"Actively Managed" Mutual Funds

"In study after study, year after year, it has been shown that the vast majority of actively managed mutual funds underperformed their benchmarks" -- Jim Cramer

"Numerous studies show that very few mutual fund managers can outperform an index fund when expenses are taken into account, and those few who will outperform cannot be identified in advance" -- Whitecoat Investor

Are you being fleeced by a commission hungry "adviser"?

CONFLICT OF INTEREST: The odds are stacked squarely against you if you invest in actively managed mutual funds instead of index funds. Yet actively managed funds (retail mutual funds) are the very products that earn Mr Advisor those fat under the table commissions of typically 5.25% per transaction. So if you go to a non-fiduciary "adviser" you will be fleeced. And you can expect that Mr Adviser will at some point try to fleece you again and again by looking for excuses to convince you to switch to yet another actively managed mutual fund that will earn him even more commission money. And this money comes indirectly from you.

CONFLICT OF INTEREST: The odds are stacked squarely against you if you invest in actively managed mutual funds instead of index funds. Yet actively managed funds (retail mutual funds) are the very products that earn Mr Advisor those fat under the table commissions of typically 5.25% per transaction. So if you go to a non-fiduciary "adviser" you will be fleeced. And you can expect that Mr Adviser will at some point try to fleece you again and again by looking for excuses to convince you to switch to yet another actively managed mutual fund that will earn him even more commission money. And this money comes indirectly from you.

PROOF IS IN THE PUDDING: Let's compare the most popular "actively managed" stock-based mutual fund with a comparable "passively managed" index fund after 5 years as of 10/11/2012. This 5 year period is a good comparison to make because in that time we had both a market collapse and a short term bull market. It's also a good time frame because the information age of high speed Internet is in full force, and therefore the efficient market hypothesis applies more than ever.

(Symbol AGTHX) American Funds Growth Fund of America - Growth Fund of America is the #1 largest "actively managed" American large cap growth stock fund, and the #3 overall largest mutual fund behind PTTAX (a bond fund) and VTSMX (a "passively managed" large cap growth fund). That means that commission hungry brokers have been pushing this fund big time!

$100,000.00 - Original investment

$94,250.00 - Balance after subtracting 5.75% front end load!

$85,305.68 - Balance after -9.49% 5-year performance (including 0.68% expense ratio)

(Symbol SPY) SPDR S&P 500 - This investment is an ETF, which means that it is "passively managed". It merely seeks to replicate the S&P 500 Index. That means no high paid Harvard MBA's in suits are actively attempting to pick and choose the best stocks nor is anyone trying to time the market. This greatly lowers "expense ratio" costs and "turnover ratio" costs. Brokers generally do not push this fund because it pays no lucrative commissions.

$100,000.00 - Original investment

$99,990.00 - Balance after subtracting $10 deep discount broker transaction fee (Schwab, AmeriTrade, Fidelity or Vanguard)

$95,460.45 - Balance after -4.53% 5-year performance (including 0.09% expense ratio)

Conclusion: Avoid brokers and the products they select for you

After 5 years you would be approximately $10,154.77 richer had you just avoided Mr. Broker and instead invested in an index ETF like SPY on your own via Schwab, Ameritrade, Vanguard or Fidelity with a self-directed account!

Growth Fund of America charges you 5.75% right off the top in order to pay your broker his lavish commission... But for the privilege of getting what??? Growth Fund of America also has an annual expense ratio of 0.68% to pay for it's active managers, which is 0.59% higher than SPY's expense ratio. After all of those expenses and fees put you in a hole, to add insult to injury, SPY outperformed Growth Fund of America by 4.15%!!!

Anyone could have predicted this losing outcome because Growth Fund of America has an R-Squared measurement of 96.84. An R-squared rating in the 90's indicates that a fund is very closely mirroring it's benchmark index, and of course mirroring a much lower cost index fund like SPY or VOO! There's no point in paying 5.75% and paying high ongoing management fees and paying for high turnover ratio costs for the "privilege" of simply copying an index!!! The only person who benefits is your broker!! Buying an index fund is as easy as tieing your shoe laces.

Comparing "actively managed" funds VS "passively managed" funds from 2008 - 2011:

64% of actively managed large cap funds were beaten by the S & P 500 Index.

75% of actively managed mid cap funds were beaten by the S & P Mid Cap 400 Index.

63% of actively managed small cap funds were beaten by the S & P Small Cap 600 index.

57% of global funds were beaten by their respective indexes.

65% of international funds were beaten by their respective indexes.

81% of emerging market funds were beaten by their respective indexes.

NerdWallet Study - 3/27/2013 - Only 24% of professional managers beat the indexes over the last 10 years. Active managers did 0.12% better than the indexes before fees, BUT charged so much in fees that in the end they underperformed the indexes.

86% of large cap active managers failed to beat their benchmarks in 2014

Forbes article - Another study confirming that index funds outperform professionally managed funds.

