REVIEW OF

Ken Moraif Money Matters

Infomercials

(Rebranded as Retirement Planners of America)

As heard on KABC - 790 AM Los Angeles

Market timing (AKA "market guessing")

VS Buy, hold and rebalance

Reviewing Moraif's endless anecdotes, strawman arguments and

statements of opinion VS Moraif's actual performance data

*Moraif's market timing strategy versus buy / hold / do nothing:

Approximately 52.91% in missed gains from 1/3/2007 to 2/1/2023

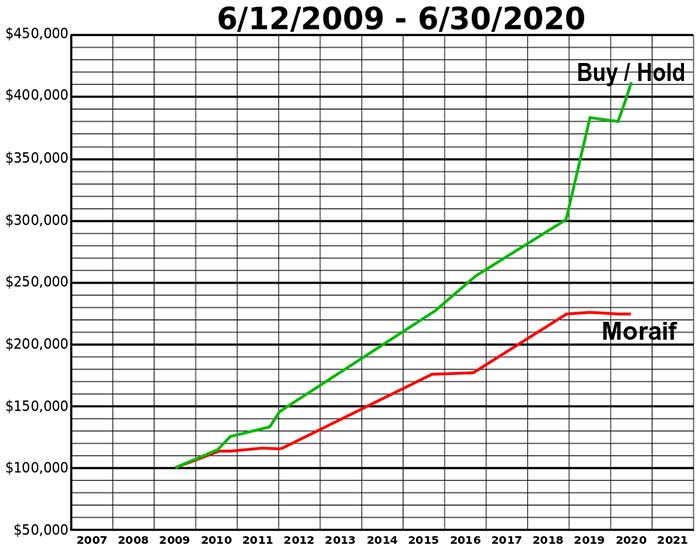

Approximately 113.81% in missed gains from 6/12/2009 to 2/1/2023

Approximately 47.79% in missed gains from 1/3/2007 to 9/9/2020

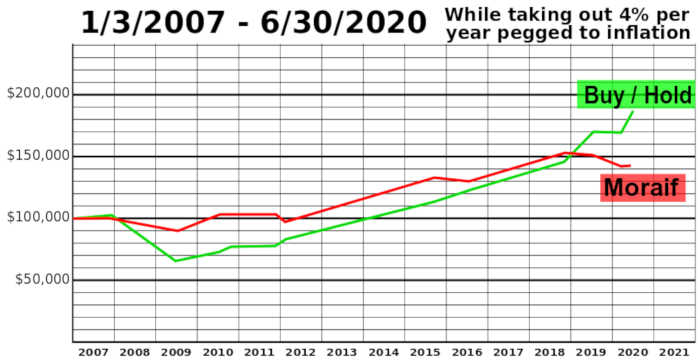

while taking 4% annual withdrawals pegged to inflation

* Based on various estimates and assumptions

What others say about market timing in general as a strategy:

"Nobody but nobody, has consistently guessed the direction of the bond or stock market over any meaningful length of time." -John Markese, President, American Association of Individual Investors Journal

"Far more money has been lost by investors preparing for corrections than has been lost in corrections themselves" -- Peter Lynch, former manager of best performing mutual fund in the world, Fidelity Magellan Fund.

"By trying to time the market, you are essentially gambling with your financial future at very poor odds" -- Baltimore Sun

"Market Timing is impossible to perfect" -- Mark Rieppe, Senior Vice President At The Schwab Center For Financial Research

“In the 1995–99 period, buying and holding large-cap stocks would have outperformed about 99.8 percent of the more than 1 million possible quarterly switching sequences between large-cap stocks and U.S. T-bills." -- Financial Analyst Journal

"You've gotta be right at least twice. The odds are just terrible." -- John Bogle, founder and former CEO of The Vanguard Group

"If you want to suppress volatility it’s likely you’ll suppress your returns as well, it’s just that simple" -- The Irrelevant Investor

“If your advisor thinks he can pick winning stocks, choose winning actively managed mutual funds, or time the market -- steer clear!” -- Whitecoat Investor

"If you try to select when to be in and when not to be in, chances are you’re gonna miss the opportunity." -- Ric Edelman

"If you can give up the obsession [of trying to beat the market] and settle for getting the returns of the market, you'll wind up with more peace of mind, lower expenses, less drama and less risk. Best of all, you'll have above-average returns." -- Paul A. Merriman

1) Market Timer: Ken Moraif is an asset manager who advocates market timing (versus the conventional "buy, hold and rebalance" investing strategy).

The strategy of market timing goes against the advice of many of the most respected experts such as Warren Buffet, Peter Lynch, John Bogle, etc.

According to financial analyst Mark Hulbert, 80% of timers fail over any reasonable period of time. He states "I don't like those odds. Neither should you".

Semantics game: Apparently, in order to dodge criticism, Moraif has laughably suggested that his sell strategy is not "market timing", but rather "trend watching". Moraif claims that market timing is defined as trying to guess the market top to get out, and then guessing the market bottom to get back in. For starters, this assertion isn't even true according to Wikipedia, which defines market timing as "the strategy of making buy or sell decisions of financial assets (often stocks) by attempting to predict future market price movements." That's essentially what Moraif is trying to accomplish!

Secondly, whether a strategy is to guess the top or to use stop-loss as an exit point is irrelevant. Both strategies are banking on the financial asset price going lower after selling, and then buying back in at that better price, thus resulting in a net gain versus if you had simply held the asset by never selling in the first place.

2) The way to sell something to somebody is to scare them: Moraif is constantly banging the "fear drum" to sell his market timing / asset management services by making anecdotal statements like "these are unprecedented times". Technically, moving forward, all times are unprecedented. Peter Lynch has said not to be driven by fear because "there is always something to worry about". Click here to see year by year, all of the reasons to be fearful and constantly avoid being an investor.

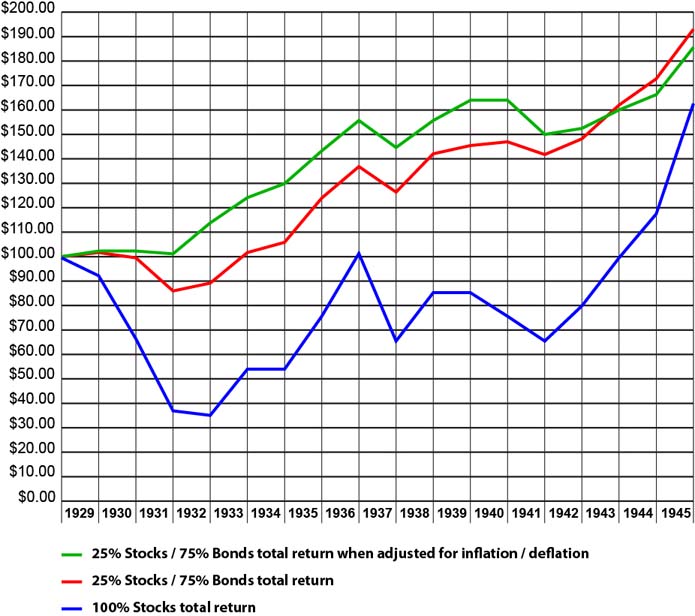

In order to justify market timing strategy, Moraif has repeated the notion that it supposedly took 25 years for the stock market to get back to even after the 1929 crash. In reality it took less than 4 1/2 years to get back to even. This is also a strawman argument because he is ignoring diversification into bonds. On a yearly basis, a low-risk mix of 25% S&P 500 index / 75% total bond market index never lost money at any time when factoring in deflation.

