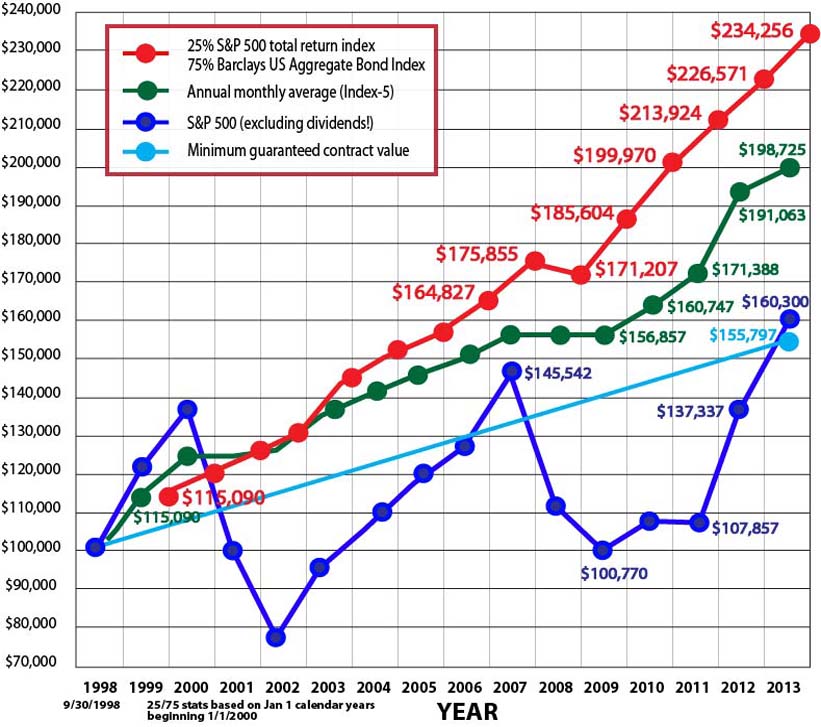

Note: The above chart factors in calendar rebalancing on Jan 1 of every year

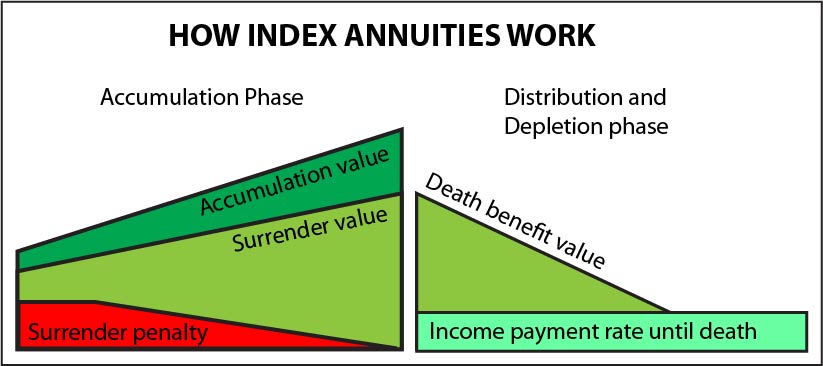

Above rate of withdrawal for each year: Jan 2000: $4,000, 2001: $4,136, 2002: $4,251.81, 2003: $4,319.84, 2004: $4,419.19, 2005: $4,538.51, 2006: $4,692.82, 2007: $4,842.99, 2008: $4,978.59, 2009: $5,167.78, 2010: $5,147.11, 2011: $5,229.46, 2012: $5,396.81, 2013: $5,510.14, 2014: $5,592.79, 2015: $5,682.28, 2016: $5,687.96

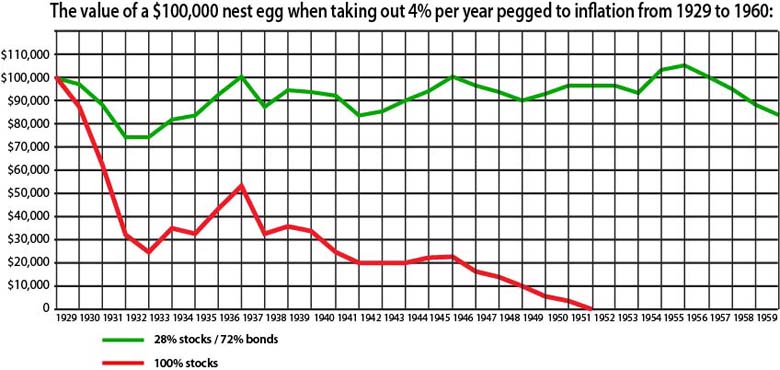

Note: The above chart factors in calendar rebalancing on Jan 1 of every year. Furthermore, returns are not adjusted for deflation. There was double digit deflation during the 19230's. In reality your portfolio did not drop to the $75,000 range when adjusted for deflation.

NOTE: This is not to say that a 28/72 portfolio is the best allocation strategy for you right now. The returns of a 28/72 mix are presented to demostrate how safely and easily an annuity is outperformed if all you need to do is beat an annuity. Speak to a fee-only fiduciary on a one-time or one-task basis if you need personalized allocation ratio help.

