The Pros and Cons of Annuities

(previous) PAGE 4 of 9 (next)

1 - 2 - 3 - 4 - 5 - 6 - 7 - 8 - 9 - FAQ - Top Annuity Lies

Index Annuities - Immediate Annuities

Life Insurance

Headline of "Tax Deferral" is over rated!

In reality annuities may be a tax disadvantage!

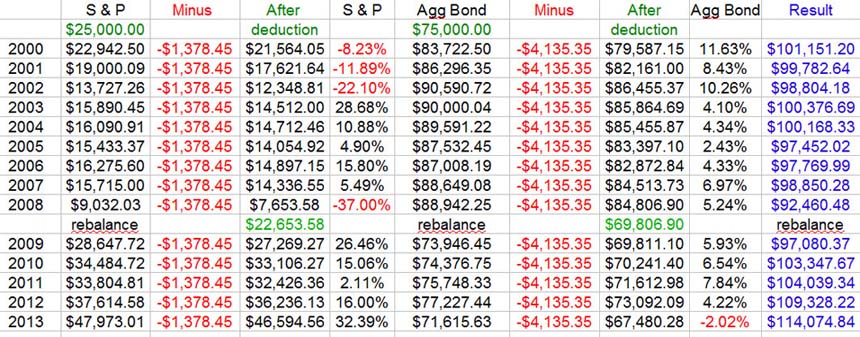

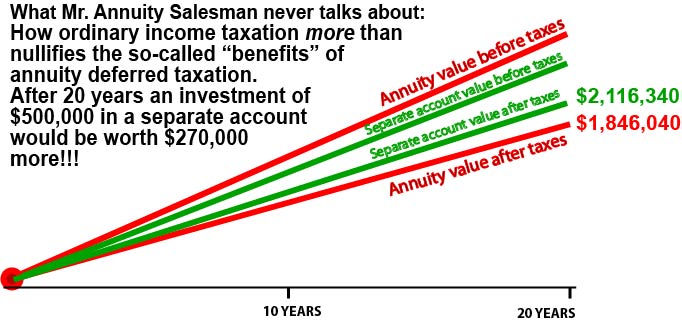

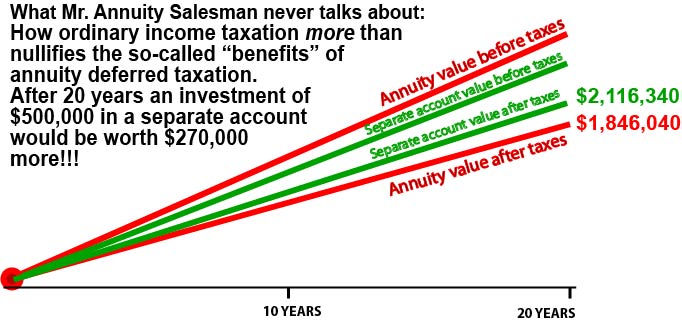

When you invest money in an annuity, your profits become subject to the “ordinary income tax rate” which is much higher than the normal “capital gains” tax rate that you enjoy with normal investments like stocks, bonds and ETF’s. So when Mr. Annuity Salesman starts boasting about how gains (such as dividends) are deferred, he’s not telling you that eventually the government will simply make up for it, and then some with higher taxes. What matters is not what you make, but what you keep! Does an annuity’s deferred taxation advantage outweigh the fact that in the end (at the time of distribution) earnings are taxed at the higher ordinary income rate? That question was tackled in a Wealth Manager article called "Photo Finish" in which the effects of ordinary income taxation on annuities was studied. When they compared a variable annuity to other tax efficient investments it was determined that if you invested half a million dollars, after 20 years you would be $270,000 richer had you just avoided a variable annuity. Although this study looked at a variable annuity, the study inherently sheds light on all annuities and concluded "the tax-deferred accumulation feature of annuities is overrated". And this study compared the annuity with a very expensive separate account that had a hypothetical 1.5% in annual fees -- not a portfolio of low cost ETF's! For example the expense ratio of VOO is only 0.08% per year and BND's expense ratio is only 0.10%! The study also assumed a higher (and more costly) separate account turnover rate. A portfolio of low cost ETF's would have done much much better than the annuity. It should also be noted that this study was conducted in 2004. The capital gains tax has been raised some, but to my knowledge there is no recent study, so at best an annuity salesman should not be making conclusive statements that the tax-deferral feature is and will be a net gain. Remember that calculating annuity taxation versus normal ETF investments is extremely complicated and changes depending on the person's tax bracket, which nobody can predict moving into the future. Also the IRS is subject to change the tax structures. Here's the numbers from the 2004 Wealth Manager study....