Moraif made a failed "fearless forecast" that the Dow would drop to 11,500 in 2016. Such a forecast sure smells like an attempt to induce people into feeling the need to pay for his market timing asset management services.

In Moraif's 30 second radio spots he states that "It's critical to have a protective strategy", seeming to suggest that without a sell strategy you will (or are likely) to suffer significantly lower returns. As we will learn later in this review, buy/hold strategy is actually the superior strategy. Moraif's protective strategy has actually caused all of his clients who happen to have adhered to his stock market timing strategy beginning anywhere between 2007 and early 2020 to present, to underperform a buy/hold/do-nothing strategy.

3) Paying someone just 1% per year by itself can have a devastating effect on your retirement. Here's some examples of what happened when you reduced returns by 1% per year while adhering to two different allocation ratios:

50% stocks / 50% bonds

From 1972 to 1997 while taking out 4% per year $100,000 grew to $220,618.83

From 1972 to 1997 while taking out 5% per year $100,000 ran out of money in mid 1993.

28% stocks / 72% bonds

From 1972 to 1997 while taking out 4% per year $100,000 grew to $105,686.37

From 1972 to 1997 while taking out 5% per year $100,000 ran out of money in late 1991.

NOTE:

For the above examples, yearly withdraws were increased with (pegged to) the average rate of inflation for the year.

Calendar rebalancing was implemented on January 1st of every year.

An annual 1% drag on a portfolio will by itself cost you 18.2% after 20 years and 26% after 30 years. All of a sudden the 4% rule of retirement becomes the 3% rule. You must reduce your spending! Presumably Moraif's clients are paying that 1% fee for general advisory services and not just market timing. However investors should be aware that 1) the strategy of buy/hold and rebalancing of index funds is so simple that a 3rd grader can do it, and 2) there are other options besides paying an adviser 1% per year. One can hire a fee-only adviser on a one-time basis to come up with a financial "game plan" if needed. You can also use "light advice" services offered by companies such as Vanguard which only charges 0.3% per year. The actual investing part is easy. There are also lots of free options such as Blackrock's core portfolio builder. Vanguard also has a free portfolio creation tool. Their nest egg calculator is also very helpful.

4) Two conflict of interests: Market timing inherently presents a conflict of interest. If someone believes that an adviser is needed to time the market, then that adviser's services must be used on an ongoing basis, year after year, which benefits the asset manager. A one-time recommendation to employ a buy, hold and rebalance strategy does not serve the asset manager's best financial interests because no costly ongoing services of an asset manager are required.

Furthermore, Moraif apparently recommends actively managed funds. According to a poster on Bogleheads, the fees on the mutual funds that he recommends are "not low" and returns were disappointingly low. Actively managed mutual funds are famous for under performing their benchmark indexes. Actively managed mutual funds typically pay advisers under-the-table commissions. If Moraif is in fact paid each time a transaction takes place, then this is yet another conflict of interest. If he is paid an ongoing commission ("trailer fee") then this is also a conflict of interest(that motivates him to push actively managed fund(s) rather than index funds.

The solution is to work with a fee-only fiduciary. That fact that Moraif recommends actively managed mutual funds suggests that he is merely a fee-based advisor.

It should be noted that the estimated gains or missed gains (covered below) resulting from Moraif's sell strategy do not account for mutual fund over or under performance versus their benchmarks.

5) Paid 60 minute radio advertisements presented as "radio shows" -- Moraif pays for radio air time to run infomercials to promote his advisory services. Other than the disclaimers at the very beginning and end, Moraif presents these infomercials as being part of the regular (unpaid) programming. Make no mistake, these "Money Matters radio shows" that run on KABC-AM in Los Angeles are paid commercial advertisements. This should be evident by the way he incessantly self-promotes.

6) On his infomercial Moraif never fails to boast about how his firm is listed on Barron's: Top 100 Independent Wealth Advisors. But if you listen to his disclaimer, Barrons doesn't even consider what consumers (who want to attempt to time the market) would care about most, namely investment performance! So this "top 100" list is no help in telling us if Moraif has been over or under-performing the benchmarks. In this review we will attempt to shed light on this question.

Moraif says that Barron's doesn't track investment performance because "client investment goals differ". This is comical because it doesn't matter if client investment goals differ. You simply compare to the benchmarks! Are his mutual funds beating the indexes after fees? Is his strategy of market timing beating the strategy of buy and hold? This is the constant theme of Ken Moraif's commercials: Always doing Kansas City shuffles instead of providing performance data.

7) Moraif urges listeners to come out to his sales pitches at hotels that he calls "seminars". Make no mistake, the purpose of these "seminars" is to ultimately convince attendees to use his paid advisory services. People don't buy expensive radio time and rent out hotel conference rooms for charity.

8) Lack of transparency regarding rate of return versus the benchmarks -- Moraif is not GIPS complaint! So how can anyone begin to come to any conclusions about the efficiency or inefficiency of Moraif's market timing strategy? GIPS (Global Investment Performance Standards) independently verifies adviser claims through fair representation and full disclosure of investment performance results. You can search for "Moraif", "Money Matters" or "Retirement Planners of America" on this list of firms claiming GIPS compliance.

Click here for variables to consider when estimating the market timing performace of Moriaf's firm.

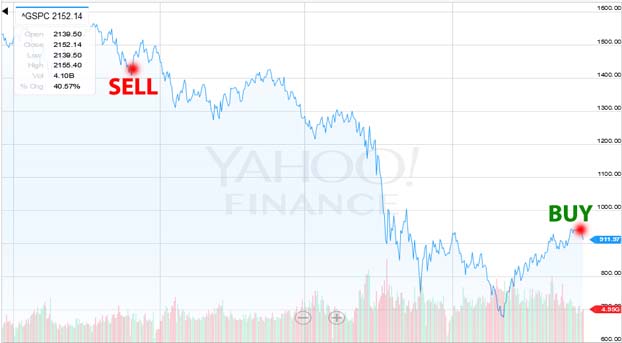

9) *Only averted 26.62% of the 55.25% market crash -- In Moraif's commercials it is stated that "Clients that followed Ken's advice did not lose money in the stock market crash of 2008." In fact Moraif told his clients to get out of the stock market from Nov 27, 2007 (S&P 500 total return index closing price of 2,238.52) until June 12, 2009 (closing price of 1,541.7). Assuming 1.25% in annual asset management fees (on Jan 1st of each year) and lost dividends (from being out of the market), this would have saved his investors approximately 26.62% of what was a 55.25% (not including Money Matters fees) stock market loss from peak to bottom. This figure does not factor in the adverse effects of prematurely paying capital gains taxes within a taxable account, discussed near the end of this review.