NOTE: Some annuity salesmen love to cite the early 1930's depression to instill fear of the open markets, but the markets today are a different beast than they were in that age. Back then there was a lack of government regulation coupled with fraud which inflated prices, creating a bubble. There was also wild speculation fueled by easy credit which further led to artificially inflated stock prices. By the late 1920's borrowed money accounted for a whopping 90% of stock purchase prices. 40% of every dollar loaned in America was for stocks. Stocks had become so over hyped that even shoe shiners were borrowing money to invest in stocks. And when accounting for 1930's deflation, at not time did a 75/25 portfolio lose money.

2) Confusing roll-up value, accumulation value, accumulated value, income pool, income rate, income value, interest crediting or income base as somehow being return on investment or cash surrender value: The only way to compare the performance of an investment product to other investments like bond and stock ETF's is to calculate the return on investment (ROI) after you cash out or your heirs inherit what's left (if any). When people talk about stock and/or bond market returns, they speak in terms of ROI on an annualized basis. For example in the year 2014 the S&P 500 index provided a total ROI (including dividends) of 13.52% and 10 year treasury bonds provided a total ROI (including interest) of 10.75% for the same year.

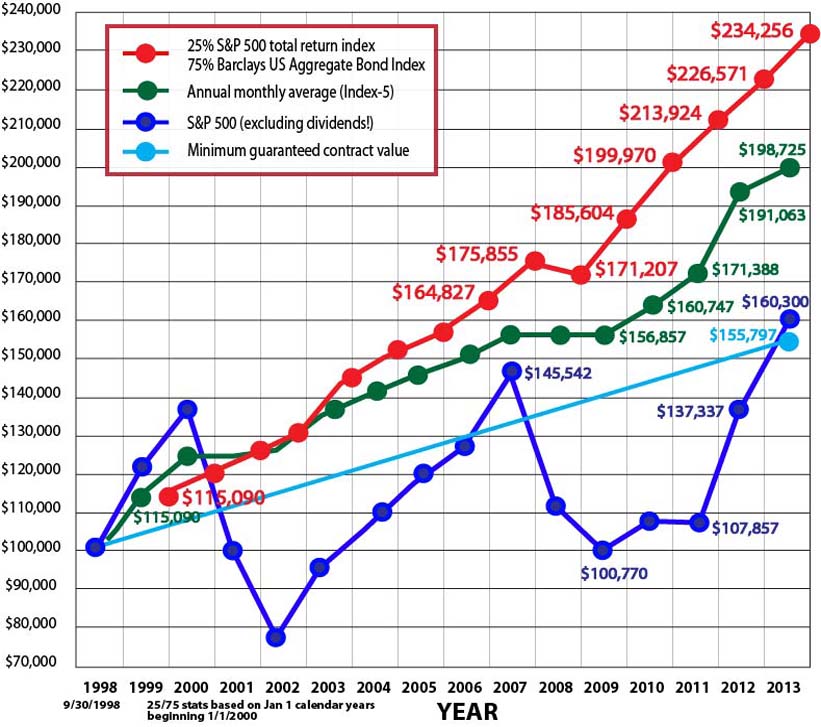

Compounding Returns: Furthermore if an annuity has a period of several years whereby no distributions are paid out to the annuitant (often referred to as the "accumulation phase") then we should be comparing the annuity to the compounded returns of other investments (like bond and stock index funds). An investment grows faster when dividends are reinvested and gains are left untouched to continue to grow. For example an investment of $100,000 that grows for 10 years at a perfect rate of 6% each year left you with not $160,000, but $179,084.77. In a real world example, from Jan 1, 2000 - Jan 1, 2013 when a portfolio of 25% S&P 500 index and 75% total bond market index was allowed to compound and rebalanced at the end of each year, it provided an average annualized ROI of 6.2%.

Simple Interest -- Not compounding interest: Unfortunately insurance companies use simple interest instead of compounding interest to calculate index annuity returns. This further mutes index annuity returns.

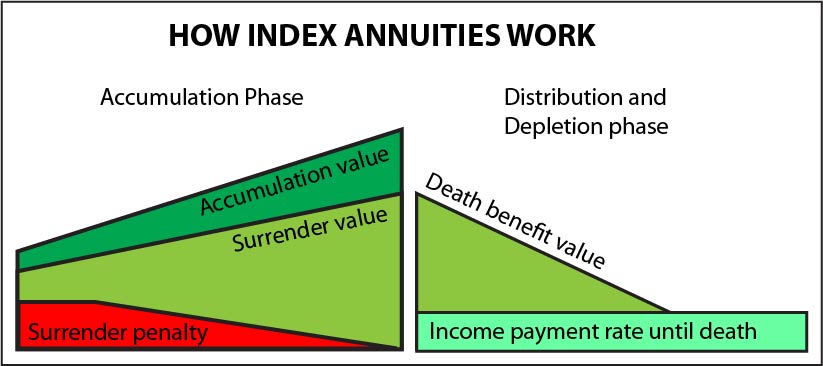

So the problem with index annuities is that when Mr. Commission-based adviser ambiguously talks about "return" he's not talking about return on investment, surrender value or death benefit value. He's merely talking about the growth rate of your money which at the "distribution phase" will serve as a basis for determining how much you will receive in income payments. Insurance companies might use terms such as "interest crediting", income base", "protected benefit value" or "accumulation value", none of which refer to what really matters, namely "underlying value" (minus closing or surrender fees), "cash surrender value" or "death benefit value" which will ultimately allow you to determine the measurement that really matters: Return on investment!