When you invest money in an annuity, your profits become subject to the “ordinary income tax rate” which is much higher than the normal “capital gains” tax rate that you enjoy with normal investments like stocks, bonds and ETF’s. So when Mr. Annuity Salesman starts boasting about how gains (such as dividends) are deferred, he’s not telling you that eventually the government will simply make up for it, and then some with higher taxes. What matters is not what you make, but what you keep! Does an annuity’s deferred taxation advantage outweigh the fact that in the end (at the time of distribution) earnings are taxed at the higher ordinary income rate? That question was tackled in a Wealth Manager article called "Photo Finish" in which the effects of ordinary income taxation on annuities was studied. When they compared a variable annuity to other tax efficient investments it was determined that if you invested half a million dollars, after 20 years you would be $270,000 richer had you just avoided a variable annuity. Although this study looked at a variable annuity, the study inherently sheds light on all annuities and concluded "the tax-deferred accumulation feature of annuities is overrated". And this study compared the annuity with a very expensive separate account that had a hypothetical 1.5% in annual fees -- not a portfolio of low cost ETF's! For example the expense ratio of VOO is only 0.08% per year and BND's expense ratio is only 0.10%! The study also assumed a higher (and more costly) separate account turnover rate. A portfolio of low cost ETF's would have done much much better than the annuity. It should also be noted that this study was conducted in 2004. The capital gains tax has been raised some, but to my knowledge there is no recent study, so at best an annuity salesman should not be making conclusive statements that the tax-deferral feature is and will be a net gain. Remember that calculating annuity taxation versus normal ETF investments is extremely complicated and changes depending on the person's tax bracket, which nobody can predict moving into the future. Also the IRS is subject to change the tax structures. Here's the numbers from the 2004 Wealth Manager study....

A Santa Clara University researcher also came to a similar conclusion, that annuities actually perform WORSE over time when compared to plain old unmanaged index funds. Annuities are a tax time bomb.

Also even if you choose to believe that you will break even or save money with an annuity, do not lose sight of the fact that even the lowest cost variable annuity is more expensive than normal investments like ETF's, and other annuities (such as index annuities) have the deck stacked against you with things like lower participation rate caps, etc. Don't lose sight of the fact that taxation is just one aspect of annuities that you need to look at.

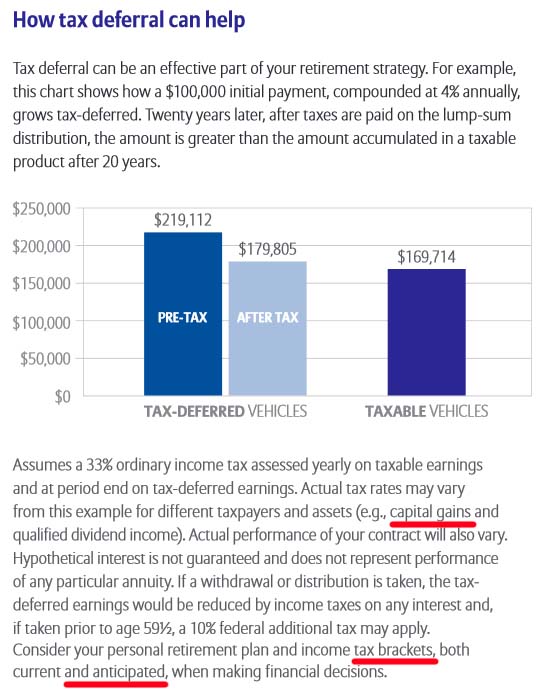

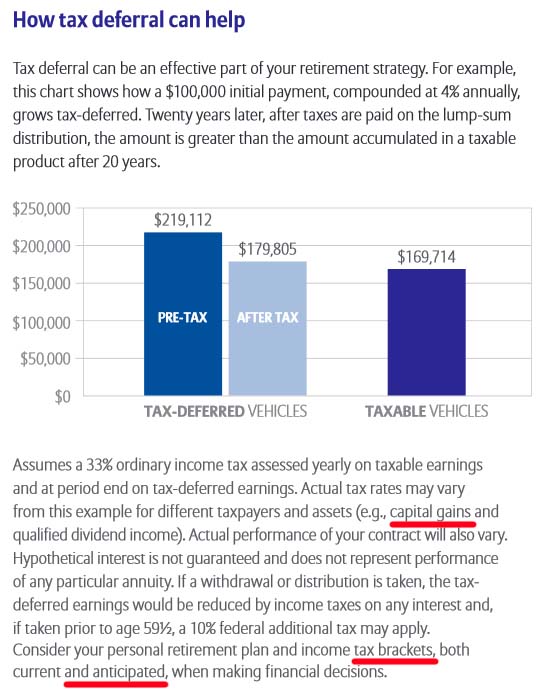

AT RIGHT: Deceptive insurance company advertising at its best. This insurance company chart might lead senior citizens into believing that with an equity index annuity they will be saving on taxes. This chart conveniently did not compare the annuity to normal investments, which are taxed at the LOWER capital gains tax rate. If your current and future tax bracket isn't a super low one, then your annuity will be taxed to death as I explain in the next paragraph! By the way, nobody can predict what their tax bracket will be in the future (example: You are forced to sell your home at a large gain, forced to sell your annuity to pay for a loved one's medical bills, etc, etc). I've underlined the critical points that this insurance company glossed over.

