Buying Real Estate as an Investment

Get Rich Quick Seminars

Also be sure to visit this page which discusses investing in non-traded REIT's (Real Estate Investment Trusts) including crowd funded real estate investing.

Even after people are licking their wounds from the 2006 housing bubble collapse, the get-rich-quick-in-real-estate "gurus" are returning from the dead with their free seminars, books, etc as if nothing ever happened. Never mind that their former "students" lost a fortune and had to declare bankruptcy! And even people who didn't go to one of these get rich seminars and just bought a home to live in with lots of borrowed money found out the hard way that real estate is not a sure "safe haven" investment.

Understand that any investment that someone pitches as having bigger profit potential than normal investments (such as stocks and bonds) must have greater risk. It doesn't matter if we're talking about real estate or any other investment. For anyone to achieve high rewards in real estate they have to take on much greater risk, they amplify those risks by borrowing money and must get lucky by doing so during a market upswing. Things can just as easily backfire as they did after 2006.

You often hear real estate seminar salesmen saying "real estate has created lots of billionaires", suggesting that real estate is a better alternative to traditional stock and bond index investing. Actually Forbes Magazine ranks real estate at #3, behind #2 technology and #1 investments.

GET RICH IN REAL ESTATE SEMINARS

Once you show up at one of these get rich in real estate seminars you will discover that it's all just a ploy to upsell you expensive courses that cost upwards of $33,000. Now you know why the "seminar" was free! Nobody holds seminars for charity! Once you're dumb enough to pay for their expensive course they teach you about how to bid on low-priced "fixer upper" homes that normal buyers don't want. The people who are suited to flip houses are seasoned construction guys who can fix and repair anything from A to Z. They already know people whom they trust to do work that they might not be equipped to do. They're also very skilled at identifying expensive deal-killing problems such as a foundation issues, code violations, etc.

Sometimes people have a perception that stocks and bonds are "risky" and real estate is "safe". This notion has been perpetuated by the National Association of Realtor advertisements in which they have described real estate as "safe and secure". Understand that the NAR represents salesmen (realtors) who should never be relied upon for any type of investment advice. And just because a piece of property isn't sold on the stock market doesn't mean that it isn't affected by the stock market or affected by the same economic conditions that affect the stock market. Both are tied to the economy in general. When stocks go down, people have less money to spend on things like real estate.

Real estate has risks just as any other investment and shouldn't be treated differently. For example, as Rule #3 states, don't over allocate into any one asset class. Again we are talking about investment real estate -- not a home that you can afford and to be used as your primary residence. If you buy real estate, along with other risks, you are putting all of that money in one house in one region.

When an investor borrows money to purchase a home rather than paying 100%, the margin for error when prices fluctuate is smaller. Taking out a loan to invest in property amplifies your risk! For example if you invest with a 25% down payment and then prices in your area go down 25% you have now lost 100% of your money -- Not 25%. This is how many NBA athletes sadly lost everything and declared bankruptcy. They put all of their "eggs" in the real estate "basket" while amplifying their risk by borrowing money.

Some other things to keep in mind with regard to real estate...

Buying real estate is a hands-on job, whereas buying an index fund is as simple as placing a buy order through a deep discount brokerage firm.

Over long periods of time stocks have been the best performing asset class -- Certainly not real estate.

Real estate is not liquid. If you need to cash out you can't just place a sell order through Charles Schwab first thing in the morning. Selling a home at fair market value and closing escrow without a hitch might take many months if not longer.

When you sell real estate expect to subtract up to 6% in broker commissions. This contrasts greatly with paying just $20 in deep discount brokerage commissions when buying and selling real estate securities.

If you sell at a sizeable capital gain then that gain will be taxed in just one tax year. This compares with other investments like stocks, bond and ETF's in which you can sell in parts thus lowering your tax bracket.

How well someone does in real estate should be measured in annual percentage return on investment. So if someone tells you that they made a quick $70,000 by flipping a house I want to know how much money they invested, for how long and minus all of the expenses and time invested. If it took them a year to flip a $400,000 home into a $480,000 minus $40,000 in expenses then they only made a 10% return on their investment. If the S & P 500 index went up 10% during that same time period then I want to know why someone took that much risk and wasted that much time when they could have been watching TV on a couch the whole time!

Real estate isn't always a "safe haven" and real estate prices may vary greatly by region:

| City | Period from 2006 to 2012 |

| Modesto, CA | - 66% |

| Las Vegas, NV | - 64% |

| Fort Meyers, FL | - 57% |

| US Real Estate Average | - 22% |

| Syracuse, NY | + 1% |

| El Paso, TX | + 7% |

| S & P 500 stock index | +15% (dividends reinvested) |

| Pittsburgh, PA | + 17% |

Note that the above chart does not reflect that when you sell property you pay upwards of a 6% broker commission, and when buying and selling there are closing costs and other expenses. When owning a house you incur the costs of maintenance, property taxes and fire and possibly earthquake insurance. This contrasts with owning an S&P 500 index fund which would cost about $10 to buy and $10 to sell and have annual passive management costs of about 0.05% per year.

How has real estate performed historically?

According to Fidelity Research Institute, real estate averaged a 5.9% annual return from 1963 to 2006. From 1963 to 2008 real estate appreciated 5.4%. The Fidelity study may be biased to the downside because Fidelity is in the business of selling other asset classes.

According to the S&P/Case-Shiller Home Price Index the average US residential real estate grew by 9.31% per year from 1998 to 2007. One would expect this rate of return to be high because it does not include the bear markets that proceeded and followed.

According to a study by Jack Francis and Roger Ibbotson, real estate grew by 8.6% per year from 1972 to 1999.

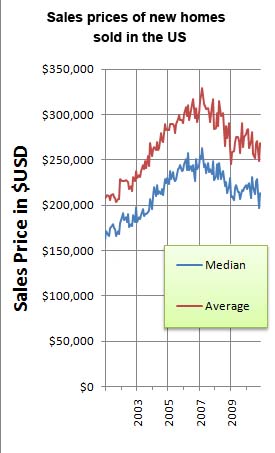

How has real estate performed more recently?

How has real estate performed more recently?

If you invested in property at or near the peak in 2007 you are still in bad shape. In 2013 the S & P 500 stock index surpassed it's 2007 peak, but US real estate as a whole is still around its low. For anyone who thinks that real estate is a "safe haven", look no further than the last 6 years in comparison to stocks.

Think this is a "buying opportunity" or at least a reason to place even bigger bets in real estate? Nobody really knows but some alarmists believe that real estate might be headed into yet another bubble. When it comes to investing your savings, never abandon the basic rule of diversification. The time tested method of investing is with stocks and bonds.