To top it off, once you annuitize an index annuity, depending on the terms of the contract, your heirs may be limited in how much they receive. This further reduces the final calculation of your actual return on investment.

Think you can estimate the actual ROI of an index annuity?

According to Glenn Daily, a fee-only insurance consultant "The opacity of the [index annuity] products’ fees and complexity of the return calculations makes it impossible for investors to figure out if they’re getting a good deal."

Note that once you enter the income phase of an annuity contract it gets to the point that you would need to be a mathematician to calculate return on investment results. This is just one reason why you might encounter investors who are "happy" with their index annuity. They have no idea how their index annuity has performed versus a bond index fund / stock index fund portfolio, let alone what the difference between accumulation value or income rate and actual internal rate of return (or return on investment) is.

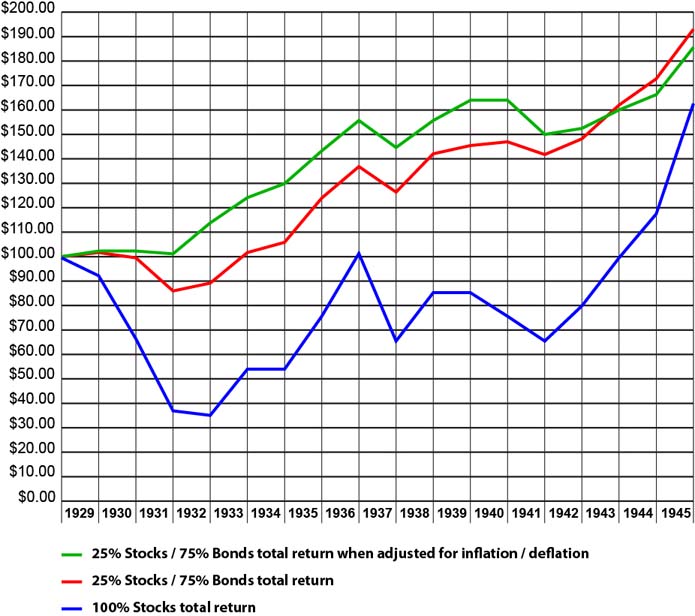

Roll-up value: This is not money that you can cash out. It's merely an accounting ledger that is used to later determine income payment rate. Advisors are famous for using the ambiguous word "return" when referring to roll-up rate.

Surrender value: This is money that you can cash out, minus the surrender penalty.

Death benefit value: Once you enter the distribution phase, taking income payments, those income payments (and other fees such as "guaranteed income rider" fees) reduce the death benefit value. It is also critical to understand that with most index annuities the growth of your money during the income phase stops.

Income payment rate: During the income phase you start taking income payments for the rest of your life. This income rate will vary depending on how generous the insurance company was at letting your roll-up value increase. For example, a generous roll-up rate will result in a less generous income payment rate.

Your age: The later you begin taking income payments (distribution phase) the higher the income payment rate.

Death benefit value: Your heirs get any left over money (if any) that was not paid out to you. Typically, if you live to your life expectancy, there is nothing left for your heirs. Also, generally the more that you contractually stand to earn in income payments, the less that is left for heirs.

Index annuity returns lack transparancy.

So what kind of return on investment can you expect to get with an index annuity? Stock market like returns or CD like returns?

Index annuity returns (internal rate of return or annualized return on investment) lack transparency. Unlike publicly traded securities like stock and bond index funds, you can't research past performance of index annuities on any website such as Yahoo Finance.

Index annuities are so complex that it's impossible for consumers to figure out if these products are a good deal or not. Insurance salesmen spend an enormous amount of time talking about how index annuities work, but never talk about how much they return, other than to suggest that index annuities might earn high returns, which they just won't. They paint a rosy picture in order to make the sale.

Fortunately a few experts as well as fee-only fiduciary advisers, all of which have no dog in this fight, have spoken up. And the verdict is that index annuities were actually designed to compete with CD's. Yet index annuities continue to be falsely advertised by unscrupulous "advisers" as providing market-like returns. They don't. Even in 2014 with interest rates at record lows, there is no guarantee that lowly CD's might wind up performing better over the duration of an index annuity contract. CD rates are low now but they have plenty of time to go up in years to come. According to William Reichenstein CD's may not only do better but are simply the better choice.