AT RIGHT: Deceptive insurance company advertising at its best. This insurance company chart might lead senior citizens into believing that with an equity index annuity they will be saving on taxes. This chart conveniently did not compare the annuity to normal investments, which are taxed at the LOWER capital gains tax rate. If your current and future tax bracket isn't a super low one, then your annuity will be taxed to death as I explain in the next paragraph! By the way, nobody can predict what their tax bracket will be in the future (example: You are forced to sell your home at a large gain, forced to sell your annuity to pay for a loved one's medical bills, etc, etc). I've underlined the critical points that this insurance company glossed over.

It's not what you make, but what you get to KEEP!

Seeing is believing: Annuity distributions are taxed excessively!

Thus annuities are an even longer commitment!

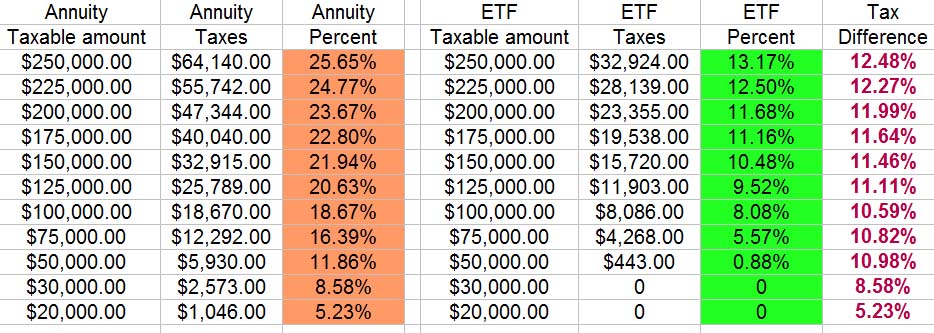

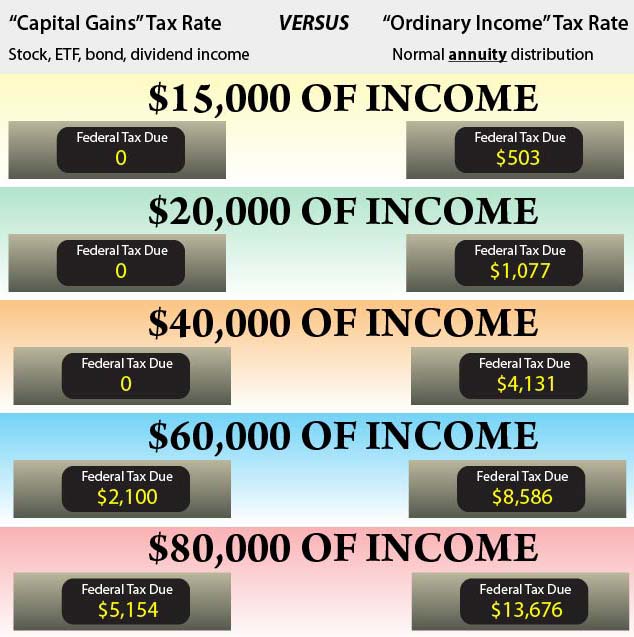

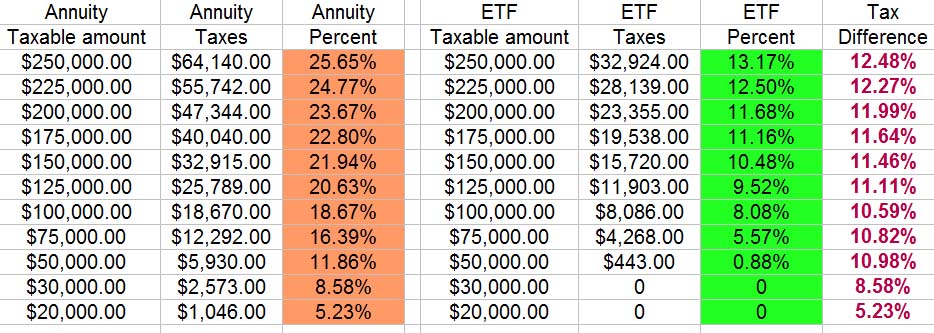

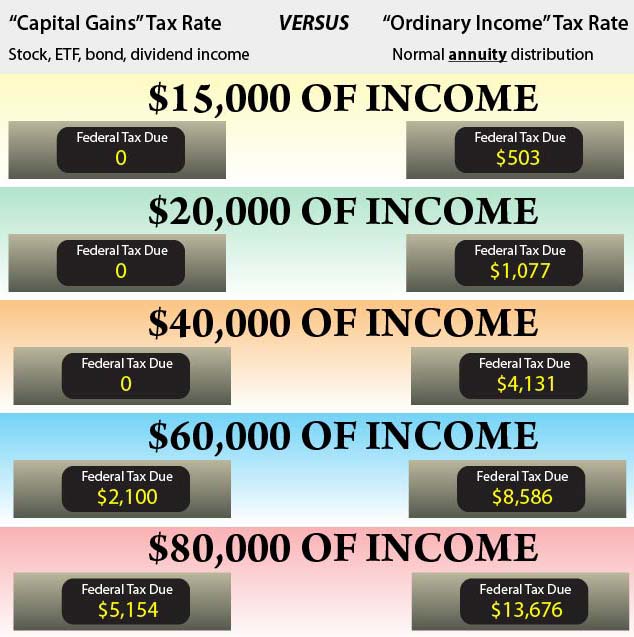

In the chart below I used Turbo Tax 2013 to compare taxation of a normal annuity distribution versus taxation of the same amount of income (or sales) from a normal portfolio (of ETF's, bonds, stocks, dividends, interest). As you can see, the annuity gets taxed to death! The more money you pull out of an annuity the nastier the effects of ordinary income taxation, hence the need to tightly control money taken out of an annuity each year. Don't expect Mr. Annuity Salesman to talk about any of this. This is why annuities are long, long, long term investments. If you were under the impression that after the insurance company's "surrender period" passed or if at any time down the line you suddenly wanted to cash out, you could just pull it all out at once, you will find out the hard way what "liquidity risk" really means and why an annuity is the worst investment you could have ever chosen.

Annuities have extremely limited tax write-off ability

If you have such things as investment losses, the IRS currently only allows you to deduct $3,000 in losses each year to offset ordinary income. The rest carries over to the next year upon which you can continually only deduct $3,000 in loses per year for as long as you live. So if you have a huge loss to write off, you may never even get a chance to write it off. This hurts both you and your beneficiaries. For example $40,000 in annuity distributions minus $40,000 in stock loses equals $37,000 in taxable income for the year.

In contract, with normal investments like ETF's you can deduct loses from capital gains income dollar per dollar. For example $40,000 in stock gains minus $40,000 in stock loses equals zero taxable income for the year.

Taxable gains must be withdrawn first -- Not principal

Also known as "last in / first out" or "LIFO" for short. Whenever you take a distribution from an annuity, the IRS requires that taxable gains must be withdrawn first. This contrasts with ETF's, stocks, bonds and other normal investments which can be strategically sold on an individual basis in order to minimize your taxes.