NOTE: The above chart reflects the S&P 500 price return index

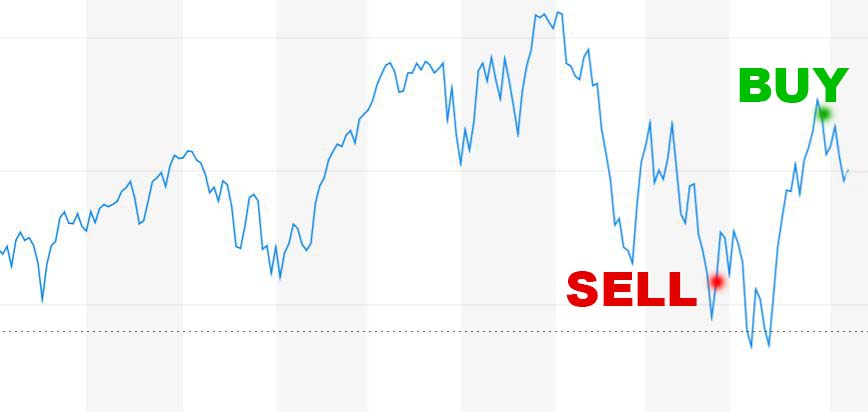

ANALYSIS: Bungled reentry into the market. Take note that since the great crash of 1929, the stock market had only crashed 50% or more one time, and that was from 1937 to 1938, when stocks were down as much as 52.2%. Yet, by 3/9/2009 the S&P total return index had lost 55.25%. At this point in time, at least on paper, Moraif had saved his clients a whopping 51.08% (of the 55.25% total drop)!!! This was a ONCE-IN-A-LIFETIME OPPORTUNITY to lock in all of these savings by buying back in!!! Yet, he squandered this opportunity by sitting around and waiting for the market to recoup another 19.95% of those savings! From the perspective of going from the bottom price of 1,095.04 to the buy-in price of 1,541.70, Moraif missed out on 40.07% in gains. Moraif evidently insisted on following his metrics, which involve the price of the S&P 500 index versus the 200-day moving average. If so, this inflexibility and insistence on adhering to strategy proved to be a costly mistake.

If you're thinking that it is wise to stay out of the market even after it drops 55.25%, because stocks could go even lower, like the 1929 crash of 89.2%, you need to study what caused that crash, what has changed, and what steps were taken to prevent such crashes in the future. And, regardless, rarely if ever does any investor ever get an opportunity to beat the market by a whopping 50%. As a matter of course, Moraif should have gotten back in.

10) Ignoring diversification into bonds -- While clients who followed Moraif's advice did not lose money in 2008, neither did conservative buy and hold retiree investors who were simply diversified into stocks and bonds. A low risk retiree portfolio of 75% ten year treasuries and 25% S&P 500 stocks did not lose money. In fact this low risk allocation gained 3.1% in 2008.

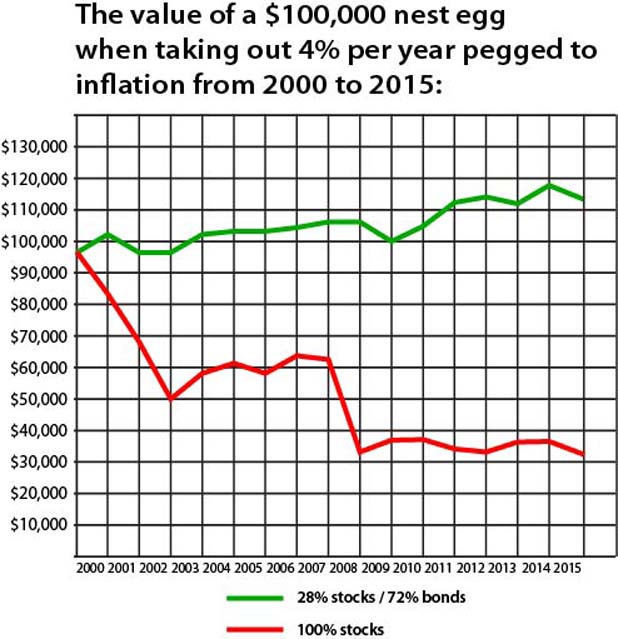

MORAIF'S STRAWMAN PRESENTATION: Ken Moraif says that by owning 100% stocks your portfolio would have run dangerously low since 2000 if "eating your seed corn" (taking out 4% per year). This is the same deception used by insurance salesmen and other product and services pushing salesmen. He blatantly ignores age-appropriate diversification into bonds.

Note: The above chart factors in calendar rebalancing on Jan 1 of every year

Above rate of withdrawal for each year: Jan 2000: $4,000, 2001: $4,136, 2002: $4,251.81, 2003: $4,319.84, 2004: $4,419.19, 2005: $4,538.51, 2006: $4,692.82, 2007: $4,842.99, 2008: $4,978.59, 2009: $5,167.78, 2010: $5,147.11, 2011: $5,229.46, 2012: $5,396.81, 2013: $5,510.14, 2014: $5,592.79, 2015: $5,682.28, 2016: $5,687.96

Here in one of his videos (which has recently been taken down) Moraif demonstrated how a "portfolio" of 100% stocks failed to sustain adequate returns for a retiree during the 2000's. Then he conveniently leaps to sweeping conclusion by saying "That's why I believe that buy/hold is a recipe for disaster. I think it is financial insanity. What I think is a better idea is you should have a buy, hold and sell strategy". The real financial insanity is for a retiree to put 100% of their money in stocks! It sure appears as though Moraif is being willfully ignorant of how diversification protects against stock volatility so that he can sell his services to know-nothing investors who don't understand how bonds are like brakes on a car that protect against stock market volatility.

More strawman talk: Using 80% stocks as a benchmark for diversification

In his radio infomercial Moraif states that "when we come back from the break I will debunk buy and hold" strategy. Unfortunately Moraif simply repeats his strawman argument of looking at a portfolio that is overexposed to stocks. Ironically he says "We believe in taking the least amount of risk possible". Well, according to Ibbotson, from 1970 to 201 the lowest risk allocation was only 28% stocks and 72% bonds. Yet Moraif talks about investors who lost 25% in the 2008 market crash. It is a mathematical fact that in order to have lost 25% in 2008 they would need to have invested 80% in stocks and only 20% in bonds. They were over allocated into stocks! Therefore Moraif is presenting a strawman argument. And from this strawman argument he declares "There are times when diversification is not enough". If he was being straight forward he would instead say "If you are sufficiently diversified into bonds then diversification and buy/hold/rebalance works great".

More strawman talk: The 1929 crash

Moraif says that it took 25 years for investors to recover from the 90% stock market crash of 1929. Again he is completely ignoring diversification into bonds in order to puff up his market timing service. In reality an ultra low risk portfolio of 75% bonds / 25% stocks never lost money when accounting for deflation.