TRUSTWORTHY SOURCE:

According to Chris Wang of Runnymede Capital Management, a fee-ONLY fiduciary firm, with all index annuities you can expect paltry returns of about 1% to 3% and this is only when held for at least 10 years. He says that if anyone promises you returns of 6% or more then run for the door!

TRUSTWORTHY SOURCE:

According to fee-only financial adviser Michael Zhuang, who sold 6 index annuity contracts from 2006 to 2010, all of them lagged the S&P 500 index by a huge margin. One contract actually lost money, despite the fact that index annuities are advertised as "can't lose" products. Two index annuity contracts were purchased right before the market crash and still lagged the S&P 500 index by a large margin!

The article is dated July 4, 2014 and Mr. Zhuang says that a new client of his "recently" provided him with these contracts for analysis. So for the sake of estimating an annualized return using a compounding ROI calculator we will assume that April 1, 2014 was the closing contract value date. As you can see, none of the contracts returned more than 2.2% per year.

| Purchase date |

Annuity

Annualized ROI |

Annuity

Total Return |

S&P Total Return |

Duration |

| 7/25/2005 |

1.4% |

16.2% |

90.2% |

8.6 years |

| 3/28/2006 |

2.1% |

18.8% |

78.1% |

8 years |

| 5/15/2007 |

1.6% |

11.8% |

49.9% |

6.8 years |

| 9/26/2007 |

2.2% |

15.9% |

48.8% |

6.5 years |

| 5/12/2009 |

1.7% |

8.9% |

138.9% |

4.8 years |

| 6/04/2010 |

-2.4% |

-9.2% |

92.7% |

3.8 years |

Notice that one annuity contract actually dropped 9.2% in value. Index annuities are advertised as being products that can "never never drop below zero". This obviously isn't true!

BIASED AND UNRELIABLE SOURCE:

*By default we are going to regard Advantage Compendium as an unreliable source that may aim to inflate index annuity returns to the upside for reasons discussed below. Nevertheless, according to this "research firm", from 2007 to 2012 the average annualized return of all index annuities in their "study" was just 3.27%. It is unknown if these annuity contracts were gathered from actual consumers, and if so whether it was done in a random fashion. If they asked insurance companies to provide contracts then this study is once again as useless as Marrion's joint-authored paper called "Real World Indexed Annuity Returns". Also keep in mind that 5 years is too short of a time period to analyze. For this reason alone, results could very well be skewed to the upside because insurance companies are famous for lowering participation rate caps. Nevertheless, the worst index annuity returned 1.2% per year. The very best returned 5.5% per year, but of course you as a consumer can't know in advance what an index annuity will return. This compares with a blend of 20% stocks / 80% bonds which returned 5.49% during this bear market period that included the 57% stock market crash from 2007 to 2009. So even during a time period when we would expect index annuities to do better, they still failed!

Also according to Advantage Compendium, from September 2005 to September 2010, the average index annuity returned only 3.89%. That’s slightly better than the 3.81% you would have earned with a 5-year CD! And a taxable bond fund would have returned 5.1%.

So let's review... Investors flock to index annuities because they fear stock market crashes, yet during a 5-year period that included one of the worst stock market crashes of all time, the average index annuity was easily beaten by a simple bond-heavy bond/stock portfolio. And this is all before taxes. Expect Uncle Sam to shave 10% more off of the index annuity than with normal taxable account investments!

*Advantage Compendium is led by Jack Marrion, who according to Advisor Perspectives, operates a website and service that provides information to the insurance industry, mostly to help promote the sales of index annuities. Marrion also coauthored a fatally flawed study called "Real World Indexed Annuity Returns" that is picked apart here (see question #26). One of the most glaring mistakes is that they asked the insurance companies to provide index annuity contracts instead of going to actual consumers for contracts to study! The study also could not be independently peer reviewed.

BIASED AND THEREFORE UNRELIABLE SOURCE:

According to even AnnuityThinkTank, which promotes annuities, moving forward in today's low interest rate market environment you can expect to see index annuity returns only in the 2 to 5% range! These returns estimates should also be regarded as inflated to the upside.

All of these studies paint a pretty dismal looking picture considering that...

1) You are locking your money in prison for many years under threat of draconian surrender penalties,

whereas stock and bond index funds can be sold at any time, for any reason and without penalty.

2) Even during some of the worst of times from Jan 1, 2000 - Jan 1, 2013 an ultra-conservative portfolio of 75% 10-year Treasuries and 25% S&P 500 stock index, when compounded and rebalanced annually, returned an average of 6.2%.

3) You can't rebalance an index annuity. Rebalancing is a simple, basic strategy that can increase bond ETF / stock ETF portfolio returns by up to 0.35% per year according to Vanguard.