Headline of "Tax Deferral" would be meaningless to those who

already have their money in tax deferred accounts

Annuity salesmen may proudly proclaim that annuities grow tax deferred, yet according to LIMRA 58% of annuity buyers are already invested in tax-deferred accounts such as IRAs. So 58% of investors were really sold something they didn't need! And as previously stated the Wealth Manager study demonstrated that there is no advantage to tax deferral anyway. Either way you are being sold snake oil.

The fraudulent 10% annuity salesman lie

I've found numerous websites and You Tube videos that shamelessly only talk about the 10% pre-age 59 1/2 early withdrawal penalty, with NO mention (or they gloss over) the fact that there's a whole lot more than a 10% penalty that will hit you if you withdraw money before age 59 1/2. Even after age 59 1/2, when the 10% penalty goes away, there's tons of other mandatory taxes to worry about. Tax accountants report that it's very common that they have clients who are stunned to find out years later (at the time of having their taxes prepared) that there are additional taxes far above and beyond the 10% that they were told by Mr. Annuity Salesman. You also have the state withholding tax (about 1% in California) plus you must pay ordinary income tax on gains. In accordance with the Post Tefra act, whenever you withdrawal money from an annuity, gains are first withdrawn (and taxed!) before principal is withdrawn. So if your non-qualified annuity has gained in value you can expect to be taxed 3 times (state, federal, plus ordinary income taxation). Enjoy!

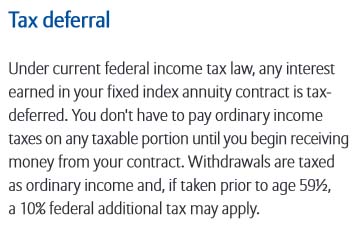

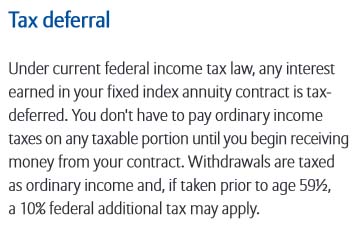

At right is an actual screen shot from an Allianz brochure that advertises equity index annuities. They never mentioned that you may pay a state penalty.

At right is an actual screen shot from an Allianz brochure that advertises equity index annuities. They never mentioned that you may pay a state penalty.

Think you can just get out at age 59 1/2? Think again!

Getting out of an annuity will be expensive!

Damned if you do and damned if you don't: Staying in a variable annuity will erode your savings via high fees even if you're with the lowest cost company (Vanguard). Staying in a variable annuity will also subject you to continued higher taxes on future gains. So why not just pull all of you money out once you turn age 59 1/2 (since there is no 10% + perhaps 1% state penalty to worry about after age 59 1/2)?

The problem is that getting out will be painful too! Below we are looking at just Federal taxes. Once you get up over $35,000 in annual withdrawals, you start to pay at least ten percent more per year in taxes than if you were to take profits on an index fund ETF! This is why they say that annuities are long, long, long term investments! When Mr. Annuity salesman told you that you could just get out at age 59 1/2 he was keeping you in the dark about the nasty tax consequences...