Also in order for your portfolio to have lost 90%, you would have had to have begun investing at the peak of 1929. Stocks more than tripled from 1924 to 1929. So in addition to ignoring bonds, Moraif is cherry picking the worst possible starting point.

On 8/20/2016 Moraif was still using the same ole' strawman argument about the 2008 stock market crash causing investors to have to un-retire.

On 10/17/2017 Moraif ran a radio spot stating "In 2008 the stock market crash wiped out 12 years of gains in 17 months". That's if you were insanely positioned 100% in stocks! In reality a 28/72 portfolio dropped less than 1% in 2009 and was up 3.96% in 2007.

11) Cherry picking -- At the end of his radio infomercial the legal disclaimer says that information presented "should not be regarded as a complete analysis of the subjects discussed". Perhaps Moraif's lawyers believe that he CHERRY PICKS that information which makes himself look good, leaving out or glossing over all of the bad information!

In Moraif's commercials he not only cherry picks a high risk "portfolio" of 100% stocks, but he also loves to only talk about how he instructed his clients to get out in 2008, without discussing in any meaningful detail what he has done since then. On his website it appears that there are no written details of his market timing blunders. This is confirmed by doing a Google search for "Ken Moraif" + some of the dates that he called for his clients to get in and out of the market. Sometimes in Moraif's 60 minute radio infomercials, he vaguely alludes to his market timing blunders by simply saying that his strategy "is not perfect" without discussing the ugly details about percentages of missed gains. Despite claims that he posts this information on his website, nowhere does there appear to be a complete and detailed disclosure of his market timing calls. He has only posted a link to this video about his 2010 market timing blunder. In this video he does not disclose the exact percentage of missed gains. He only says the "market gained pretty nicely. We were out of the market during that time".

It appears as though Moraif has posted no written disclosure or video about his 2011 blunder. The only information on the Internet appears to be a consumer's blog called "Investment Myth Busters".

12) *Missing out on about 9.98% in gains -- Moraif instructed his clients to get out of the market from June 8, 2010 (S&P 500 total return index closing price 1,765.29) until October 6, 2010 (S&P 1,941.50 closing price), thus missing out on gains of approximately 9.98% before management fees. For all of the calculations made in this review we shall assumes that Moraif's clients held mutual funds that trade at the close of market. The market dropped about 16% from peak to bottom during this market correction. Clients who followed this advice within a taxable account would have also paid short-term capital gains taxes on gains because Moraif had gotten them back into the market less than 1 year earlier (on June 12, 2009).

13) *Missing out on about 12.03% in gains based on report -- According to a report by Investment Myth Busters, which is substantiated by one of Moraif's videos, Moraif instructed his clients to get out of the market from August 5, 2011 (S&P 500 total return index 2,039.04) until January 19, 2012 (S&P 2,258.80), thus missing out on S&P 500 total return index gains of 10.78% before management fees, or 12.03% after a 1.25% management fee. The market dropped about 19.38% from peak to bottom during this market correction. Clients with taxable accounts who followed this advice (if IMB's story is true) would have also paid short-term capital gains taxes because Moraif had previously gotten them back into the market less than 1 year earlier (on October 6, 2010). Again, we are assuming that this report is true.

14) Missing out on about 11.25% in gains.-- Moraif instructed his clients to get out of the market in August of 2015, apparently at the close of trading on August 21. We shall then assume that a Moraif client placed an order to sell their stock mutual fund(s) on the following Monday August 24, 2015 (S&P 500 total return index 3,512.65). Moraif says that he instructed his clients to put the proceeds into a mix of money market funds and bonds.

Since Moraif is not GIPS complaint and he does not disclose the full details we are forced to make estimates. So for demonstration purposes we shall assume that Moraif instructed his clients to put 50% in cash and 50% in a total bond market index fund.

Moraif announced that he instructed his clients to get partially back into the market during the week of April 11, 2016 to April 15, 2016. However he didn't say what percentage or what day.

According to a forum post, Moraif buys back into the market when the S&P 500 index moves a certain percentage above the 200-day moving average. Indeed the S&P 500 price index closed just above that 200-day moving average point on Wednesday April 13, 2016 at 3,918.95 (or 2,082.42 price return index).

We shall assume that his investors got back into stock mutual fund(s) at the close of trading on April 13 (3,918.95 S&P 500 total return index). And we shall assume that these investors used the cash half of their portfolio to get back into stocks. That would mean that he locked in losses (missed gains) of approximately 11.93% with that 50%. Moraif stated that he intended get his clients back into the market "gradually" over the coming months. On July 1 Moraif announced that he had counseled his clients to get back fully invested into the market. We don't know if he said to sell the bond half of their portfolio at that time or if he made that call earlier in time. If he made this call on July 1st then it would have taken approximately 3 days for funds to clear. For simplicity we shall assume that investors sold their bond position 3 days earlier, on July 28. That means that this half of the portfolio gained 3.32% from August 24, 2015 until 7/1/2016. When it's all said and done, these market timing calls would have cost his clients approximately 11.25% in missed gains, after 1% management fee. This figure does not account for taxes within a taxable account.

15) *Missing out on either roughly 13.62% or 10.42% in gains. Moraif declared a sell signal on Friday Dec 14, 2018, but didn't actually execute the sales until Monday December 17, 2018 during the course of the day, with all clients getting the same average sale price. This would seem to indicate that Moriaf held securities that trade during the day (such as index funds) rather than mutual funds that close after the close of trading. Since Moraif is not GIPS complaint we will use the average daily price of 5,098.26 (S&P 500 total return index) as a sell price estimate. The average daily price of the S&P 500 price return index was 2,565.84.

On Friday March 22, 2019 Moraif announced on his infomercial that he has counciled his clients to start getting back into the stock market "gradually". He said the buy signal came on Friday March 22, 2019. According to this forum post the call was to put only 25% back in. He didn't say at what time or at what price, nor did he say if they bought index funds (which trade during the day) or mutual funds (which generally use the closing price of the day as the trade price). On this date, the S&P 500 total return index traded in a range of between 5,686.19 and 5,595.04 (price return index range of 2,846.16 and 2,800.47). The average S&P total return index price for the day was 5,640.62. The S&P total return index closed at 5,595.50.

So for purposes of estimating a buy back price of securities that trade during the day we would use the average price of the day of 5,640.62 (the price return index average daily price was 2,823.15). That would mean that Moraif locked in missed gains of approximately 10% for this portion that was bought back into the market. If Moraif bought back into mutual fund(s) then we would use the closing price of the day of 5,595.50 and assume 9.75% in missed gains.

At this time, the rest of the these client's stock money remained out of the stock market. According to the forementioned post, Moraif's plan was to get 25% back into the market a month later, another 25% in two months, and then the remaining 25% in 3 months.

The average price of the S&P price return index on 4/22/2019 was 2,902.93. (The total retun index average daily price was 5,807.09) If Moraif bought back in on another 25% on this date then he locked in about 13.14% in missed gains for this block of money. If Moraif bought back into mutual fund(s) then we can use the closing price of the day of 5,817.16 and assume 14.1% in missed gains.