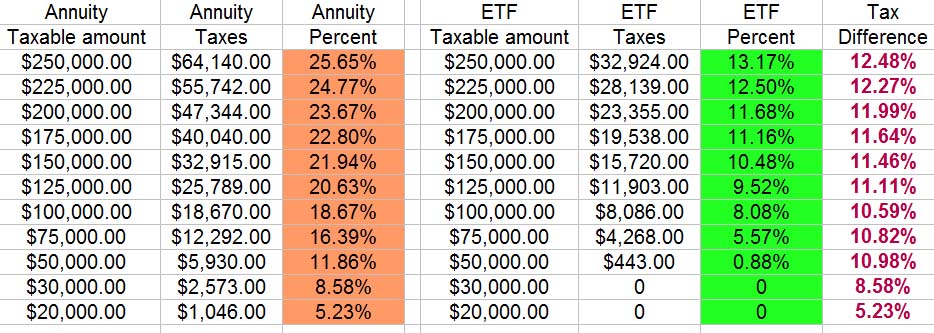

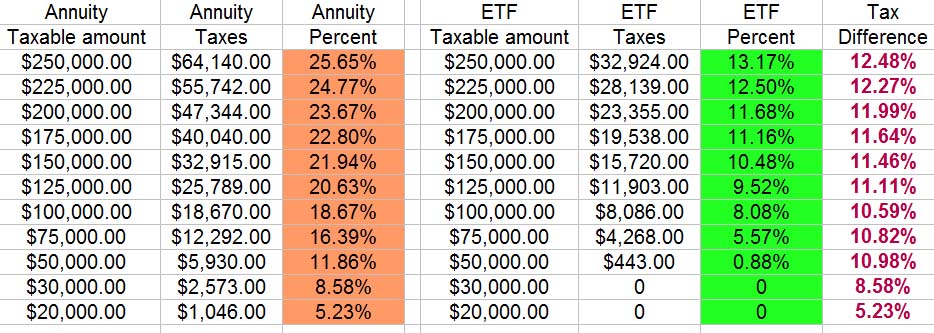

4) You must pay the higher "ordinary income" tax rate on annuity gains. Normal investments like index funds are taxed at the lower "capital gains" tax rate.

5) If you are looking to invest after-tax money you would be subject to a 10% Federal tax and an additional state tax if you were to need to withdrawal money early. With normal investment like ETF's you would not incur these tax penalties ever.

6) Annuities have extremely limited tax write-off ability. The IRS currently only allows you to deduct $3,000 in losses each year to offset ordinary income. The rest carries over to the next year upon which you can continually only deduct $3,000 in loses per year for as long as you live. So if you have a huge loss to write off, you may never even get a chance to write it off. This hurts both you and your beneficiaries. For example $40,000 in annuity distributions minus $40,000 in stock loses equals a whopping $37,000 in taxable income for the year!

7) LIFO "Last in / first out" - With annuities the IRS requires that taxable gains must be withdrawn first. This contrasts with other normal investments like ETF's, stocks and bonds which can be strategically sold in order to minimize taxes.

8) With annuities your heirs have no stepped up cost basis on annuity gains that occur during your lifetime.

9) Historically inflation has run at about 3% on average. It's been said that when investing you should "never bear too much risk or bear too little risk". With an index annuity you are bearing too little risk.

Annuity promoter AnnuityThinkTank also states that if some adviser has been suggesting to you that an indexed annuity might produce double digit returns or "has guarantees at 6, 7, 8% or higher" you need to bolt out the door! You will never get those rates as a return on investment. Again, those guaranteed 6% returns are merely annual income payment rates -- Not the same as return on investment. When insurance companies have guarantees of such high returns you can expect that the surrender value / death benefit value will be systematically chipped away by high hidden fees.

Also beware of any adviser who touts past performance of index annuities going back to the 90's. This is like comparing apples to oranges because back then interest rates were much higher than they are today. Insurance companies are not making the same promises now that they did back then.

Zero growth of principal once you start the distribution phase (annuitize)