Therefore, if you have an accumulated value of a few hundred thousand dollars in your annuity, you will need to tightly control how much you withdraw. At the same time, if you take out too little it might take 10 years or more to get it all out. Chances are that your annuity is growing each year (with the markets). You will need to guess how much you can take out and how long it will take. Keep in mind that once annuity gains are all withdrawn, you can take out all of your original investment amount tax free. Speak to your fiducairy investment and tax advisers first.

The state penalty and higher ordinary income tax rate that your "adviser" conveniently never mentioned or just glossed over

If you ever need to cash out of a portion of an annuity before age 59 1/2, just for starters you are hit with a mandatory Federal (10%) withholding penalty. But brokers usually conveniently never mention that there's usually also a state tax withholding penalty that is NOT tax deductible, meaning you cannot deduct against it with losses (such as stock losses, property taxes, etc). Then it get much worse! Then that same amount that you withdraw is also subject to Federal and State taxable income that is essentially taxed even more!!! How much extra you are taxed depends on your tax bracket. So for example, when it's all said and done, after you are taxed three times you really might be looking at perhaps of 27% in Federal and state early withdrawal penalties if you earned $40,000 that year. If you're in an even higher tax bracket then that withdrawal will be taxed at an even higher rate -- as high as 35% (or 39.6% beginning in 2013)! This often comes as a big shock to annuity investors because the investment advisor who sold them the policy only stressed the 10% mandatory Federal tax. They conveniently omit telling you about the additional federal and state taxes that blind side you the second time, or they leave it up to you to find and decipher from the fine print of the prospectus (if they even give you one). It's all part of how they soften the shock when trying to sell you the investment so that they can lock in the lucrative deal for themselves.

So annuities are advertised as being this "great tax advantage", when in reality annuities are taxed at higher rates than stocks or mutual funds!!! Whenever you start withdrawing money from an annuity, the gains are heavily taxed as "ordinary income" rather than at the lower and more reasonable "capital gains" tax rate. Note that if your money was in a "pre-tax account" then the original principal that you initially invested is also taxed.

False adviser selling point: "Income for life"

Real headline should be: CONSTRICTED FOR LIFE!

One of the headlines that annuity pushers use as an annuity "selling point" is to say that an annuity is great because you get paid at regular intervals for the rest of your life. You get "lifetime income". Well stop the presses! You can effectively achieve the exact same thing with an ETF, stock or any other normal, liquid investment. Normal investments like ETF's pay dividends, and when dividend income isn't enough, you simply sell off a portion of your shares as you need the money. Simple. Again, enjoy paying only $10 per trade with a deep discount brokerage, and enjoy paying the lower capital gains rate as well as all of the other endless downsides of annuities described on this page.

The real headline should be that with an annuity, once you enter the income phase (AKA "annuitize" the contract), you are contractually locked for life into their payment schedule rules and regulations. After the income date has passed, neither partial withdrawals nor full surrenders are permitted. So you are paying high fees and higher taxes in exchange for being constricted. An annuity is a binding contract that just makes no sense.

Warning about Immediate Annuities including Single Premium Immediate Annuities

First of all, with SPIA's and other immediate annuities you put yourself squarely behind the 8-ball and you screw over your loved ones. Once you start getting payments (or "annuitize" the contract) your money is gone forever. If for some reason you need or want your money back, you cannot have it. Gone forever!

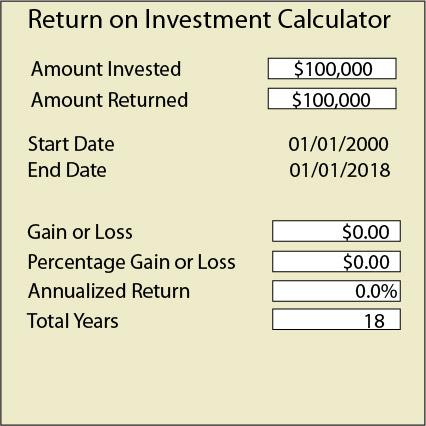

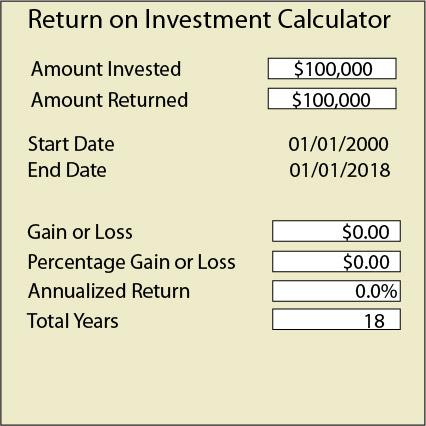

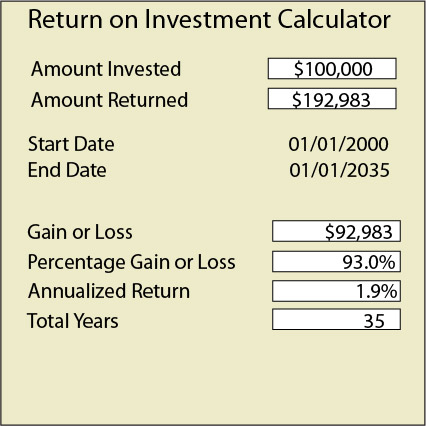

Forbes Magazine did a hypothetical study of a couple, age 62 and 64 who purchases a SPIA. The best annuity the author found paid 5.51%. Based on 5.51% for the first 18 years (if they live that long) the rate of return would be zero! After 25 years their rate of return would be a paltry 1.3%. After 35 years their rate of return would be 1.9%. These are pathetic returns on investment!