CONCLUSION: Buy ETF's (also known as "passively managed" funds or "index funds")

Mutual Funds Enrich the Financial Services Industry at Your Expense

According to this Forbes article the fees charged by actively managed funds are too high, the management talent is too scarce, and the competition is too intense for active managers to outperform the indexes over the long-term. Charley Ellis calls buying actively managed funds a "loser's game".

Article - Do you think that with active management they will quickly move your money to safety during bear markets? According to this article "nothing could be further from the truth".

ALERT: Are you also paying an "asset manager"?

Understand that illiquid investments like annuities and actively managed mutual funds with large front-end load charges (example 5.25% entry fee) or back-end loads that continue for several years are long-term investments. If you are working with a personal adviser (or "asset manager") who is charging you an annual fee then you are REALLY being fleeced! I argue there is no point in paying them 1% or 2% per year to supposedly "manage" these types of investments which are already being managed.

ALERT: Has an "adviser" recommended that you sell a mutual fund?

Understand that actively managed mutual funds that have front-end or back-end load fees are designed to be held for many years. If you paid a 5.25% front-end load fee only to be persuaded by your broker to sell off the fund after only 5 years or less in order to get you into some other supposedly "better" investment then a bad mistake has occurred. Actively managed mutual funds are expensive enough as is, but paying an additional 1% per year (if held for 5 years) is not acceptable. Your broker is probably looking to earn another commission by convincing you to execute another transaction. At best your broker had poor judgment in picking the "wrong" fund if he already wants you to switch to another investment. Switch to a fiduciary adviser or do it yourself by investing in ETF's. You may wish to contact an attorney to see if any churning laws have been violated by your broker / adviser. Many attorneys will give your case a free evaluation so don't hesitate to ask!

How to do your own fund comparisons:

1) Go to Yahoo Finance.

2) Enter the ticker symbol of the fund and click "Get Quotes".

3) Click "Profile" from the left panel.

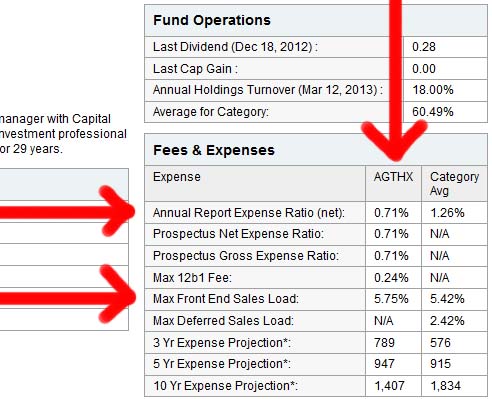

4) Look under "fees and expenses". In this case the fund has an expense ratio of 0.71% per year as well as a 5.75% front end load.

5) Now determine what would be the best ETF or ETF's to compare the fund to by reading the fund objectives under "Fund Summary" also found on the "profile" page. You might also click "holdings" on the left panel to see in more detail. For example if a fund invests in American growth stocks then comparing it to an S & P 500 index ETF might be a reasonable comparison.

Beware of Broker Fraud: Mutual Fund Churning

Understand that when a broker / adviser sells you a mutual fund that has a front end or back end load, you are paying a lot of money (usually 5.75%) for the so-called "privilege" of having it managed by Wall Street experts. Actively managed mutual funds (with these expense load fees) are intended to be held for several years if not much longer. So if Mr. Broker convinces you to sell such an actively managed mutual fund then you have made a big 5.75% mistake! Your broker may have committed securities fraud. Contact an attorney because you may be entitled to compensation. Most attorneys will give you an initial phone consultation for free.

FREQUENTLY ASKED QUESTIONS:

I found an actively managed small-cap growth mutual fund that has beaten the total stock market index over the last 20 years. Why wouldn't I invest in it?

Back in the 90's active managers at least had a little bit of an advantage because the Internet was still evolving. News travelled slowly. Therefore it follows that you should really only be interested in looking at recent performance. Secondly, comparing a smallcap fund with the total stock market index is not an apples to apples comparison. A smallcap fund is certainly going to perform better because it takes on more risk than the total stock market. You want to compare it with a small cap growth ETF while looking at other factors such as the actively managed fund's higher fees and possibly higher turnover ratio. Even if the fund has beated the comparable index fund, studies have shown that this is not likely to give you any advantage in the future.

Warren Buffet was right -- Index fund wins over 10 year period

NEXT ARTICLE: Pump & Dump microcap stock fraud

Disclaimer and Waiver - Nothing on this consumer advocate website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy, hold or sell, or as an endorsement, of any company, security, fund, product or other offering. This website, its owners, affiliates, agents and / or contributors are not financial or investment advisors or broker / dealers and assume no liability whatsoever by your reliance on the information contained herein. The information should not be relied upon for purposes of transacting securities, assets, financial products or other investments. Your use of the information contained herein is at your own risk. The content is provided 'as is' and without warranties, either expressed or implied. This site does not promise or guarantee any income or particular result from your use of the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained. Always hire and consult with a professional regarding the evaluation of any specific information, opinion, or other content.