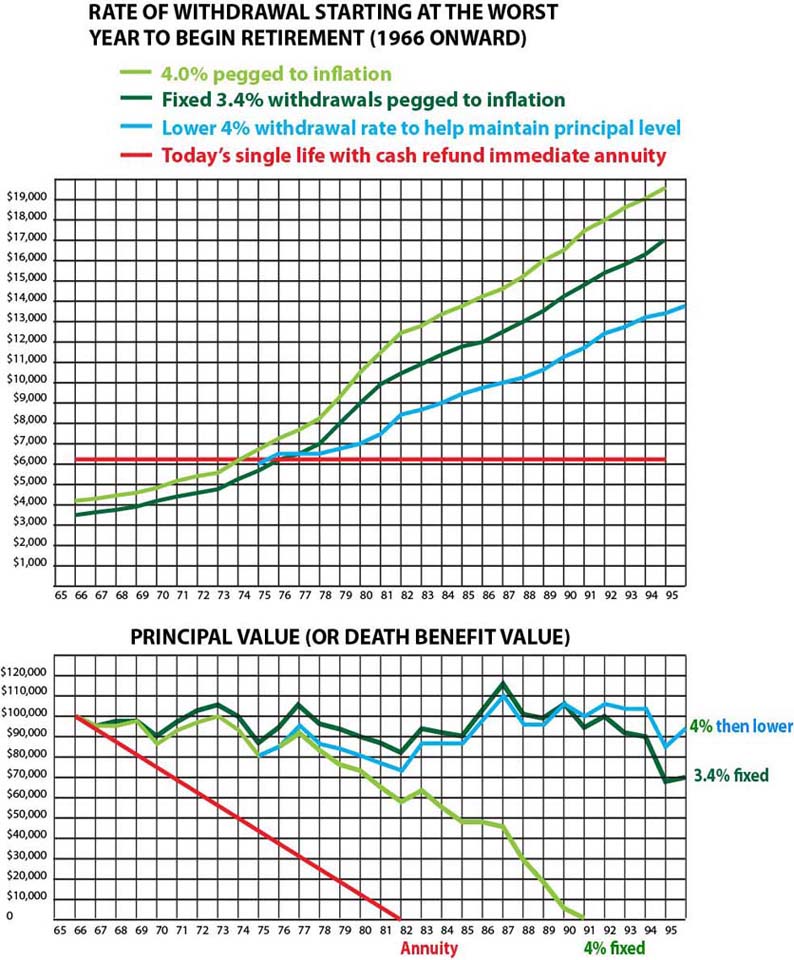

If you think that earning income payment "returns" of 6% or more is attractive then you need to take a closer look at what is happening. Imagine if once you retired, your stocks and bonds suddenly stopped growing in value for the rest of your life. You would be really upset! Of course as you're spending down that money in retirement, your account value (in this case we're talking about your "death benefit value") will very quickly drop to zero. For example at 6% your annuity's death benefit value (left for heirs) would run down to zero after 16.6 years. "Guaranteed income riders" typically cause the death benefit value to deplete even faster. Typically if you die at around your actuarial life expectancy then your heirs get nothing. Even if you die before your account value hits zero, the return on investment (ROI) of your account from the perspective of your heirs is still zero. It's as if your money was never invested -- just hiding under your mattress earning nothing. Well guess what? This is exactly how most index annuities work!

This is how the insurance company really gets you! As if the "accumulation phase" wasn't enough of a raw deal, the insurance company will likely make an even bigger killing once you turn on the income stream of a fixed index annuity. Most index annuities work the same way that an immediate annuity works. Your money stops growing once you turn on the income spigot. The insurance company simply begins giving you back your money. Each payment gets subtracted from your "income base" bucket of money. There may also be fees that the insurance company subtracts, such as if you elect to pay for a guaranteed income rider.

If you die before all of the income base money has been depleted then whatever remains goes to your heirs. In this case the return on investment of your money during the distribution phase is zero!

If your income base drops to zero the insurance company may continue to pay you income if you pay for a costly "guaranteed income rider". Even if you live to be 95 years old, you will be hard pressed to get a 2% to 3% return on investment. Over long time periods, earning a zero to 3% return on investment is just plain pathetic compared to how you would otherwise do with a low-risk portfolio of a couple of stock & bond index funds.

There are some index annuities that allow your money to grow during the income phase or they will allow your income payment rate to increase with inflation, but there's always a catch! Remember that insurance companies never play Santa Claus. First of all they are going to reduce the growth of your money during the income phase and / or reduce the death benefit. Second of all they are going to put caps on inflation adjusted growth of your money.

Fixed Payments For Life = Eventual poverty!

Much the way an immediate annuity works, index annuities pay fixed income payments for life, and therefore should eventually get dwarfed by inflation. At first you are getting paid a high rate of return of perhaps 6% or more, but eventually that high fixed annual payment rate may reach the inflation adjusted equivalent of 2.5%, 2% or even 1.5% if you live long enough and / or inflation is high. If taking out the recommended 4% from your stock/bond portfolio seems too little and depressing now, try living on 1.5% with an index annuity later in life!

1966 is regarded as the worst year to begin retirement. We had low bond / stock returns and high inflation. In fact in order to keep your principal from running too low, with a 28/72 portfolio you had to reduce your income by about age 75. However, by this point you were taking the same income as with today's SPIA. But notice how by easing up on income you were still way ahead of the SPIA by your mid-80's and beyond, just when you are most in need of higher income. Again, this chart represents a worst case scenario for bonds and stocks! The annuity still got slaughtered! Essentially with an annuity you are guaranteed poverty later in life in exchange for splurging on higher income initially.

What does the insurance company do with your money?

Nothing that you can't easily do on your own, but without indirectly paying for

insurance company profit, overhead costs, and sales agent commission.

Another tell-tale way to estimate index annuity returns is to look at what the insurance company actually does with your money after you give it to them. Understand that insurance companies are not and cannot be playing Santa Claus or they would go out of business. Insurance companies are for-profit companies. Additionally they have overhead costs, not the least of which being the hefty commission of as much as a 5% - 20% that they must pay your "adviser" up front if and when he manages to sell you that annuity! The insurance company's expert mathematicians and financial analysts are betting that when they sell annuity contracts they will come out the winner. Just as when you deposit money at your bank or buy a certificate of deposit, the bank doesn't stuff your money in a vault. They turn around and loan your money to someone else at a higher rate than they pay you.