With a SPIA all you will get are the fixed payment amounts even as inflation rises. If you do live long enough then the purchasing power of those fixed payments will have declined significantly due to inflation. For example $100,000 in 1989 only had the purchasing power of $54,000 in 2012 after 23 years. A better strategy would be to stick to the recommended 4% annual withdrawals. This would enable keeping pace with inflation in later years.

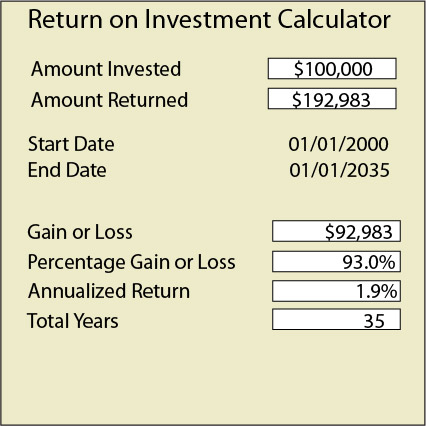

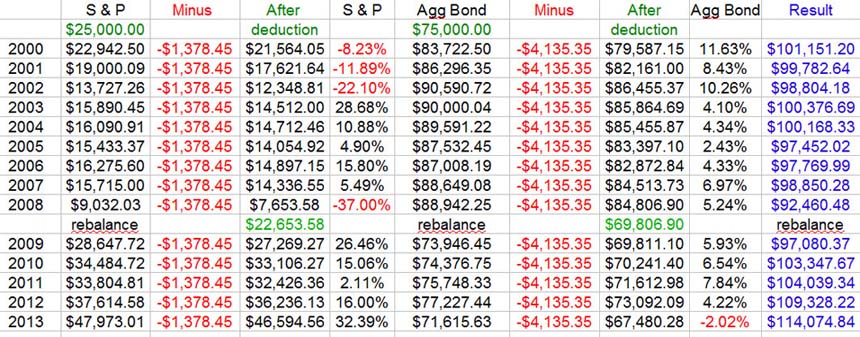

SPIA Fails Even During Bear Market

So was a SPIA a good place to put your money recently over a 14-year period from January 1, 2000 until January 1, 2013? How would a simple portfolio of 25% S&P 500 stocks (using the total return index) and 75% Barclays US Aggregate Bond Index (using this chart) have performed versus the highest paying SPIA that Forbes writer Marotta was able to find? The best quote the writer found was a SPIA that paid $27,569 per year (or 5.5138% for the life of the annuitant). What I found is that with a 25 / 75 portfolio, and a simple rebalancing strategy, and while receiving the same yearly payments of $5,513.80 (through dividends and selling off principal) as you would get with the best SPIA available, you still retained your original principal! And this occurred during terrible financial markets, beginning with the year 2000 in which the 1990's bull market came to an end! If ever there was a time period that you would expect a SPIA to have its big opportunity to outperform a traditional portfolio of stocks and bonds, this period that included the so-called "lost decade" was it! Instead the expensive SPIA protected you from nothing. As you can see from this chart, over the last 14 years your 25 / 75 portfolio was never in danger of going to zero...

Note the rebalancing strategy that I used. If and when the stock portion of the portfolio dropped 50% or gained 50% (to 12 1/2% or 37 1/2%) then this was the time to rebalance it back to 25/75. On Jan 1, 2009 it had actually dropped to just below 10%.

And by not forfeiting their money to an insurance company, if this couple were to die in 2013 their heirs were poised to inherit a tax free $102,134.26 rather than inheriting zero with the SPIA!

And unlike a SPIA in which part of each payment is taxed at the higher ordinary income tax rate, with the traditional portfolio none of those gains are taxed at that higher ordinary income tax rate. As you can see in this chart, with normal investments you incur lower taxes or may not pay any taxes at all.

One thing that isn't quantified in the above calculations is that you can’t "rebalance" a SPIA. Rebalancing is a basic strategy that investors use to mitigate risk by keeping their portfolio properly diversified, and at the same time this can increase your returns. For example after stocks had lost 50% of their value at one point in 2009, what used to be a 25 / 75 portfolio became a mix of perhaps 90% bonds and 10% stocks. You could sell off some of that bond ETF money and shift that same money into your S & P 500 stock ETF so that you are poised to reap bigger gains when the market inevitably bounces back. Conversely when stocks soar up in value and bonds lag, you can shift money back into bonds.