The average price of the S&P price return index on 5/22/2019 was 2,858.29. (The total return index average daily price was 5,728.27) If Moraif bought back in on another 25% on this date then he locked in about 11.39% in missed gains for this block of money. If Moraif bought back into mutual fund(s) then we can use the closing price of the day of 5,724.71 and assume 12.29% in missed gains.

The average price of the S&P price return index on 6/24/2019 was 2,949.48. (The total return index average daily price was 5,922.59) If Moraif bought back in on another 25% on this date then he locked in about 14.95% in missed gains for this block of money. If Moraif bought back into mutual fund(s) then we can use the closing price of the day of 5,914.29 and assume 16% in missed gains.

To summarize, when we assume the forementioned four sales at the average price of the day, it averages out to 12.37% in missed gains as a result of this latest market timing venture. When using the closing prices for each day, for purposes of estimating buyback into mutual funds(s) it averages out to 13.03%. It appears from later statements that he put managed money into securities that trade during the day.

However, what Moraif did with the proceeds from the sale of equities on 12/17/2018 is unclear. Did he sit in cash or did he invest some or all in bonds? If he immediately invested (after giving trading 3 days for funds to clear) all into a total bond market index fund such as BND and sold each 25% block three trading days before getting reinvested in stocks, then this would have mitigated some of the 12.37% in missed stock market gains by approximately 3.79%. That reduces missed gains to about 9.17% if we assume that Moraif reinvested in securities that trade during the day. If Moraif bought back into mutual fund(s) then we can assume 8.58% in missed gains.

When we add Moraif's 1.25% management fee on January 1st, this further reduces Moriaf's performance from 12.37% to 13.62% in missed gains, assuming he sat in cash while out of the market. If he swept money into BND, then this reduces Moraif's performance to 9.83% in missed gains.

Moraif contradicts himself: On his 4/9/2020 infomercial, Moraif stated that a critic of his on Twitter posted that Moraif sold at the bottom of [the market] in December of 2018. Moraif countered by saying "No, we didn't. We didn't sell in December. We sold in October, two months before the bottom."

Unless Moraif had been repeatedly giving out misinformation on his radio infomercials in 2018 and 2019, then Moraif's 4/9/2020 comments are just plain false. Here's an audio clip of Moraif contradicting himself during his January 26, 2019 infomercial.

"As you may know, if you've been listening to the show, we counseled our clients to get out of all equities, all stocks on December 17th of last year, so we are currently sitting outside of the stock markets." -- Ken Moraif, Jan 26, 2019.

16) *Missing out on roughly 15.87% in gains. Ken Moraif announced on his radio infomercial that his 'sell signal' came to get out of all equities on Tuesday March 10, 2020.

When Moraif sold all equities back in 2018, he disclosed that they sold during the course of the day, with all clients getting the same average sale price, which implies that he bought securities that trade during the day (as opposed to mutual funds that trade at the end of the day). It is possible that he bought back into mutual funds in 2019 when he got back in. But, we must still assume that Moraif has some clients who are the custodians of their own brokerage accounts, and thus process their own trades according to Moraif's buy/sell instructions. These clients may have bought securities that trade during the day, such as index funds.

As for clients who have their money managed by Moraif, it is unclear if that money was placed in index fund(s), which trade during the course of the day, or mutual fund(s) which trade at the close of the day. Mutual fund sell prices may be higher or lower than the day's closing net asset value. But, for purposes of estimating Moraif's performance, we shall use the S&P 500 total return index closing price of 5,868.11 as a sell price benchmark. If so, Moraif waited for stocks to drop 14.88% off of their Feb 19, 2020 high. In his last 4 market timing attempts, Moraif waited for stocks to go down approximately 12.75%, 12%, 7.5% and 11.25% (all based on estimates and assumptions).

As for clients who manage their own brokerage accounts, and also owned index funds, we shall assume that they would have placed their sell orders before the open of Tuesday trading. In which case, according to Yahoo Finance charts, their sell price in early trading could have been anywhere between roughly 2,775 and 2,840 (price return index) as there was a price spike at the opening bell. If this group of clients owned mutual funds, then we can use the S&P closing price of 2,882.23 (price return index) as a sell price benchmark (5,868.11 total return index).

Moraif has boasted that his firm sold a day before the World Health Organization declared coronavirus a pandemic. However, by this time the virus had already created a wall of worry. The S&P 500 index had already dropped 14.88%.

UPDATE: Moraif announced on 6/5/2020 that they reached their buy signal on 6/3/2020, putting only 10% back into stocks the next day on 6/4/2020. It is unclear if he invested in securities that trade during the day or mutual funds that settle at the end of the day. The S&P 500 total return index average price of the day was 6,364.01. The closing price of the day was 6,369.54. That means that if Moraif bought back into mutual fund(s) then he locked in missed gains of about 8.5% for this block of money.

On Friday 7/10/2020 Moraif stated that "this week" they had brought their equity allocation up to 25%. It is unknown which day they reinvested. And again, it is unclear if they invested in securities that trade during the day or at the close of trading. We shall assume that this time, that the plan is similar to the last market timing effort when Moraif mechanically invested each additional amount 1 month after the previous reinvestment into the market. 7/4/2020 fell on a Saturday, so we shall assume that 7/6/2020 was the trade day that they put another 15% back into the market, thus locking in 11.04% in missed gains for this block of money. The closing price of the S&P 500 total return index on 7/6/2020 was 6,516.05.

On Thursday 8/6/2020 Moraif stated that on Friday (8/7/2020) they were going to increase their stock exposure to 75%. It is unclear if he would be investing that money into securities that trade during the day or mutual funds that settle at the end of the day, and whether the purchase had already taken place at the close of trading on 8/6/2020 (and therefore that money wouldn't begin to again be "exposed" to the market until Friday). Fortunately for purposes of estimating Moraif's performance, there was little difference in the closing price of the S&P 500 index on these two days. On 8/6/2020 the S&P 500 total return index closed at 6,870.86. On 8/7/2020 it closed at 6,876.65. We shall give Moraif the benefit of the doubt by using 8/7/2020 as the entry price for this money. Therefore Moraif locked in 17.18% in missed gains for this 50% block of money.

Moraif announced that on 9/9/2020 they were planning on reinvesting the final 25%. The closing price of the S&P 500 total return index on 9/9/2020 was 6,986.76.

The end results of this market timing attempt was approximately 15.87% in missed gains for the stock portion of client's accounts. The bond portion suffered approximately 2% in missed gains.

Despite these loses, on Feb 18, 2022, Moraif amazingly asserted that selling was a "good move" that enabled them to "win the pandemic". Perhaps Moraif's clients have amnesia or are unaware that they lost money as a result of Moraif's "Invest and Protect Strategy".