So what does the insurance company do with your money? According to William Reichenstein, professor of investments at Baylor University who has studied index annuity contracts, an insurance company will typically pay your adviser his lavish commission, then invest 94.33% in bonds, 3.67% in derivatives linked to the S&P 500 index and keep the remaining 2%. That's it!

STOP THE PRESSES!!!

Right off the bat this tells you that there is NO WAY that you are going to earn 6 or 7% returns! It's just plain too good to be true! Why? Because from 1928 to 2013 10-year Treasury bonds returned a geometric average of 4.93% and 3-month Treasury bills returned 3.53%. From 2004 to 2013 10-year Treasuries averaged 4.27% while 3-month T-bills averaged 1.54%.

In selling you an index annuity, the insurance company is betting that they will do better than whatever they will pay you by simply investing heavily in bonds.

This should set off alarm bells in your head because ANYONE can invest in bonds and the S&P 500 index through index funds! And as an individual investor you do not have "overhead costs" nor do you have to pay an up front commission to anyone! Without these expenses, this makes it even more likely that you will do better than the index annuity. All you have to do is invest in a low-risk bond heavy portfolio. And in doing so you would also retain your liquidity, meaning the ability to sell at any time, for any reason and without penalty. And you would be paying lower taxes on gains, you won't have to deal with LIFO, you won't be screwing over your heirs, etc.

Furthermore you don't necessarily have to only invest 3.67% in stocks to beat an annuity. According to a 2008 study by economic consultant Craig J. McCann, some 99% of the time indexed annuities under-perform a simple portfolio of 60% zero-coupon Treasuries and 40% S&P 500 indexing.

Some annuity salesmen like to cite a study by David Babbel, claiming that index annuities provide market-like returns. Again, they don't. This study is is fatally flawed in many ways. Click here and scroll down to question 26 for a detailed response.

Index Annuities are a Liquidity Nightmare

There are a thousand reasons why you might need to get your money back. If so, a CD will unquestionably prove to be the superior choice. If you need to get your money back, with a CD the bank simply gives you all of your original principal back minus any interest payments that were made. Your return on investment would be zero. With bond market index funds and stock market index funds there are no liquidity risks because you can sell at any time. You not only get your money back but you get to keep any gains.

Things are very different with an index annuity. Surrender early and you must pay a contingent deferred sales charge (or "surrender penalty"). Depending on the terms of the annuity contract, your return on investment could easily be a loss of 15%!

is the same as cash surrender value or death benefit value. In reality your actual return on investment (ROI) will never be anywhere close to that high rate or "return" that is being advertised. Advisers also love to ignore what really matters when evaluating an investment: Return on Investment. They instead talk about the annual interest rate paid (or hopefully paid) by an index annuity or the "income base" (sometimes called "protected benefit value") of an index annuity, which is merely a basis for determining interest payments. The only way to evaluate the performance or expected performance of an investment is by looking at the cash surrender value or "death benefit" value (for your heirs). Advisers are famous for using the word "return" in an ambiguous way when referring to income base or interest rate. They are not talking about ROI.

Index annuities exposed by various respected experts

A professor at Baylor University and expert witness on annuity products, William Reichenstein says that over the long term, simply investing in a conservative portfolio (conservative stocks and bonds or the equivalent ETF's) easily beats an index annuity. According to Reichenstein, over the last 44 years, the average index annuity would have under performed a very ultra-conservative portfolio consisting of 85% one-month T-bills, and 15% large-cap stocks by nearly two percent per year, on average! He identified only two rolling 10-year periods in which the most popular index annuities would have beaten the conservative 85/15 portfolio. Also according to Reichenstein, since 1957 there has never been a 3 year period in which the 85/15 portfolio of T-bills and S&P 500 index stocks has lost money. This is critical because with an 85/15 portfolio there are no surrender penalties and the 85/15 portfolio is taxed at a lower rate. Keep in mind that this study was done for demonstration purposes to show how easily an index annuity is beaten. This is not to say that this allocation ratio is right for you. Meet with a fee-only fiduciary RIAA. They will likely get you invested mainly in bond and stock ETF's.

Summary of William Reichenstein's study of equity index annuity performance from 1957 - 2008.

In a study conducted by Dr. Craig McCann of UCLA and Dr. Dengpan Luo of Yale University, they discovered that investors would be better off in a simple portfolio of U.S. Treasury bonds and large cap stocks – a whopping 97% of the time. Other studies have suggested that when someone buys an annuity this typically results in a wealth transfer of as much as 15% to 20% from the investor to the insurance companies and the sales agents. Insurance companies know it. This is why they love to sell annuities. The deck is stacked in their favor. Source

The problem with index annuities is that they have high fees, they give up too much of the up side potential ("performance caps") that you would otherwise enjoy from a combination of bond and stock ETF's, you pay much higher taxes, and the market crash that your so-called "adviser" is warning you about is not likely to be sustained over 5 years or more (or whatever the surrender period of the index annuity is). Insurance companies know this. That's why they are able to make what appears to be a too good to be true offer. It is not. If you still are ever tempted to lock your money up in an index annuity, at the very least be sure to get an expert second opinion from a fee-only fiduciary registered investment adviser.