One thing I never factored in was the costs of owning a stock ETF like VOO (0.08%) and AGG (0.14%). And with Scottrade the cost of placing buy and sell orders would be about $220 during this 14 year time period.

For help on calculating if you will have enough money in retirement you should test out numbers using this retirement withdrawal calculator. When entering "expected annual return on fund" keep in mind that the total bond market returned 5.73% from 2000 - 2013. If you are 65 now then I recommend entering 35 as your life expectancy, which means that you would die at age 100.

Avoid Equity Index Annuities

Index annuities are sold by broker / advisers (salesmen) who are adept at completely ignoring bond/stock diversification. Index annuities were easily beaten even during the so-called "lost decade" from 2000 - 2010.

According to Craig J. McCann, Ph.D., CFA of the Securities Litigation & Consulting Group, Inc. “Existing equity-indexed annuities are too complex for the industry’s sales force and its target investors to understand the investment." He also said that "the complexity is designed into what is actually a quite simple investment product [and this allows] the true cost of the product to be completely hidden." And he says that equity-indexed annuities pay "extraordinary commissions" to the sales forces who sell them.

Forbes Magazine has this to says about equity index annuities, "Just say 'No' when someone tries to sell you an Equity-Indexed Annuity. Then turn around and run, don’t walk away."

Avoid Hybrid Fixed Indexed Annuities and Guaranteed Lifetime Income Riders

CLICK HERE to read the truth about hybrid fixed indexed annuities and how the guaranteed lifetime income rider is a scam. The 6%, 7% or 8% return that they are promising is not the true return on investment. It is much lower -- Probably about 1.5% to 2%. The guaranteed fixed lifetime income comes with a steep fee that will wreak havoc on your returns. Over a lifetime you will pay thousands if not hundred of thousands of dollars in fees.

Taxes on gains from fund transfers within annuities are deferred: BIG DEAL!

Annuity pushers also argue that you will save money because you don't pay taxes when you make trades within an annuity -- For example if you shift a little money from a natural resources fund (that has swelled from 20% to 30% of your annuity portfolio) to a growth stock fund. The problem with this argument is that generally you won't be making much of any trades at all. You initially diversify amongst the funds and then leave them alone for years. If one fund outperforms the rest, then years later you might reallocate money back into the other funds to remain diversified, but otherwise you just aren't doing any shifting of money in and out of funds. So the little bit that you might save on taxes from a fund reallocation really doesn't amount to a hill of beans. Keep in mind that eventually not only will you have to pay taxes, but you will pay much higher ordinary income taxes.

LIE: Annuities are safe and guaranteed

LIE: Annuities are safe and guaranteed

TRUTH: Your eggs may be at risk in one basket

Annuity pushers are always advertising annuities as "safe" and "guaranteed". This is sometimes a lie because annuities, like ALL investments have risks, and any so-called "guarantees" may only be as safe as the one single insurance company that writes the annuity policy. In fact Executive Life Insurance Company became insolvent in 1991. It is unclear, but word is that angry investors may have gotten between 40 and 70 cents on the dollar. Since then at least 62 other major insolvencies have occurred. The worlds largest insurance company AIG would have gone bankrupt in 2008 were it not for the Federal government bailing them out. Furthermore, with the US government in such debt, some are saying that life insurance companies are at high risk because they are typically over-exposed to none other than long term government bonds. So the risk of insolvency alone is enough reason to never invest in annuities that may be backed by vulnerable guarantees. Remember that bankrupt insurance companies keep no promises.

The state insurance guarantee fund is "code" for annuities being potentially risky investments!

Advisers might use the false selling point that some annuities may be insured by your state guarantee fund and therefore you should somehow be excited about this. The complete opposite argument should be made -- that annuities have unique risks, and therefore they need such a fund that may only pay pennies on the dollar and only up to a limited dollar amount. The very reason that certain annuity products need state protection is because the insurance companies that sell annuities have unusual risks of insolvency that other investments such as ETF's stocks don't have! Brokers usually fail to emphasize that certain annuity investments over and above that state guarantee amount could be be at risk in the event of insolvency. With any other investments such as ETF's and stocks you would still have 100% of your investment. Don't necessarily count on receiving the full guarantee amount in the event of a massive market meltdown.

(previous) PAGE 4 of 9 (next)

1 - 2 - 3 - 4 - 5 - 6 - 7 - 8 - 9 - FAQ - Top Annuity Lies

OR MOVE ON TO THE NEXT ARTICLE: Oddball investments

Disclaimer and Waiver - Nothing on this consumer advocate website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy, hold or sell, or as an endorsement, of any company, security, fund, product or other offering. This website, its owners, affiliates, agents and / or contributors are not financial or investment advisors or broker / dealers and assume no liability whatsoever by your reliance on the information contained herein. The information should not be relied upon for purposes of transacting securities, assets, financial products or other investments. Your use of the information contained herein is at your own risk. The content is provided 'as is' and without warranties, either expressed or implied. This site does not promise or guarantee any income or particular result from your use of the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained. Always hire and consult with a professional regarding the evaluation of any specific information, opinion, or other content.