BONDS: Moraif disclosed that they also made the call to sell off all bonds, and that the proceeds from the sales of both bonds and stocks were put into money market accounts. On 3/10/2020 the BND price return index was at 86.59. Apparently they got back into bonds on (or possibly before) 7/6/2020. On this date, the BND price return index was 88.31. This leaves about 1.986% in missed gains for this bond block of money. BND yields about 2.5%. A money market account probably couldn't have yielded more than 0.5%. So that would mean that there was a grand total of over 2% in missed gains for this bond portion.

17) *Missing out on roughly 7.47% in stock market gains. Moraif announced that they had reached their 'sell signal' on 2/23/2022, and therefore would be selling the stock portion of clients' portfolios the next day, on Wednesday February 24, 2022. For clients who use RPOA as the custodian of their money, that means that they sold TCOEX. He said that they also sold their position in TCOBX (an emerging markets bond fund). They continued to hold TCOFX (another bond fund) until April 12, 2022, at which time they sold it. Proceeds from all of the sold positions basically went into a money market fund, which earned interest.

It is unknown if Moraif locked in the closing price (the way mutual funds typically settle) or some other price during trading on this day. Indications are that trades of the TCOEX fund might be priced at the close of the market. Though TCOEX is not an S&P 500 index fund, it is listed by Morningstar as a large cap blended fund, which is similar to the S&P. Either way, for simplicity, and perhaps to better gauge clients who own equities that more closely mirror the S&P 500 index, we will continue to use the S&P 500 index as the benchmark for analyzing Moriaf's performance. The closing price for the S&P 500 total return index on the presumed 2/24/2022 sell date was 9,005.37.

*Based on various estimates and assumptions.

In these calculations, we are not factoring in TCOEX price and dividend underperformance + expense ratio differences versus VOO: TCOEX has underperformed the S&P 500 index fund VOO's price return index by about 4.75%. VOO also pays a higher dividend yield by 1.34%. If RPOA was invested in TCOEX for 1 year and 5 months, then this would mean 1.90% in missed dividends. TCOEX has an annual expense ratio of 0.69%. That's a difference of 0.66%. Multiply that to reflect 1 year and 5 months of higher expenses. Compare this with S&P 500 index funds like SWPPX (.02%), or IVV (0.03%). Presumably, RPOA gradually bought into this fund in 2020, from 6/4/2020 to 9/9/2020 (see previous market timing attempt). The bottom line is that it appears as though RPOA clients would have been better off owning a plain old S&P 500 index fund from 2020 to 2022.

Moraif got back into the market on or about 3/30/2022. Like the previous five market timing attempts, he got back in at a higher price. The S&P 500 total return index closed at 9,678.30 on 3/30/2022. It is unknown how much he put back into equities, however, according to a tip from someone claiming to be a client, 100% was put back in. If so, this amounts to 7.47% in missed market gains. Based on figures cited by the forementioned forum poster, clients who owned TCOEX missed out on 5.8% in gains.

During this 2022 correction, the S&P 500 index dropped 12.82% from peak to bottom. When we add the 7.47% in missed gains, that leaves us with a break even point of 20.29%. This improves on his break even point average (discussed further down this page).

18) *Only averted 5.45% (including money market earned interest) of the 24.49% market crash -- On 4/22/2022, less than a month after getting back into the market, Moraif once again reached yet another sell signal. He said he would sell on Monday April 25th, 2022. The closing price for the S&P 500 total return index was 9,040.86. This 5.45% figure does not include the 1.25% average RPOA management fee, nor does it include any applicable 'platform fees' (ex- the 0.3% Pershing fee apparently implemented April 2022).

Moraif announced that they would be 'buying into our equity positions' on 2/1/2023. It is unclear if they got 100% back into equities or not. It appears as though they did, but then later sold off a portion of stocks around the time of debt ceilling worries, perhaps from late April to late May 2023. As of 6/23/2023 Moraif said "We are not in our more aggressive stocks as of this point. We're in our conservative stocks." The closing price for the S&P 500 total return index on 2/1/2023 was 8,782.77.

On 6/9/2023, Moraif said that they would be getting 'fully invested in our stock porfolio' after the 13th or 14th of June 2023. Later, he said that they got back in on June 26, 2023. On this day, the S&P total return index closed at 9,297.12.

For the portion (perhaps it was 100%) that was invested on 2/1/2023, clients would have saved 2.85% plus an additional amount of savings as a result of the cash having been parked in an interest earning money market account. During the time that this money was sidelined, interest rates spiked up. A source reports that client earned rates were 2% for roughly the first half of this timing call, and 4.73 for the second half. That would suggest an annualized rate of 3.35%. The money didn't sit for a full year -- Instead for about 9 months and 10 days. That would mean that roughly an additional 2.6% was earned in interest by being out of the market. And so, we add 2.6% to 2.85%, giving 5.45% in savings by being out of equities. NOTE: This 5.45% figure is before RPOA's 1.25% management fee and 0.30% Pershiing 'platform fee' (for those clients who use RPOA to be custodian of their money). This 5.45% figure does not factor in mutual fund under/over performance and dividend yield differences versus a low-cost index fund (that a buy-hold investor would own), and does not factor in expense ratio. Clients who had RPOA as the custodian of their money for this market timing attempt may have actually lost money -- not gained 5.45% versus buy/hold.

For the bond portion, as of 6/16/2023, RPOA remains in a money market fund.

19) *Total: Approximately 96.98% in missed market gains from 2009 to 7/20/2020 -- According to estimates described on this page, including according to information from sources including Investment Myth Busters, clients who followed Moraif's market timing advice from 2009 through 7/20/2020 have missed out on approximately 96.98% in market gains by being out of the market at the wrong times. This can also be viewed from the perspective of a 49.23% loss. These figures include a 1.25% asset management fee charged on Jan 1 of every year for simplicity. This does not even include loses due to taxes within a taxable account, added trading costs, nor does it include mutual fund under or over-performance versus benchmark index funds. As of July 20, 2020, your $100,000 invested on 6/12/2009 is now worth about $219,548.68. The same $100,000 in a buy-hold-and-do-nothing account is worth $432,473.89.

Will these clients ever make up for this catastrophic blunder? Again that translates to 49.23% from a loss perspective. Remember that Moraif only averted about 29% of the 56% market crash from Nov 27, 2007 until June 12, 2009. Past performance suggests that these clients now need a much bigger market crash just to get back to even, and no more botched timing calls. The problem is that the stock market has fallen 50% or more only 3 times since 1928.

Ironically Ken Moraif mocks buy and hold investors who say "It's OK to lose 37% because the market will come back". So by Moraif's logic, his very own market timing strategy is garbage!

As for clients who followed Moraif's advice note for note from 2007 to 7/20/2020 and were not drawing from their nest egg, estimates indicate that these clients would be in the red after a hypothetical 1.25% annual Ken Moraif management fee. They are down about 29.02% (or from the perspective of missing out on 40.88%). If these trades took place within a taxable account, then depending on their tax bracket, these clients are doing even worse. If you paid just 15% taxes on gains then you paid out approximately $11,842 in taxes. This represents money that can no longer compound, as well as money that heirs will not inherit. Figures do not account for Moraif recommended mutual fund fees and under or over-performance of the benchmarks. According to one blogger on Bogleheads, the fees on the mutual funds that Moraif recommends are "not low" and returns were disappointingly low.