The performance chart that the insurance industry DOESN'T want you to see...

Keep in mind that the green line is not even cash surrender value, which is reduced by a surrender penalty! Therefore at all times the annuity is beaten by the low risk 25/75 allocation.

Stuck in an index annuity now?

Consider a 1035 exchange and SEPP withdrawals

If you're already invested in an index annuity and the insurance company's surrender period has expired then speak to a fee-only fiduciary adviser. If you're perhaps younger than age 57 then it might make sense to do a tax free 1035 exchange to a Vanguard variable annuity. You've probably heard bad things about variable annuities. Variable annuities are indeed bad investments, but if you are already stuck in an annuity, Vanguard's variable annuity is actually a way of making the best of a bad situation. Vanguard's variable annuity has no surrender penalties and the lowest fees. History says that you should get better returns than your index annuity even in a conservative allocation of perhaps 33% S&P 500 index fund and 67% total bond market index. Then if you're about age 54 1/2 or younger you can get a head start on getting your money out of that variable annuity by setting up a substantially equal periodic payment (SEPP) program whereby you can take out about 5% per year without incurring a 10% pre-59 1/2 Federal tax penalty.

If you are still in your 30's and the insurance company's surrender penalty has expired then it might make sense to just bite the bullet, pay the 10% Federal penalty and get out of your index annuity rather than switching to Vanguard. You should be saving at least 0.65% per year in separate account fees, sub fund management fees and turnover costs by being invested in a couple of bond and stock index funds rather than being in Vanguard's variable annuity. Multiply this times 20 years and you ought to make up for the 10% penalty AND enjoy the lower capital gains tax rate on future gains.

The disastrous effects of taxation on annuities...

About 58% of index annuity buyers are already in tax deferred accounts such as IRAs. Clearly these people were sold snake oil. Even if you held a conservative portfolio of 85% 1-month treasuries and 15% in a large cap stock index fund, all held outside a tax favored account that was subject to the highest 35% tax bracket, after taxes you still would have beaten the average index annuity in 39 out of 44 rolling 10 year periods. According to researcher William Reichenstein, there has never been a three-year period since 1957 where this 85/15 portfolio has lost money.

Don't count on the new DOL fiduciary rule to protect you

This ARTICLE is proof positive that fiduciary standard does not go far enough in protecting you from commission-hungry annuity salesmen. "Savvy financial advisors" will simply go the extra mile to protect themselves by 1) not educating consumers about how diversification into bonds protects against stock market volatility and 2) get unsophisticated clients to agree that they have ultra low risk tolerance and probably won't need to get their money back anytime soon or for life.

If you need money help then only way to stamp out conflict of interest is to work with a fee-ONLY fiduciary and do so on an hourly or one time basis. Be sure to get them to agree in writing. Verbal agreements don't exist!

CONCLUSION: Beware of passive aggressive, soft sales tactics. There's an army of advisors out there who are very skilled and pretending to be critics who are in your corner. They are not. Be sure to learn about the most common lies and deceptions used by product pushing salesmen, some of which are fiduciaries!

Related links:

CLICK HERE for historical total returns of S&P 500 index and total bond market (Barclay's Aggregate) since 1980.

CLICK HERE for historical total returns of S&P 500 index and 10-year treasuries since 1928.

CLICK HERE for a great consumer advocate article about equity index annuities.

1 - 2 - 3 - 4 - 5 - 6 - 7 - 8 - 9 - FAQ

OR MOVE ON TO THE NEXT ARTICLE: Oddball investments

Debunking Tony Robbins and index annuities

Disclaimer and Waiver - Nothing on this consumer advocate website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy, hold or sell, or as an endorsement, of any company, security, fund, product or other offering. This website, its owners, affiliates, agents and / or contributors are not financial or investment advisors or broker / dealers and assume no liability whatsoever by your reliance on the information contained herein. The information should not be relied upon for purposes of transacting securities, assets, financial products or other investments. Your use of the information contained herein is at your own risk. The content is provided 'as is' and without warranties, either expressed or implied. This site does not promise or guarantee any income or particular result from your use of the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained. Always hire and consult with a professional regarding the evaluation of any specific information, opinion, or other content.

![]() "The stock market [alone] is risky!" -- Annuity salesman strawman argument

"The stock market [alone] is risky!" -- Annuity salesman strawman argument

![]() "Look at the high rate of annuity return!" -- Annuity salesman switcharoo

"Look at the high rate of annuity return!" -- Annuity salesman switcharoo![]() Failure to mention that the growth of your money stops once you take income.

Failure to mention that the growth of your money stops once you take income.![]() Failure to mention that death denefit (inheritance) value erodes quickly.

Failure to mention that death denefit (inheritance) value erodes quickly. ![]() Failure to mention that terms (caps, etc) of the annuity contract can change.

Failure to mention that terms (caps, etc) of the annuity contract can change.