When you invest money in an annuity, your profits become subject to the “ordinary income tax rate” which is much higher than the normal “capital gains” tax rate that you enjoy with normal investments like stocks, bonds and ETF’s. So when Mr. Annuity Salesman starts boasting about how gains (such as dividends) are deferred, he’s not telling you that eventually the government will simply make up for it, and then some with higher taxes. What matters is not what you make, but what you keep! Does an annuity’s deferred taxation advantage outweigh the fact that in the end (at the time of distribution) earnings are taxed at the higher ordinary income rate? That question was tackled in a Wealth Manager article called "Photo Finish" in which the effects of ordinary income taxation on annuities was studied. When they compared a variable annuity to other tax efficient investments it was determined that if you invested half a million dollars, after 20 years you would be $270,000 richer had you just avoided a variable annuity. Although this study looked at a variable annuity, the study inherently sheds light on all annuities and concluded "the tax-deferred accumulation feature of annuities is overrated". And this study compared the annuity with a very expensive separate account that had a hypothetical 1.5% in annual fees -- not a portfolio of low cost ETF's! For example the expense ratio of VOO is only 0.08% per year and BND's expense ratio is only 0.10%! The study also assumed a higher (and more costly) separate account turnover rate. A portfolio of low cost ETF's would have done much much better than the annuity. It should also be noted that this study was conducted in 2004. The capital gains tax has been raised some, but to my knowledge there is no recent study, so at best an annuity salesman should not be making conclusive statements that the tax-deferral feature is and will be a net gain. Remember that calculating annuity taxation versus normal ETF investments is extremely complicated and changes depending on the person's tax bracket, which nobody can predict moving into the future. Also the IRS is subject to change the tax structures. Here's the numbers from the 2004 Wealth Manager study....

When you invest money in an annuity, your profits become subject to the “ordinary income tax rate” which is much higher than the normal “capital gains” tax rate that you enjoy with normal investments like stocks, bonds and ETF’s. So when Mr. Annuity Salesman starts boasting about how gains (such as dividends) are deferred, he’s not telling you that eventually the government will simply make up for it, and then some with higher taxes. What matters is not what you make, but what you keep! Does an annuity’s deferred taxation advantage outweigh the fact that in the end (at the time of distribution) earnings are taxed at the higher ordinary income rate? That question was tackled in a Wealth Manager article called "Photo Finish" in which the effects of ordinary income taxation on annuities was studied. When they compared a variable annuity to other tax efficient investments it was determined that if you invested half a million dollars, after 20 years you would be $270,000 richer had you just avoided a variable annuity. Although this study looked at a variable annuity, the study inherently sheds light on all annuities and concluded "the tax-deferred accumulation feature of annuities is overrated". And this study compared the annuity with a very expensive separate account that had a hypothetical 1.5% in annual fees -- not a portfolio of low cost ETF's! For example the expense ratio of VOO is only 0.08% per year and BND's expense ratio is only 0.10%! The study also assumed a higher (and more costly) separate account turnover rate. A portfolio of low cost ETF's would have done much much better than the annuity. It should also be noted that this study was conducted in 2004. The capital gains tax has been raised some, but to my knowledge there is no recent study, so at best an annuity salesman should not be making conclusive statements that the tax-deferral feature is and will be a net gain. Remember that calculating annuity taxation versus normal ETF investments is extremely complicated and changes depending on the person's tax bracket, which nobody can predict moving into the future. Also the IRS is subject to change the tax structures. Here's the numbers from the 2004 Wealth Manager study....

AT RIGHT: Deceptive insurance company advertising at its best. This insurance company chart might lead senior citizens into believing that with an equity index annuity they will be saving on taxes. This chart conveniently did not compare the annuity to normal investments, which are taxed at the LOWER capital gains tax rate. If your current and future tax bracket isn't a super low one, then your annuity will be taxed to death as I explain in the next paragraph! By the way, nobody can predict what their tax bracket will be in the future (example: You are forced to sell your home at a large gain, forced to sell your annuity to pay for a loved one's medical bills, etc, etc). I've underlined the critical points that this insurance company glossed over.

AT RIGHT: Deceptive insurance company advertising at its best. This insurance company chart might lead senior citizens into believing that with an equity index annuity they will be saving on taxes. This chart conveniently did not compare the annuity to normal investments, which are taxed at the LOWER capital gains tax rate. If your current and future tax bracket isn't a super low one, then your annuity will be taxed to death as I explain in the next paragraph! By the way, nobody can predict what their tax bracket will be in the future (example: You are forced to sell your home at a large gain, forced to sell your annuity to pay for a loved one's medical bills, etc, etc). I've underlined the critical points that this insurance company glossed over.

At right is an actual screen shot from an Allianz brochure that advertises equity index annuities. They never mentioned that you may pay a state penalty.

At right is an actual screen shot from an Allianz brochure that advertises equity index annuities. They never mentioned that you may pay a state penalty.