20) Presenting anecdotes rather than performance data: Not surprisingly Moraif has a disclaimer to go with his radio infomercial, informing listeners that his anecdotes should not be construed as an endorsement for Moraif. We couldn't agree more! Anecdotes are a cop out. Anecdotes tell us nothing about performance versus the benchmarks.

21) Making excuses with an endless charade of anecdotes rather than disclosing performance data: Moraif appears to explain away his market timing blunders by saying "We’re not here to make you rich quick. We’re here to help you not become poor." Make no mistake, either his stop/loss strategy has been a net gain or a net loss (versus the benchmarks) for 50% or more of his clients. Performance is everything when it comes to the question of buy and hold versus market timing. Not surprisingly, by attempting to "not become poor", investors who followed Moraif's advice since June 2009 have become poor! The very market crash that they feared has essentially occurred in slow motion by being out of the market at the wrong times. If Moraif was truthful he'd say that "We made you poor by trying to help you not to become poor".

As previously discussed, if your goal is to "not become poor" then you simply take less risk by diversifying more into bonds.

More recently Moriaf appeared to try to lessen his market timing failures by stating on his radio infomercial that "It's not about getting high returns" and that instead it's about taking "only as much risk as it takes to meet our client's goals". He might as well say "money isn't everything!" His anecdote is nothing more than a variation of his "We’re not here to make you rich quick. We’re here to help you not become poor" anecdote. And you mitigate stock market risk by diversification into bonds. Diversification has nothing to do with market timing! Make no mistake, market timing is attempting to sell the stock portion of one's portfolio in attempt to buy lower. Either the strategy is profitable after fees or you are missing out on gains. In evaluating market timing strategy you compare performance versus a benchmark. The S&P 500 index is indeed an appropriate benchmark to use in determining if Moraif's stock market timing strategy produces a net gain or loss.

Moraif has also used the anecdote of playing defense instead of offense. He says that he believes that retirees and people close to retirement need to take the least amount of risk as possible. The problem is that the very strategy of market timing is risky! Moraif is living proof of this! Any clients who followed his advice from 2009 to 2017 missed out on approximately 44% in stock market gains, again based on estimates and assumptions, and assuming that Investment Myth Buster's story is true. By paying someone about 1% per year to essentially place bets (by attempting to time the market) you are taking risks.

Moraif has also presented a storm shelter analogy to justify being wrong with his market timing calls. He says that if you retreat into the storm shelter and there's no tornado, that's OK. But this analogy does not apply to investing! Imagine if you lost a body part or a family member if you retreated into your storm shelter but no tornado passed over your house. That's a better way of summarizing what can happen if you fail at market timing. It's catastrophe in slow motion!

Moraif also says "defense wins super bowls" or that trying to "score as many points as possible" is a bad strategy because it might backfire. The real question is whether attempting to time the market with the stock portion of your portfolio is likely to make you richer or poorer. So far Moraif has proven that his market timing strategy has severely backfired for his clients. And again, you can mitigate risk simply by diversifying into bonds.

Moraif says "there's this tiny little thing that's wrong with buy/hold [strategy]. Oh yeah! Bear markets!". And there's this tiny little thing that's wrong with market timing. Oh yeah! Mistiming the market! People who followed Moriaf's market timing advice since 2009 have missed out on 44% in market gains!

On 4/24/2020 Moraif adopted yet another anecdote, “I Don’t Care About Missing Out on Gains. I Want to Miss Out on Losses.” The problem is that missing out on gains is the same as taking losses! The only thing that matters is your account value.

Ken Moraif presents what he calls a "buy-hold myth" that if the stock market crashes "don't worry about it because the market always comes back". Well unfortunately Moraif's own market timing doesn't pass this smell test either! The market doesn't come back after you repeatedly mistime the market either! Is Moraif telling his clients who have missed out on 44.5% in gains "Don't worry about it. We'll correctly time the next crash and it will be a big one"?

Moraif says that he doesn't ever want to have a conversation with clients telling them that they just lost 30, 40 or 50 percent of their money because they didn't have a sell strategy. For starters, as previously discussed, Moraif has never averted more than 29% in market loses. Most importantly Moraif's market timing advice has essentially caused clients to miss out on approximately 44.5% in stock market gains since 2009. Has he had a conversation with his clients to explain this?

In order to justify his market timing strategy, Moraif asks "Do you think there will be a bear market sometime between now and the rest of your life?" The pertinent question that he fails to ask is whether attempting to time the market is likely to result in a net gain versus a buy / hold strategy.

22) Market timing is also a double edged sword if you are taking withdrawals from a portfolio.

"If you're retired, your investments are not able to withstand large losses" -- Moraif

(Note: For argument sake we will ignore the fact that a portfolio that is well diversified into bonds is not likely to decline 30%, and that Moraif only averted 27% of the 56% decline of 2008 when including his management fees.)

Moraif argues that you cannot afford to sustain large losses in the early years of retirement because you may run out of money. For example, if you are relying on $4,000 of income per year, and your $100,000 sufferes a 30% market decline to $70,000, you are no longer taking out 4%. $4,000 is now 5.7% of $70,000. This increases the chances of the portfolio running out of money within 30 years.

But what he's ignoring is that by attempting to time the market while taking withdrawals in retirement, you can also experience the equivalent of "large losses" that put your portfolio at risk.

Conventional wisdom suggests that if we cherry pick looking at Moraif's clients from 2007 onward, these clients who were drawing income from their protfolios would have at least fared better (versus buy / hold & withdraw 4% per year) than clients who had not been taking out any withdrawals. In the early going this was true -- When taking out 4% per year in retirement, by 6/12/2009, the "buy / hold & withdraw 4%" portfolio was down to $66,203.90. However by mid 2019, the "buy / hold & withdraw 4%" portfolio actually surpassed Moraif's "buy / hold / sell & withdraw 4%" portfolio. By 6/23/2020, the "buy / hold & withdraw 4%" portfolio was outperforming Moraif's "buy / hold / sell & withdraw 4%" portfolio by 1.32%. Again, this happened even when we selectively put the "buy / hold & withdraw 4%" strategy to a stress test -- starting right before a bear market! Therefore, buy / hold was able to withstand the large 2008 loss, even while taking out the recommended 4% per year in retirement.

23) Being out of the market is risky: Anyone who has paid for and followed Moraif's advice from June 12, 2009 to July 10, 2020 has missed out on somewhere in the neighborhood of 88.60% in stock market gains after fees and before taxes where applicable. Another way of looking at it is that these clients have suffered roughly a 46.98% loss by attempting to time the market (versus buy and hold). Using Moraif's past market timing performance as a benchmark, and using assumptions discussed on this page (including estimated sell dates and prices) it could take a 72% market crash just to get these investors back to even. Unfortunately market crashes of 50% or more have only occurred 3 times since 1928. They are rare!

Even if we try to make Moraif's market timing strategy look its best, by cherry picking 2007 as a starting point and taking out 4% per year, these clients who had the immediate benefit of averting 29% of the 56% crash of 2007 - 2009, have now missed out on roughly 35.23% in gains up until July 10, 2010. Another way of looking at it is that these clients have suffered roughly a 26.05% loss by attempting to time the market (versus buy and hold).

24) Stop loss strategy is far from perfect: Moraif appears to employ some variation of a stop / loss strategy, meaning that he doesn't get out of the market until stocks have already gone down some, and he doesn't get back in until the market has rebounded to some degree. That means that stop/loss strategy can only be expected to protect from a portion of a market decline if it works at all.

25) Moraif's strategy appears to be dependent on quite sizeable crashes in order to even begin to have a positive result: How much does the stock market need to crash before Moraif's market timing strategy saves his clients money? Moving forward, we can only guess. If past performance (8 market timing ventures from 2007 to 2023) is any indication of future results, it is fair to assume that Moraif's break even point might be somewhere roughly around a 28.74% stock market crash, before taxes. So, if the stock market were to decline approximately 35%, one might expect Moraif to save his clients only about 6.12% before taxes. The dilemma is that since 1928 the stock market has fallen 30% or more only 9 times, or about once every 10 years (as of Dec 2015). And the stock market has only fallen 50% or more 3 times since 1928.

| Market Drop | Gains or missed gains | Break even point |

| -55.25% | +26.62% [1] | 28.63% |

| -15.63% | -9.98% | 25.61% |

| -18.64% | -12.03% [2] | 30.67% |

| -12.96% | -11.25% [3] | 24.21% |

| -19.36% | -13.62% [4] | 32.98% |

| -33.79% | -15.87% | 49.66% |

| 24.49% | -3.57% [5] | 28.06% |

| 30.01% average |

NOTE: [1] 1.25% management fees were subtracted on 1/1/2008 and 1/1/2009.

[2] 1.25% management fee was subtracted on 1/1/2012.

[3] 1.25% management fee was subtracted on 1/1/2016.

[4] 1.25% management fee was subtracted on 1/1/2019.

[5] 0.30% Pershing 'program fee' was subtracted on on 4/1/2022, a 1.25% RPOA fee on 1/1/2023, and estimated money market interest of 2.60% was added to returns. The last two market timing calls are treated as one call (2/23/2022 to 2/1/2023).

Prior to 2020, Moraif's 'break even point' average was somewhere roughly around a 28.42% stock market crash before taxes. Moraif's 2020 market timing attempt really hurt his break even point average. The market dropped 33.79%, but instead of saving his clients about 6.34%, these clients lost out on 15.87% in gains, and thus a 49.66% market drop 'break even point'.

26) Other odds that work against stop loss strategy: Since 1900, after 10% declines in the stock market, only 1 out of 4 times has the market dropped 20% or more. Moraif's past performance indicates that 10% is not enough of a drop to result in a positive market timing outcome. The stock market generally goes up over time -- not down. Since 1928 the S&P 500 index has hit a new high every 18 days on average.

27) Market timing can be a tax disaster: When taxes are paid sooner than later, those taxes represent money that will not get a chance to further grow and compound. It gets much worse. If you were to die before otherwise holding on to your investments, then 100% of that money that you paid in taxes (due to market timing strategy) represents forever lost money that heirs will not inherit, in addition to not compounding. Heirs normally get stepped up cost basis in California (no inheritance tax) and there are no Federal taxes on the first 5.43 million of inheritance. Because of all of these tax problems, Moraif's market timing strategy makes even less sense for the very retiree investors that he appeals to in his infomercials ("if you're retired or retiring soon then you need to come out to our next seminar")

28) Using a stop / loss strategy is not rocket science: If you absolutely insist on attempting to time the market, anyone can implement a stop loss strategy. If the S&P 500 index falls perhaps 10%, 15%, 20% or [pick any number] you can decide to sell. And you can decide not to buy back into the market until stocks bounce back by a certain percentage from the lowest low. Or you can decide to buy back into weakness, locking in averted losses.

29) Not practicing what he preaches: As discussed earlier in this review, during his infomercials Moraif almost always omits disclosing all of his market timing blunders in detail. He usually cherry picks talking about how he instructed his clients to get out of the market in 2008 and then he'll say that his strategy is "not perfect", and he might mention one of his blunders as an example, but he usually conveniently skips informing listeners about each of his other blunders. Yet Moraif has spent a lot of time talking about how he's a finalist for a BBB "Torch Award for Ethics".

"I believe that ethics, and honesty and disclosing everything to prospective clients and to clients is how we will be successful in the long run" -- Ken Moraif

Evidently the BBB has never actually scrutinized Moraif's lack of full disclosure during his infomercials. And what does that say about the Better Business Bureau (which is not a government agency, but a franchise)?

Final thoughts

Investors will always be drawn to market timers because it's human nature that we hate hate losing money more than we love making money. Unfortunately, according to experts like Mark Hulbert, the strategy of market timing is more likely to backfire.

The stock market is a leading indicator -- not a lagging indicator. Stock investors bet on the future -- not old news. Once news is released, it instantly becomes old news. The efficient market hypothesis states that one cannot "beat the market" because stock prices always reflect all available information and stocks always trade at their fair market value. Prices change instantly to reflect any new public information. Therefore investors may want to rethink whether they can actually avert a market crash after stocks have fallen (due to bad news).

A basic time-tested way to mitigate risk is to allocate more money into bonds rather than stocks, and then rebalance as needed. According to Vanguard, rebalancing can add up to 0.35% in annual increased returns with a 60% stock/40% bond portfolio, although there is debate about whether rebalancing increases returns much if any.

Risk and return are directly correlated with each other. If you want the potential for higher returns you will have to take on greater risk. If you take on less risk then you will not participate in all of the returns of a rising market.

Readers are encouraged to peer review calculations by downloading this Open Office spreadsheet showing Moraif's performance since 2007, as well as this spreadsheet showing Moraif's performance since 2007 while taking out annual withdrawals. Also this spreadsheet of performance since 2009.

* Based on various estimates and assumptions

Related articles:

How Active Managers Sucker Naive Investors In - Article about Ken Moraif

Investment Mythbusters - Money Matters with Ken Moraif - Wrong Again!

Build a billion dollar practice

Review of Doug Andrew Missed Fortune

Debunking Tony Robbins and index annuities

Disclaimer and Waiver - Nothing on this consumer advocate website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy, hold or sell, or as an endorsement, of any company, security, fund, product or other offering. This website, its owners, affiliates, agents and / or contributors are not financial or investment advisors or broker / dealers and assume no liability whatsoever by your reliance on the information contained herein. The information should not be relied upon for purposes of transacting securities, assets, financial products or other investments. Your use of the information contained herein is at your own risk. The content is provided 'as is' and without warranties, either expressed or implied. This site does not promise or guarantee any income or particular result from your use of the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained. Always hire and consult with a professional regarding the evaluation of any specific information, opinion, or other content.